MetLife 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and dividend rates for policies that permit such adjustments. The Company also uses certain derivative instruments in the management of

credit and interest rate risks.

Current Environment. Concerns over the availability and cost of credit, the U.S. mortgage market, geopolitical issues, energy costs,

inflation and a declining real estate market in the United States have contributed to increased volatility and diminished expectations for the

economy and the financial markets going forward. These factors, combined with declining business and consumer confidence and

increased unemployment, have precipitated an economic slowdown and with the National Bureau of Economic Research having

announced in the 4th quarter of 2008 an ongoing U.S. recession that began in December 2007. As a result of the stress experienced

by the global financial markets, the fixed-income markets are experiencing a period of extreme volatility which has negatively impacted

market liquidity conditions. Initially, the concerns on the part of market participants were focused on the sub-prime segment of the

mortgage-backed securities market. However, these concerns have since expanded to include a broad range of mortgage-backed and

asset-backed and other fixed income securities, including those rated investment grade, the U.S. and international credit and inter-bank

money markets generally, and a wide range of financial institutions and markets, asset classes and sectors. Securities that are less liquid

are more difficult to value and have fewer opportunities for disposal.

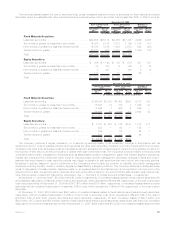

As a result of this unprecedented disruption and market dislocation, we have experienced both volatility in the valuation of certain

investments and decreased liquidity in certain asset classes and, as such, have experienced an increase in certain Level 3 investments. As

demonstrated in “- Fixed Maturity Securities — Available for Sale — Fair Value Hierarchy,” during 2008 we have experienced an increase in

certain Level 3 investments which include less liquid fixed maturity securities and equity securities with very limited trading activity. Even

some of our very high quality assets have been more illiquid for periods of time as a result of the recent challenging market conditions.

These market conditions have also lead to an increase in unrealized losses on fixed maturity and equity securities in 2008, particularly for

residential and commercial mortgage-backed, asset-backed and corporate fixed maturity securities; and within the Company’s financial

services industry fixed maturity and equity securities holdings.

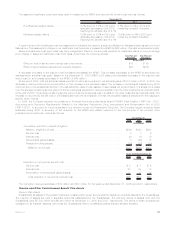

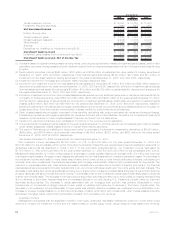

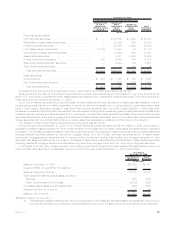

Composition of Investment Portfolio Results

The following table illustrates the net investment income, net investment gains (losses), annualized yields on average ending assets and

ending carrying value for each of the components of the Company’s investment portfolio at:

2008 2007 2006

December 31,

(In millions)

Fixed Maturity Securities

Yield(1).................................................. 6.40% 6.42% 6.23%

Investmentincome(2) ........................................ $ 12,403 $ 12,425 $ 11,623

Investmentgains(losses)...................................... $ (1,949) $ (615) $ (1,119)

Endingcarryingvalue(2)....................................... $189,197 $233,115 $233,514

Mortgage and Consumer Loans

Yield(1).................................................. 6.08% 6.56% 6.60%

Investmentincome(3) ........................................ $ 2,774 $ 2,648 $ 2,365

Investmentgains(losses)...................................... $ (136) $ 3 $ (8)

Endingcarryingvalue ........................................ $ 51,364 $ 46,154 $ 41,457

Real Estate and Real Estate Joint Ventures(4)

Yield(1).................................................. 2.98% 10.29% 11.43%

Investmentincome .......................................... $ 217 $ 607 $ 550

Investmentgains(losses)...................................... $ (10) $ 59 $ 4,897

Endingcarryingvalue ........................................ $ 7,586 $ 6,767 $ 4,981

Policy Loans

Yield(1).................................................. 6.22% 6.21% 6.02%

Investmentincome .......................................... $ 601 $ 572 $ 547

Endingcarryingvalue ........................................ $ 9,802 $ 9,326 $ 9,178

Equity Securities(7)

Yield(1).................................................. 5.25% 5.14% 3.56%

Investmentincome .......................................... $ 249 $ 244 $ 106

Investmentgains(losses)...................................... $ (257) $ 164 $ 84

Endingcarryingvalue ........................................ $ 3,197 $ 5,911 $ 4,929

Other Limited Partnership Interests(7)

Yield(1).................................................. (2.77)% 27.09% 22.42%

Investmentincome(loss) ...................................... $ (170) $ 1,309 $ 945

Investmentgains(losses)...................................... $ (140) $ 16 $ 1

Endingcarryingvalue ........................................ $ 6,039 $ 6,155 $ 4,781

Cash and Short-Term Investments

Yield(1).................................................. 1.62% 4.91% 5.68%

Investmentincome .......................................... $ 307 $ 424 $ 437

Investmentgains(losses)...................................... $ 3 $ 3 $ (2)

Endingcarryingvalue ........................................ $ 38,085 $ 12,505 $ 9,472

Other Invested Assets(5)(6)(8)

Investmentincome .......................................... $ 383 $ 526 $ 447

Investmentgains(losses)...................................... $ 4,260 $ (474) $ (736)

Endingcarryingvalue ........................................ $ 17,248 $ 8,076 $ 6,524

Total Investments

Grossinvestmentincomeyield(1)................................. 5.71% 6.88% 6.65%

Investmentfeesandexpensesyield............................... (0.16)% (0.16)% (0.15)%

Net Investment Income Yield ................................. 5.55% 6.72% 6.50%

83MetLife, Inc.