MetLife 2008 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

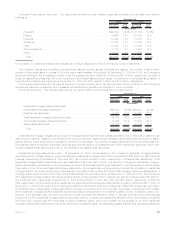

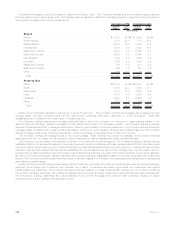

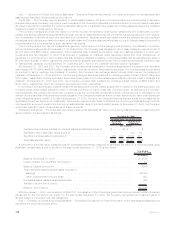

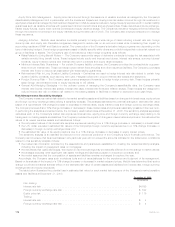

The following table presents the notional amount and current market or estimated fair value of derivative financial instruments, excluding

embedded derivatives, held at:

Notional

Amount Assets Liabilities Notional

Amount Assets Liabilities

Current Market

or Fair Value Current Market

or Fair Value

December 31, 2008 December 31, 2007

(In millions)

Interest rate swaps . . . . . . . . . . . . . . . . . . . . . $ 34,060 $ 4,617 $1,468 $ 62,410 $ 784 $ 768

Interestratefloors ..................... 48,517 1,748 — 48,937 621 —

Interestratecaps...................... 24,643 11 — 45,498 50 —

Financialfutures....................... 19,908 45 205 12,302 89 57

Foreign currency swaps . . . . . . . . . . . . . . . . . . 19,438 1,953 1,866 21,201 1,480 1,719

Foreign currency forwards . . . . . . . . . . . . . . . . 5,167 153 129 4,177 76 16

Options ............................ 8,450 3,162 35 6,565 713 1

Financialforwards ..................... 28,176 465 169 11,937 122 2

Credit default swaps . . . . . . . . . . . . . . . . . . . . 5,219 152 69 6,625 58 33

SyntheticGICs ....................... 4,260 — — 3,670 — —

Other.............................. 250 — 101 250 43 —

Total .............................. $198,088 $12,306 $4,042 $223,572 $4,036 $2,596

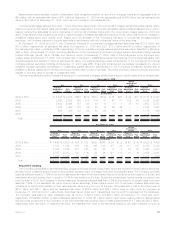

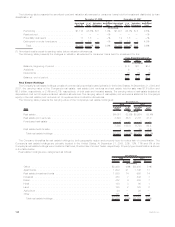

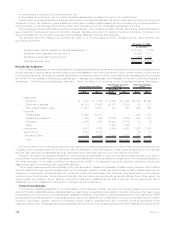

Fair Value Hierarchy. Derivatives measured at estimated fair value on a recurring basis and their corresponding fair value hierarchy, are

summarized as follows:

Derivative

Assets Derivative

Liabilities

December 31, 2008

(In millions)

Quoted prices in active markets for identical assets and liabilities (Level 1) . . . $ 55 —% 273 7%

Significantotherobservableinputs(Level2) ........................ 9,483 77 3,548 88

Significantunobservableinputs(Level3)........................... 2,768 23 221 5

Totalestimatedfairvalue ..................................... $12,306 100% $4,042 100%

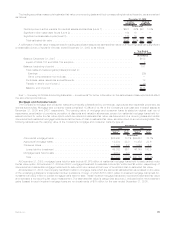

The valuation of Level 3 derivatives involves the use of significant unobservable inputs and generally requires a higher degree of

management judgment or estimation than the valuations of Level 1 and Level 2 derivatives. Although Level 3 inputs are based on

assumptions deemed appropriate given the circumstances and are consistent with what other market participants would use when pricing

such instruments, the use of different inputs or methodologies could have a material effect on the estimated fair value of Level 3 derivatives

and could materially affect net income.

Derivatives categorized as Level 3 at December 31, 2008 include: financial forwards including swap spread locks with maturities which

extend beyond observable periods; interest rate lock commitments with certain unobservable inputs, including pull-through rates; equity

variance swaps with unobservable volatility inputs or that are priced via independent broker quotations; foreign currency swaps which are

cancelable and priced through independent broker quotations; interest rate swaps with maturities which extend beyond the observable

portion of the yield curve; credit default swaps based upon baskets of credits having unobservable credit correlations as well as credit

default swaps with maturities which extend beyond the observable portion of the credit curves and credit default swaps priced through

independent broker quotes; foreign currency forwards priced via independent broker quotations or with liquidity adjustments; equity

options with unobservable volatility inputs; and interest rate caps and floors referencing unobservable yield curves and/or which include

liquidity and volatility adjustments.

At December 31, 2008 and 2007, 2.7% and 1.5% of the net derivative estimated fair value was priced via independent broker

quotations.

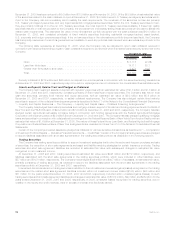

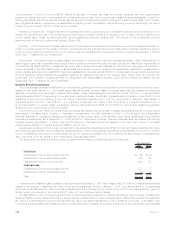

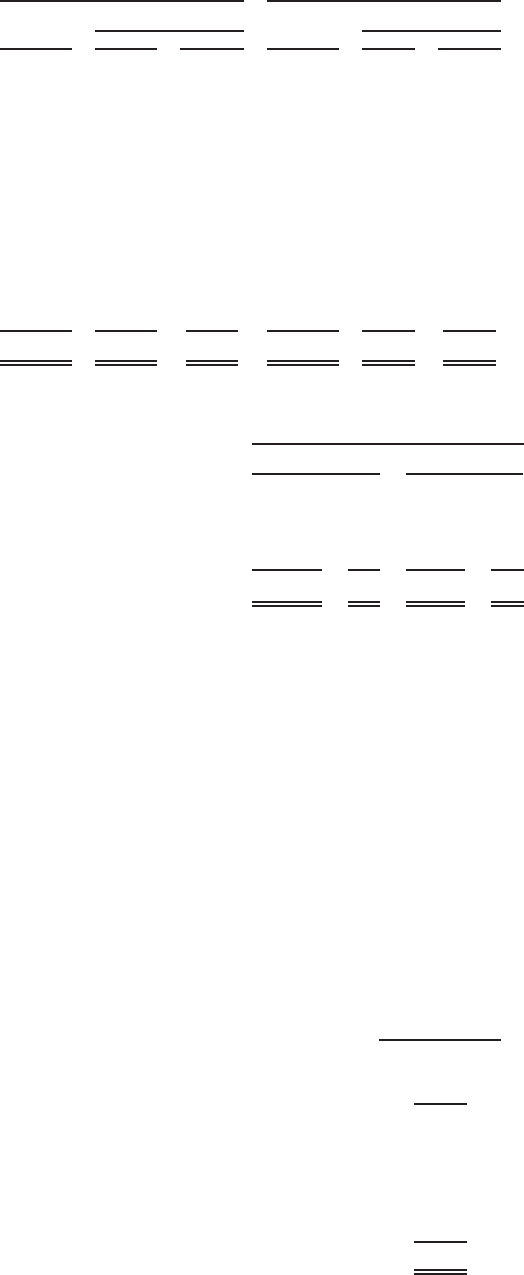

A rollforward of the fair value measurements for derivatives measured at estimated fair value on a recurring basis using significant

unobservable (Level 3) inputs for the year ended December 31, 2008 is as follows:

Year Ended

December 31, 2008

(In millions)

Balance, December 31, 2007 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 789

ImpactofSFAS157andSFAS159adoption...................................... (1)

Balance,beginningofperiod................................................ 788

Total realized/unrealized gains (losses) included in:

Earnings............................................................ 1,729

Othercomprehensiveincome(loss) .......................................... —

Purchases,sales,issuancesandsettlements ..................................... 29

Transferinand/oroutofLevel3.............................................. 1

Balance,endofperiod.................................................... $2,547

105MetLife, Inc.