MetLife 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

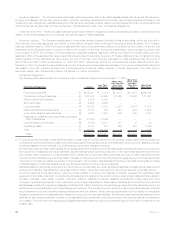

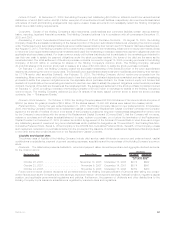

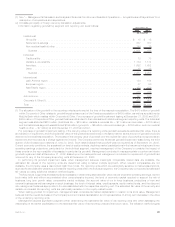

Information on the declaration, record and payment dates, as well as per share and aggregate dividend amounts, for the Company’s

Floating Rate Non-Cumulative Preferred Stock, Series A and 6.50% Non-Cumulative Preferred Stock, Series B is as follows for the years

ended December 31, 2008, 2007 and 2006:

Declaration Date Record Date Payment Date Series A

Per Share Series A

Aggregate Series B

Per Share Series B

Aggregate

Dividend

(In millions, except per share data)

November 17, 2008 . . . . . . . . . . November 30, 2008 December 15, 2008 $0.2527777 $ 7 $0.4062500 $24

August 15, 2008 . . . . . . . . . . . . August 31, 2008 September 15, 2008 $0.2555555 $ 6 $0.4062500 $24

May 15, 2008. . . . . . . . . . . . . . May 31, 2008 June 16, 2008 $0.2555555 $ 7 $0.4062500 $24

March 5, 2008 . . . . . . . . . . . . . February 29, 2008 March 17, 2008 $0.3785745 $ 9 $0.4062500 $24

$29 $96

November 15, 2007 . . . . . . . . . . November 30, 2007 December 17, 2007 $0.4230476 $11 $0.4062500 $24

August 15, 2007 . . . . . . . . . . . . August 31, 2007 September 17, 2007 $0.4063333 $10 $0.4062500 $24

May 15, 2007. . . . . . . . . . . . . . May 31, 2007 June 15, 2007 $0.4060062 $10 $0.4062500 $24

March 5, 2007 . . . . . . . . . . . . . February 28, 2007 March 15, 2007 $0.3975000 $10 $0.4062500 $24

$41 $96

November 15, 2006 . . . . . . . . . . November 30, 2006 December 15, 2006 $0.4038125 $10 $0.4062500 $24

August 15, 2006 . . . . . . . . . . . . August 31, 2006 September 15, 2006 $0.4043771 $10 $0.4062500 $24

May 16, 2006. . . . . . . . . . . . . . May 31, 2006 June 15, 2006 $0.3775833 $ 9 $0.4062500 $24

March 6, 2006 . . . . . . . . . . . . . February 28, 2006 March 15, 2006 $0.3432031 $ 9 $0.4062500 $24

$38 $96

See “— Subsequent Events.”

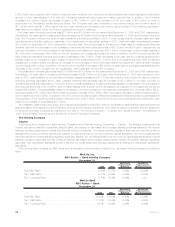

Affiliated Capital Transactions. During the years ended December 31, 2008 and 2007, the Holding Company invested an aggregate of

$2.6 billion and $2.8 billion, respectively, in various subsidiaries. In February 2009, the Holding Company contributed a total of $74 million

to two of its insurance subsidiaries.

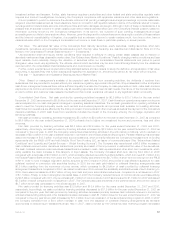

The Holding Company lends funds, as necessary, to its subsidiaries, some of which are regulated, to meet their capital requirements.

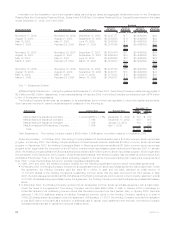

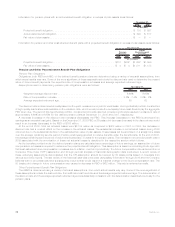

Such loans are included in loans to subsidiaries and consisted of the following at:

Subsidiaries Interest Rate Maturity Date 2008 2007

December 31,

(In millions)

Metropolitan Life Insurance Company . . . . . . . . 3-month LIBOR + 1.15% December 31, 2009 $ 700 $ 700

Metropolitan Life Insurance Company . . . . . . . . 7.13% December 15, 2032 400 400

Metropolitan Life Insurance Company . . . . . . . . 7.13% January 15, 2033 100 100

MetLife Investors USA Insurance Company . . . . . 7.35% April 1, 2035 — 400

Total ............................ $1,200 $1,600

Debt Repayments. The Holding Company repaid a $500 million 5.25% senior note which matured in December 2006.

Share Repurchases. In October 2004, the Holding Company’s Board of Directors authorized a $1 billion common stock repurchase

program. In February 2007, the Holding Company’s Board of Directors authorized an additional $1 billion common stock repurchase

program. In September 2007, the Holding Company’s Board of Directors authorized an additional $1 billion common stock repurchase

program which began after the completion of the $1 billion common stock repurchase program authorized in February 2007. In January

2008, the Holding Company’s Board of Directors authorized an additional $1 billion common stock repurchase program, which began after

the completion of the September 2007 program. Under these authorizations, the Holding Company may purchase its common stock from

the MetLife Policyholder Trust, in the open market (including pursuant to the terms of a pre-set trading plan meeting the requirements of

Rule 10b5-1 under the Exchange Act and in privately negotiated transactions).

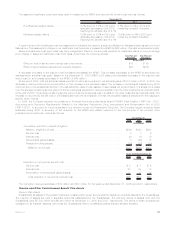

In 2006, 2007 and 2008, the Holding Company entered into the following accelerated common stock repurchase agreements:

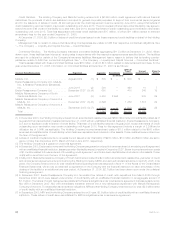

• In February 2008, the Holding Company entered into an accelerated common stock repurchase agreement with a major bank. Under

the agreement, the Holding Company paid the bank $711 million in cash and the bank delivered an initial amount of

11,161,550 shares of the Holding Company’s outstanding common stock that the bank borrowed from third parties. In May

2008, the bank delivered an additional 864,646 shares of the Holding Company’s common stock to the Company resulting in a total

of 12,026,196 shares being repurchased under the agreement. The Holding Company recorded the shares repurchased as treasury

stock.

• In December 2007, the Holding Company entered into an accelerated common stock repurchase agreement with a major bank.

Under the terms of the agreement, the Holding Company paid the bank $450 million in cash in January 2008 in exchange for

6,646,692 shares of its outstanding common stock that the bank borrowed from third parties. Also, in January 2008, the bank

delivered 1,043,530 additional shares of Holding Company’s common stock to the Holding Company resulting in a total of

7,690,222 shares being repurchased under the agreement. At December 31, 2007, the Holding Company recorded the obligation

to pay $450 million to the bank as a reduction of additional paid-in capital. Upon settlement with the bank, the Holding Company

increased additional paid-in capital and reduced treasury stock.

64 MetLife, Inc.