MetLife 2008 Annual Report Download - page 235

Download and view the complete annual report

Please find page 235 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

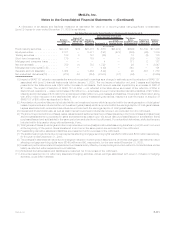

The table below summarizes both realized and unrealized gains and losses for the year ended December 31, 2008 due to changes in

estimated fair value recorded in earnings for Level 3 assets and liabilities:

Net

Investment

Income

Net

Investment

Gains (Losses) Other

Revenues

Policyholder

Benefits and

Claims Total

Classification of Realized/Unrealized Gains

(Losses) included in Earnings

Total Gains and Losses

(In millions)

Fixedmaturitysecurities ..................... $176 $(1,057) $ — $ — $ (881)

Equitysecurities .......................... — (197) — — (197)

Tradingsecurities ......................... (26) — — — (26)

Short-terminvestments...................... 1 (1) — — —

Mortgageandconsumerloans................. — — 4 — 4

Netderivatives ........................... 103 1,587 39 — 1,729

Mortgageservicingrights .................... — — (149) — (149)

Netembeddedderivatives.................... — (2,682) — 182 (2,500)

The table below summarizes the portion of unrealized gains and losses recorded in earnings for the year ended December 31, 2008 for

Level 3 assets and liabilities that are still held at December 31, 2008.

Net

Investment

Income

Net

Investment

Gains (Losses) Other

Revenues

Policyholder

Benefits and

Claims Total

Changes in Unrealized Gains (Losses)

Relating to Assets and Liabilities Held at December 31, 2008

(In millions)

Fixedmaturitysecurities ..................... $163 $ (793) $ — $ — $ (630)

Equitysecurities .......................... — (164) — — (164)

Tradingsecurities ......................... (17) — — — (17)

Short-terminvestments...................... — — — — —

Mortgageandconsumerloans................. — — 3 — 3

Netderivatives ........................... 114 1,504 38 — 1,656

Mortgageservicingrights .................... — — (150) — (150)

Netembeddedderivatives.................... — (2,779) — 182 (2,597)

Fair Value Option — Mortgage and Consumer Loans

The Company has elected fair value accounting for certain residential mortgage loans held-for-sale. At December 31, 2008, the

estimated fair value carrying amount of $1,975 million is greater than the aggregate unpaid principal amount of $1,920 million by

$55 million. None of the loans where the fair value option has been elected are more than 90 days past due or in non-accrual status at

December 31, 2008.

Residential mortgage loans held-for-sale accounted for under SFAS 159 are initially measured at estimated fair value. Gains and losses

from initial measurement, subsequent changes in estimated fair value, and gains or losses on sales are recognized in other revenues.

Interest income on residential mortgage loans held-for-sale is recorded based on the stated rate of the loan and is recorded in net

investment income.

Changesinestimatedfairvalueof$55millionhavebeenincludedinthestatementofincomeforresidentialmortgageloansheld-for-

sale for the year ended December 31, 2008.

Changes in estimated fair value due to instrument-specific credit risk are estimated based on changes in credit spreads for non-agency

loans and adjustments in individual loan quality, of which there were none for the year ended December 31, 2008.

Non-Recurring Fair Value Measurements

At December 31, 2008, the Company held $220 million in mortgage loans which are carried at estimated fair value based on

independent broker quotations or, if the loans were in foreclosure or are otherwise determined to be collateral dependent, on the value of

the underlying collateral of which $188 million was related to impaired mortgage loans held-for-investment and $32 million to certain

mortgage loans held-for-sale. These impaired mortgage loans were recorded at estimated fair value and represent a nonrecurring fair value

measurement. The estimated fair value was categorized as Level 3. Included within net investment gains (losses) for such impaired

mortgage loans are net impairments of $79 million for the year ended December 31, 2008.

At December 31, 2008, the Company held $137 million in cost basis other limited partnership interests which were impaired during the

year ended December 31, 2008 based on the underlying limited partnership financial statements. These other limited partnership interests

were recorded at estimated fair value and represent a nonrecurring fair value measurement. The estimated fair value was categorized as

Level 3. Included within net investment gains (losses) for such other limited partnerships are impairments of $105 million for the year ended

December 31, 2008.

F-112 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)