MetLife 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT

MetLife, Inc. 2008

Table of contents

-

Page 1

ANNUAL REPORT MetLife, Inc. 2008 -

Page 2

...life, group dental and group disability, generated solid top line growth. Year after year, we continue to leverage our scale in the Institutional marketplace to achieve further revenue growth and bolster our position as a leading employee benefits provider. In our Individual business, total premiums... -

Page 3

... poor credit and equity markets - and we continue to differentiate ourselves through our asset-liability management expertise. In October, we announced we were maintaining our 2008 annual common stock dividend at $0.74 a share - a step that further represents our confidence in our long-term outlook... -

Page 4

... on Accounting and Financial Disclosure Management's Annual Report on Internal Control Over Financial Reporting ...Attestation Report of the Company's Registered Public Accounting Firm ...Financial Statements ...Board of Directors ...Executive Officers ...Contact Information ...Corporate Information... -

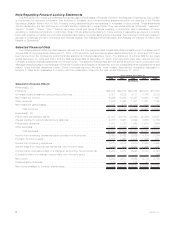

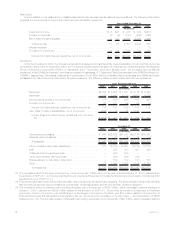

Page 5

... Premiums ...$25,914 $22,970 $22,052 $20,979 $18,842 Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Net investment gains (losses) ...Total revenues ...Expenses(2), (3): Policyholder benefits and claims ...Interest credited to policyholder account... -

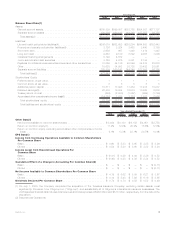

Page 6

... 2007 2006 (In millions) 2005 2004 Balance Sheet Data(1) Assets: General account assets ...Separate account assets ...Total assets(2) ...Liabilities: Life and health policyholder liabilities(4) ...Property and casualty policyholder liabilities(4) ...Short-term debt ...Long-term debt ...Collateral... -

Page 7

... policyholder funds and bank deposits. The life and health policyholder liabilities also include policyholder account balances, policyholder dividends payable and the policyholder dividend obligation. (5) The cumulative effect of changes in accounting principles, net of income tax, of $329 million... -

Page 8

...Executive Summary MetLife is a leading provider of individual insurance, employee benefits and financial services with operations throughout the United States and the regions of Latin America, Europe, and Asia Pacific. Through its subsidiaries and affiliates, MetLife offers life insurance, annuities... -

Page 9

... calculated on a cost basis without unrealized gains and losses. The decrease in net investment income attributable to lower yields was primarily due to lower returns on other limited partnership interests, real estate joint ventures, short-term investments, fixed maturity securities, and mortgage... -

Page 10

... variable annuity and life products in Individual Business. • A potential reduction in payroll linked revenue from Institutional group insurance customers. • A decline in demand for certain International and Institutional retirement & savings products. • A decrease in Auto & Home premiums... -

Page 11

... net investment income as previously discussed in the consolidated outlook. Certain annuity and life benefit guarantees are tied to market performance, which in times of depressed investment markets, may require management to establish additional liabilities. However, many of the risks associated... -

Page 12

...savings products to the markets, coupled with the Company's financial strength and strong risk management expertise, will help achieve continued growth in this challenging environment. Auto & Home Outlook Management expects premiums for the Auto & Home segment to grow slightly in 2009. The key sales... -

Page 13

... Company made five acquisitions for $783 million. As a result of these acquisitions, MetLife's Institutional segment increased its product offering of dental and vision benefit plans, MetLife Bank within Corporate & Other entered the mortgage origination and servicing business and the International... -

Page 14

... in the financial services industry, including the Company. The declining financial markets and economic conditions have negatively impacted our investment income and the demand for and the cost and profitability of certain of our products, including variable annuities and guarantee riders. See... -

Page 15

... in SFAS 157. Estimated Fair Values of Investments The Company's investments in fixed maturity and equity securities, investments in trading securities, certain short-term investments, most mortgage loans held-for-sale, and mortgage servicing rights ("MSRs") are reported at their estimated fair... -

Page 16

... changes in forecasted cash flows on mortgage-backed and asset-backed securities; and (viii) other subjective factors, including concentrations and information obtained from regulators and rating agencies. The cost of fixed maturity and equity securities is adjusted for impairments in value... -

Page 17

...including swaps, forwards, futures and option contracts. The Company uses derivatives primarily to manage various risks. The risks being managed are variability in cash flows or changes in estimated fair values related to financial instruments and currency exposure associated with net investments in... -

Page 18

... investment contracts with equity or bond indexed crediting rates. Embedded derivatives are recorded in the financial statements at estimated fair value with changes in estimated fair value adjusted through net income. The Company issues certain variable annuity products with guaranteed minimum... -

Page 19

.... Each period, the Company also reviews the estimated gross profits for each block of business to determine the recoverability of DAC and VOBA balances. Separate account rates of return on variable universal life contracts and variable deferred annuity contracts affect in-force account balances on... -

Page 20

...the mix of business, long term growth rates, comparative market multiples, the account value of in-force business, projections of new and renewal business as well as margins on such business, the level of interest rates, credit spreads, equity market levels, and the discount rate management believes... -

Page 21

... in the period in which the changes occur. Future policy benefit liabilities for minimum death and income benefit guarantees relating to certain annuity contracts and secondary and paid up guarantees relating to certain life policies are based on estimates of the expected value of benefits in excess... -

Page 22

... net income or cash flows in particular quarterly or annual periods. Economic Capital Economic capital is an internally developed risk capital model, the purpose of which is to measure the risk in the business and to provide a basis upon which capital is deployed. The economic capital model accounts... -

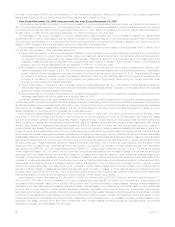

Page 23

...millions) 2006 Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Net investment gains (losses) ...Total revenues ...Expenses Policyholder benefits and claims ...Interest credited to policyholder account balances ...Policyholder... -

Page 24

... attributable to decreases in universal life and investment-type product policy fees and other revenues. These decreases were due to lower average separate account balances due to unfavorable equity market performance during the current year, as well as revisions to management's assumptions used to... -

Page 25

... are calculated on cost basis without unrealized gains and losses. The decrease in net investment income attributable to lower yields was primarily due to lower returns on other limited partnership interests, real estate joint ventures, short-term investments, fixed maturity securities, and mortgage... -

Page 26

... reports and other sales-related expenses, partially offset by an unfavorable change in DAC capitalization, net of amortization. The increase in other expenses in Corporate & Other was primarily due to higher MetLife Bank costs, higher post-employment related costs in the current period associated... -

Page 27

...$2,910 million for the comparable 2006 period. The following table provides the 2007 change in income from continuing operations by segment: $ Change (In millions) % of Total $ Change Institutional ...Individual ...International ...Auto & Home ...Corporate & Other ...Total change, net of income tax... -

Page 28

...to higher fee income from variable life and annuity and investment-type products and growth in premiums from other life products, partially offset by a decrease in immediate annuity premiums and a decline in premiums associated with the Company's closed block business, in line with expectations. The... -

Page 29

..., cash, cash equivalents and short-term investments, hedge funds and mortgage loans. Interest Margin Interest margin, which represents the difference between interest earned and interest credited to policyholder account balances increased in the Institutional and Individual segments for the year... -

Page 30

... to product guarantees coupled with high persistency rates on certain blocks of business, an increase in DAC amortization in 2006 associated with the implementation of a new valuation system, as well as one-time expenses in 2006 related to the termination of the agency force, and expense reductions... -

Page 31

... Premiums ...$14,964 Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Net investment gains (losses) ...Total revenues ...Expenses Policyholder benefits and claims ...Interest credited to policyholder account balances ...Policyholder dividends... -

Page 32

... in policyholder benefits and claims, and the amount credited to policyholder account balances for investment-type products, recorded in interest credited to policyholder account balances. Interest credited on insurance products reflects the current period impact of the interest rate assumptions... -

Page 33

... the group institutional annuity business was primarily due to the aforementioned increase in premiums and charges of $112 million in the current year due to liability adjustments in this block of business. In addition, an increase in interest credited on future policyholder benefits contributed to... -

Page 34

... and equity securities, driven by continued business growth, particularly growth in the funding agreements and global GIC businesses. Additionally, management attributes $172 million of this increase in net investment income to an increase in yields, primarily due to higher returns on fixed maturity... -

Page 35

...millions) 2006 Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Net investment gains (losses) ...Total revenues ...Expenses Policyholder benefits and claims ...Interest credited to policyholder account balances ...Policyholder... -

Page 36

... life business growth over the prior year. Policy fees from variable life and annuity and investment-type products are typically calculated as a percentage of the average assets in policyholder accounts. The value of these assets can fluctuate depending on equity performance. Net investment income... -

Page 37

... associated with the Company's closed block of business, in line with expectations. These decreases were partially offset by growth in premiums from other life products of $95 million, primarily driven by increased sales of term life business. Universal life and investment-type product policy... -

Page 38

... from variable life and annuity and investment-type products are typically calculated as a percentage of the average assets in policyholder accounts. The value of these assets can fluctuate depending on equity performance. Net investment income increased by $162 million. Net investment income from... -

Page 39

... of insurance contracts by the government in 2002. Other developments include the reduction of claim liabilities in the prior year from an experience review and the favorable impact in the current year of higher inflation rates on indexed securities partially offset by higher losses on the trading... -

Page 40

...income for the year due to the losses on the trading securities portfolio which supports unit-linked policyholder liabilities. • The home office of $24 million primarily due to an increase in the amount charged for economic capital. • Ireland by $21 million primarily due to losses in the current... -

Page 41

...$12 million due to a decrease in claims liabilities in the prior year from an experience review, higher claim experience in the current year and business growth offset by a decrease in interest credited to unit-linked policyholder liabilities reflecting net losses in the trading portfolio. Partially... -

Page 42

... continued growth of the in-force business, higher joint venture income and higher returns on inflation indexed securities, partially offset by higher compensation, infrastructure and marketing expenses. • The United Kingdom by $3 million, net of income tax, due to a reduction of claim liabilities... -

Page 43

... increases in net investment income was a decrease in: • The home office of $25 million primarily due to an increase in the amount charged for economic capital and investment management expenses. • Argentina by $7 million primarily due to unfavorable results in the trading portfolio, partially... -

Page 44

... liable for new death and disability claims of the plan participants. Also contributing is a decrease in interest- and market-indexed policyholder liabilities and the favorable impact of reductions in claim liabilities resulting from experience reviews in both the current and prior years. • Mexico... -

Page 45

... credit related impairments or losses on fixed maturity and equity securities where the Company did not intend to hold securities until recovery in conjunction with overall market declines occurring throughout the year. The increase in policyholder benefits and claims of $75 million, net of income... -

Page 46

...$1 million, net of income tax, in policyholder dividends that positively impacted net income. Also favorably impacting net income was a reduction of $11 million, net of income tax, in other expenses related to lower information technology and advertising costs. Revenues Total revenues, excluding net... -

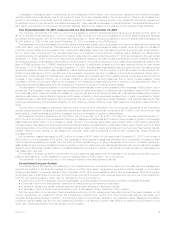

Page 47

..., 2008 2007 (In millions) 2006 Revenues Premiums ...Net investment income ...Other revenues ...Net investment gains (losses) ...Total revenues ...Expenses Policyholder benefits and claims ...Interest credited to policyholder account balances ...Other expenses ...Total expenses ...Income (loss) from... -

Page 48

... legal fees of $5 million. Interest credited to policyholder account balances was $7 million in the current year as a result of issuance of funding agreements with FHLB of NY in November 2008. Interest on uncertain tax positions was lower by $41 million as a result of a settlement payment to the IRS... -

Page 49

...this activity, blocks of securities, which are included in fixed maturity and short-term investments, are loaned to third parties, primarily major brokerage firms and commercial banks. The Company generally requires a minimum of 102% of the current estimated fair value of the loaned securities to be... -

Page 50

... in place to manage this activity at a reduced level through this extraordinary business environment. See "- Investments - Securities Lending." Internal Asset Transfers. MetLife employs an internal asset transfer process that allows for the sale of securities among the business portfolio segments... -

Page 51

... under current market conditions. The Company includes provisions limiting withdrawal rights on many of its products, including general account institutional pension products (generally group annuities, including GICs, and certain deposit fund liabilities) sold to employee benefit plan sponsors... -

Page 52

... Bank had borrowed $950 million under the Term Auction Facility for various short-term maturities. In addition, as a member of the Federal Home Loan Bank of New York ("FHLB of NY"), MetLife Bank has entered into repurchase agreements with FHLB of NY on a short-term and long-term basis, with a total... -

Page 53

... $300 million to MICC at December 31, 2008, which is included in short-term debt. In the current market environment, the Federal Home Loan Bank system has demonstrated its commitment to provide funding to its members especially through these stressful market conditions. Management expects the... -

Page 54

..., to investors placed by an unaffiliated financial institution, $2.5 billion of 35 year surplus notes to provide statutory reserve support for the assumed closed block liabilities. Interest on the surplus notes accrues at an annual rate of 3-month LIBOR plus 0.55%, payable quarterly. The ability of... -

Page 55

... million to the FHLB of NY during the years ended December 31, 2008, 2007 and 2006, respectively. In addition, in 2008 following the acquisition of a mortgage origination and servicing business, MetLife Bank began a program of taking short-term advances from the FHLB of NY. The amount of the Company... -

Page 56

... of NY and $650 million to the Federal Reserve Bank of New York related to short-term borrowings. See "Liquidity and Capital Sources - Debt Issuances and Other Borrowings" for further information. The Holding Company repaid a $500 million 5.25% senior note which matured in December 2006. MetLife... -

Page 57

... terminal funding agreements, single premium immediate annuities, long-term disability policies, individual disability income policies, LTC policies and property and casualty contracts. Included within future policyholder benefits are contracts where the Company is currently making payments and... -

Page 58

... guaranteed investment contracts, guaranteed investment contracts associated with formal offering programs, funding agreements, individual and group annuities, total control accounts, bank deposits, individual and group universal life, variable universal life and company-owned life insurance... -

Page 59

... the timing of payment. Current income tax payable is also excluded from the table. See also "- Off-Balance Sheet Arrangements." Separate account liabilities are excluded from the table above. Generally, the separate account owner, rather than the Company, bears the investment risk of these funds... -

Page 60

... time to time, have a material adverse effect on the Company's consolidated net income or cash flows in particular quarterly or annual periods. Fair Value. The estimated fair value of the Company's fixed maturity securities, equity securities, trading securities, short-term investments, derivatives... -

Page 61

... of mortgage and consumer loans. In addition, the 2007 period included the sale of MetLife Australia's annuities and pension businesses of $0.7 billion. These decreases in net cash used in investing activities were partially offset by an increase in cash invested in short-term investments of... -

Page 62

... paid, of which $176 million were returns of capital, to the Holding Company. Liquid Assets. A n integral part of the Holding Company's liquidity management is the amount of liquid assets it holds. Liquid assets include cash, cash equivalents, short-term investments and publicly-traded securities... -

Page 63

... and capital plans for the Holding Company and its subsidiaries in light of changing needs and opportunities. The dislocation in the credit markets has limited the access of financial institutions to long-term debt and hybrid capital. While, in general, yields on benchmark U.S. Treasury securities... -

Page 64

... financing arrangement associated with MRSC's reinsurance of universal life secondary guarantees, entered into an agreement with an unaffiliated financial institution under which the Holding Company is entitled to the return on the investment portfolio held by a trust established in connection with... -

Page 65

...%, as applicable. The Holding Company incurred amendment costs of $1.3 million related to the $500 million amended and restated letter of credit facility, which has been capitalized and included in other assets. These costs will be amortized over the term of the agreement. (2) Letters of credit and... -

Page 66

... as the Company's current earnings, expected medium- and long-term earnings, financial condition, regulatory capital position, and applicable governmental regulations and policies. Furthermore, the payment of dividends and other distributions to the Holding Company by its insurance subsidiaries is... -

Page 67

... in loans to subsidiaries and consisted of the following at: December 31, Subsidiaries Interest Rate Maturity Date 2008 2007 (In millions) Metropolitan Life Insurance Company ...Metropolitan Life Insurance Company ...Metropolitan Life Insurance Company ...MetLife Investors USA Insurance Company... -

Page 68

... programs was $1,261 million. Future common stock repurchases will be dependent upon several factors, including the Company's capital position, its financial strength and credit ratings, general market conditions and the price of MetLife, Inc.'s common stock. The Company does not intend to make... -

Page 69

... the prior year primarily due to a decrease in net purchases of fixed maturity securities. Investing activity results are generally due to the Holding Company's management of its capital, as well as the needs of its subsidiaries and any business development opportunities. As it relates to cash flows... -

Page 70

... shares of common stock were delivered. See "- Liquidity and Capital Resources - The Company - Liquidity and Capital Sources - Remarketing of Securities and Settlement of Stock Purchase Contracts Underlying Common Equity Units" for further information. Guarantees In the normal course of its business... -

Page 71

... equal to the then current estimated fair value of the credit default swaps. As of December 31, 2008, the Company would have paid $37 million to terminate all of these contracts. Other Commitments MetLife Insurance Company of Connecticut is a member of the Federal Home Loan Bank of Boston (the "FHLB... -

Page 72

...mix of business, long term growth rates, comparative market multiples, the account value of our in-force business, projections of new and renewal business as well as margins on such business, the level of interest rates, credit spreads, equity market levels, and the discount rate management believes... -

Page 73

... applicable plans. Virtually all retirees, or their beneficiaries, contribute a portion of the total cost of postretirement medical benefits. Employees hired after 2003 are not eligible for any employer subsidy for postretirement medical benefits. Financial Summary Statement of Financial Accounting... -

Page 74

... fair value of plan assets for the pension plans were as follows: December 31, Qualified Plans 2008 2007 Non-Qualified Plans 2008 2007 (In millions) 2008 Total 2007 Aggregate fair value of plan assets (principally Company contracts) ...Aggregate projected benefit obligation ...Over (under) funded... -

Page 75

... service period of active employees was 7.9 years for the pension plans. The increase in net periodic benefit cost in 2009 associated with the amortization of these net actuarial losses is described in the respective section which follows. As the benefits provided under the defined pension plans... -

Page 76

...summary of the reduction to the APBO and related reduction to the components of net periodic other postretirement benefit plan cost is as follows: December 31, 2008 2007 (In millions) 2006 Cumulative reduction in benefit obligation: Balance, beginning of year ...Service cost ...Interest cost ...Net... -

Page 77

... cash flows over periods of time and at interest rates deemed appropriate for each investment. Information on the physical value of the property and the sales prices of comparable properties is used to corroborate fair value estimates. Estimated fair value of hedge fund net assets is generally... -

Page 78

... benefit cost for service provided in prior years due to amendments in plans or initiation of new plans. As the economic benefits of these costs are realized in the future periods, these costs are amortized to pension expense over the expected service years of the employees. v) Amortization of Net... -

Page 79

...2008 asset balances, a 25 basis point increase (decrease) in the expected rate of return on plan assets would result in a decrease (increase) in net periodic benefit cost of $3 million for the other postretirement benefit plans. Funding and Cash Flows of Pension and Other Postretirement Benefit Plan... -

Page 80

... financial markets and the economy generally, and dispelling it may require governments to pursue a restrictive fiscal and monetary policy, which could constrain overall economic activity, inhibit revenue growth and reduce the number of attractive investment opportunities. Adoption of New Accounting... -

Page 81

... on fixed maturity and equity securities backing certain pension products sold in Brazil. Such securities will now be presented as trading securities in accordance with SFAS 115 on the consolidated balance sheet with subsequent changes in estimated fair value recognized in net investment income... -

Page 82

...-for-sale. See also Note 15 of the Notes to the Consolidated Financial Statements. Insurance Contracts Effective January 1, 2007, the Company adopted SOP 05-1 which provides guidance on accounting by insurance enterprises for DAC on internal replacements of insurance and investment contracts other... -

Page 83

... Application of Accounting Principles to Loan Commitments . SAB 109 provides guidance on (i) incorporating expected net future cash flows when related to the associated servicing of a loan when measuring fair value; and (ii) broadening the SEC staff's view that internally-developed intangible assets... -

Page 84

..., with limited exceptions. • Acquisition costs are generally expensed as incurred; restructuring costs associated with a business combination are generally expensed as incurred subsequent to the acquisition date. • The fair value of the purchase price, including the issuance of equity securities... -

Page 85

... make timely payments of principal and interest; • interest rate risk, relating to the market price and cash flow variability associated with changes in market interest rates; • liquidity risk, relating to the diminished ability to sell certain investments in times of strained market conditions... -

Page 86

... broad range of mortgage-backed and asset-backed and other fixed income securities, including those rated investment grade, the U.S. and international credit and inter-bank money markets generally, and a wide range of financial institutions and markets, asset classes and sectors. Securities that are... -

Page 87

... calculated on the cost basis without unrealized gains and losses. The decrease in net investment income attributable to lower yields was primarily due to lower returns on other limited partnership interests, real estate joint ventures, short-term investments, fixed maturity securities, and mortgage... -

Page 88

... declines in interest rates in the second half of 2007. Fixed Maturity and Equity Securities Available-for-Sale Fixed maturity securities consisted principally of publicly-traded and privately placed fixed maturity securities, and represented 58% and 71% of total cash and invested assets at December... -

Page 89

... holdings which include less liquid fixed maturity and equity securities, some with very limited trading activity. Even some of our very high quality invested assets have been more illiquid for periods of time as a result of the challenging market conditions. The Company uses the results of this... -

Page 90

... credit enhanced by financial guarantee insurers are asset-backed securities which are backed by sub-prime mortgage loans. Gross Unrealized Gains and Losses. The following tables present the cost or amortized cost, gross unrealized gain and loss, estimated fair value of the Company's fixed maturity... -

Page 91

..."- Investments - Fixed Maturity and Equity Securities Available-for-Sale - Corporate Fixed Maturity Securities" and "- Structured Securities" for a description of concentrations of credit risk related to these asset subsectors. At December 31, 2008, the Company's direct investments in fixed maturity... -

Page 92

... at Reporting Date Using Quoted Prices in Active Markets for Identical Assets (Level 1) Significant Other Significant Observable Unobservable Inputs Inputs (Level 2) (Level 3) (In millions) Total Estimated Fair Value Fixed maturity securities: U.S. corporate securities ...Residential mortgage... -

Page 93

..., over time, the Company was able to corroborate pricing received from independent pricing services with observable inputs. See "- Summary of Critical Accounting Estimates - Investments" for further information on the estimates and assumptions that affect the amounts reported above. Net Unrealized... -

Page 94

... for a period of time sufficient to allow for the recovery of their value to an amount equal to or greater than cost or amortized cost. The Company's intent and ability to hold securities considers broad portfolio management objectives such as asset/liability duration management, issuer and industry... -

Page 95

... resulted from a lack of market liquidity and a short-term market dislocation versus a long-term deterioration in credit quality, and the Company's current intent and ability to hold the fixed maturity and equity securities with unrealized losses for a period of time sufficient for them to recover... -

Page 96

... totaled $528 million, $19 million and $33 million for the years ended December 31, 2008, 2007 and 2006, respectively. The Company records impairments as investment losses and adjusts the cost basis of the fixed maturity and equity securities accordingly. The Company does not change the revised cost... -

Page 97

...- Financial Institutions, Individually Significant and Trust Preferred Security Impairments. Of the fixed maturity and equity securities impairments of $1.7 billion for the year ended December 31, 2008, $1,014 million were concentrated in the Company's financial services industry securities holdings... -

Page 98

... risk in its corporate fixed maturity portfolio. In the Company's international insurance operations, both its assets and liabilities are generally denominated in local currencies. Structured Securities. The following table shows the types of structured securities the Company held at: December 31... -

Page 99

... terms of the securities. The following table shows the Company's exposure to asset-backed securities supported by sub-prime mortgage loans by credit quality and by vintage year: December 31, 2008 Below Investment Grade Aaa Aa A Baa Total Fair Value Cost or Cost or Cost or Cost or Cost or Cost... -

Page 100

... blocks of securities, which are included in fixed maturity securities, and short-term investments are loaned to third parties, primarily major brokerage firms and commercial banks. The Company generally requires collateral equal to 102% of the current estimated fair value of the loaned securities... -

Page 101

... within net investment income totaled ($193) million, $50 million and $71 million for the years ended December 31, 2008, 2007 and 2006, respectively. Included within unrealized gains (losses) on such trading securities and short sale agreement liabilities are changes in estimated fair value of... -

Page 102

... as automobiles. Mortgage and consumer loans comprised 15.9% and 14.1% of the Company's total cash and invested assets at December 31, 2008 and 2007, respectively. The carrying value of mortgage and consumer loans is stated at original cost net of repayments, amortization of premiums, accretion of... -

Page 103

... distribution across geographic regions and property types for commercial mortgage loans held-for-investment at: December 31, 2008 Carrying Value December 31, 2007 % of Total % of Carrying Total Value (In millions) Region Pacific ...$ 8,837 South Atlantic ...8,101 Middle Atlantic ...International... -

Page 104

...167 (1) Amortized cost is equal to carrying value before valuation allowances. The following table presents the changes in valuation allowances for commercial mortgage loans held-for-investment for the: Years Ended December 31, 2008 2007 (In millions) 2006 Balance, beginning of period ...Additions... -

Page 105

..., respectively, or 2.4% and 2.1%, respectively, of total cash and invested assets. The carrying value of real estate is stated at depreciated cost net of impairments and valuation allowances. The carrying value of real estate joint ventures is stated at the Company's equity in the real estate joint... -

Page 106

... fair value or the carrying value of the mortgage loan at the date of foreclosure. Net investment income from real estate joint ventures and funds within the real estate and real estate joint venture caption represents distributions from investees accounted for under the cost method and equity in... -

Page 107

primary return on investment is in the form of tax credits, and which are accounted for under the equity method. Funding agreements represent arrangements where the Company has long-term interest bearing amounts on deposit with third parties and are generally stated at amortized cost. Funds withheld... -

Page 108

... Current Market or Fair Value Assets Liabilities (In millions) Interest rate swaps ...Interest rate floors ...Interest rate caps ...Financial futures ...Foreign currency swaps ...Foreign currency forwards ...Options ...Financial forwards ...Credit default swaps ...Synthetic GICs ...Other ...Total... -

Page 109

... included in fixed maturity securities. The counterparties are permitted by contract to sell or repledge this collateral. At December 31, 2008 and 2007, the Company provided cash collateral for exchange-traded futures of $686 million and $102 million, respectively, which is included in premiums and... -

Page 110

... $60 million is cash held-in-trust. Included within fixed maturity securities available-for-sale are $948 million of U.S. corporate securities, $561 million of residential mortgage-backed securities, $409 million of asset-backed securities, $98 million of commercial mortgage-backed securities, $95... -

Page 111

...2008 2007 (In millions) Other Policyholder Funds 2008 2007 Institutional Group life ...Retirement & savings ...Non-medical health & other ...Individual Traditional life ...Variable & universal life ...Annuities ...Other ...International ...Auto & Home ...Corporate & Other ...Total ...$ 3,346 40,320... -

Page 112

... interest credited, but exclude the impact of any applicable surrender charge that may be incurred upon surrender. Group Life. Policyholder account balances are held for death benefit disbursement retained asset accounts, universal life policies, the fixed account of variable life insurance policies... -

Page 113

... Company, which are influenced by current market rates, and generally have a guaranteed minimum credited rate between 1.5% and 4.0%. See "- Variable Annuity Guarantees." International. Policyholder account balances are held largely for fixed income retirement and savings plans in Latin America and... -

Page 114

...a current period charge or increase to earnings. The table below contains the carrying value for guarantees included in Future Policy Benefits: December 31, 2008 2007 (In millions) Individual: Guaranteed minimum death benefit ...Guaranteed minimum income benefit ...International: Guaranteed minimum... -

Page 115

... in policyholder benefits and claims expense in the period in which the estimates are changed or payments are made. The unearned revenue liability relates to universal life-type and investment-type products and represents policy charges for services to be provided in future periods. The charges are... -

Page 116

...-term guarantees on equity performance such as variable annuities with guaranteed minimum benefit riders, certain policyholder account balances along with investments in equity securities. We manage this risk on an integrated basis with other risks through our asset/liability management strategies... -

Page 117

... its Investment Department. MetLife uses derivatives to hedge its equity exposure both in certain liability guarantees such as variable annuities with guaranteed minimum benefit riders and equity securities. These derivatives include exchangetraded equity futures, equity index options contracts and... -

Page 118

...for-sale ...Net embedded derivatives within asset host contracts(2) ...Mortgage loan commitments ...Commitments to fund bank credit facilities, bridge loans and private investments ...Total assets ... ...corporate bond ... $ 2,690 979 ... Liabilities Policyholder account balances ...Short-term debt... -

Page 119

...Assets Fixed maturity securities ...Trading securities ...Mortgage and consumer loans: Held-for-investment ...Held-for-sale ...Mortgage and consumer loans, net ...Policy loans ...Short-term investments ...Cash and cash equivalents ...Total assets ...Liabilities Policyholder account balances ...Long... -

Page 120

... by type of asset or liability: December 31, 2008 Assuming a 10% Increase Estimated in Equity Fair Value(1) Prices (In millions) Notional Amount Assets Equity securities ...Net embedded derivatives within asset host contracts (2) ...Total assets ...Liabilities Policyholder account balances ...Net... -

Page 121

... effective internal control over financial reporting at December 31, 2008. Deloitte & Touche LLP, an independent registered public accounting firm, has audited the consolidated financial statements and consolidated financial statement schedules included in the Annual Report on Form 10-K for the year... -

Page 122

... internal control over financial reporting is a process designed by, or under the supervision of, the company's principal executive and principal financial officers, or persons performing similar functions, and effected by the company's board of directors, management, and other personnel to provide... -

Page 123

... Registered Public Accounting Firm ...Financial Statements at December 31, 2008 and 2007 and for the Years Ended December 31, 2008, 2007 and 2006: Consolidated Balance Sheets ...Consolidated Statements of Income ...Consolidated Statements of Stockholders' Equity ...Consolidated Statements of Cash... -

Page 124

...and their cash flows for each of the three years in the period ended December 31, 2008, in conformity with accounting principles generally accepted in the United States of America. As discussed in Note 1, the Company changed its method of accounting for certain assets and liabilities to a fair value... -

Page 125

...: Future policy benefits ...Policyholder account balances ...Other policyholder funds ...Policyholder dividends payable ...Policyholder dividend obligation ...Short-term debt ...Long-term debt ...Collateral financing arrangements ...Junior subordinated debt securities ...Current income tax payable... -

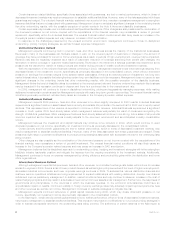

Page 126

...millions, except per share data) 2008 2007 2006 Revenues Premiums ...Universal life and investment-type product policy fees Net investment income ...Other revenues ...Net investment gains (losses) ...Expenses Policyholder benefits and claims ...Interest credited to policyholder account Policyholder... -

Page 127

... Income (Loss) Defined Foreign Net Benefit Currency Additional Unrealized Treasury Plans Translation Paid-in Retained Stock Investment Capital Earnings at Cost Gains (Losses) Adjustments Adjustment Preferred Common Stock Stock Total Balance at January 1, 2006 ...Treasury stock transactions, net... -

Page 128

... credited to bank deposits ...Universal life and investment-type product policy fees ...Change in accrued investment income ...Change in premiums and other receivables ...Change in deferred policy acquisition costs, net ...Change in insurance-related liabilities ...Change in trading securities... -

Page 129

...and 2006 (In millions) 2008 2007 2006 Cash flows from financing activities Policyholder account balances: Deposits ...Withdrawals ...Net change in short-term debt ...Long-term debt issued ...Long-term debt repaid ...Collateral financing arrangements issued ...Cash paid in connection with collateral... -

Page 130

... provider of individual insurance, employee benefits and financial services with operations throughout the United States and the Latin America, Europe, and Asia Pacific regions. Through its subsidiaries and affiliates, MetLife offers life insurance, annuities, auto and home insurance, retail banking... -

Page 131

... interests, short-term investments, and other invested assets. The accounting policies related to each are as follows: Fixed Maturity and Equity Securities. The Company's fixed maturity and equity securities are classified as available-for-sale, except for trading securities, and are reported at... -

Page 132

...fixed maturity and equity securities, supports investment strategies that involve the active and frequent purchase and sale of securities and the execution of short sale agreements, and supports asset and liability matching strategies for certain insurance products. Trading securities and short sale... -

Page 133

... the asset (typically 20 to 55 years). Rental income is recognized on a straight-line basis over the term of the respective leases. The Company classifies a property as held-forsale if it commits to a plan to sell a property within one year and actively markets the property in its current condition... -

Page 134

... acquired or are generated from the sale of originated residential mortgage loans where the servicing rights are retained by the Company. Changes in estimated fair value of MSRs are reported in other revenues in the period in which the change occurs. Funds withheld represent amounts contractually... -

Page 135

... are generally reported in net investment gains (losses) except for those (i) in policyholder benefits and claims for economic hedges of liabilities embedded in certain variable annuity products offered by the Company, (ii) in net investment income for economic hedges of equity method investments in... -

Page 136

... accounted for as a freestanding derivative. Such embedded derivatives are carried on the consolidated balance sheet at estimated fair value with the host contract and changes in their estimated fair value are reported currently in net investment gains (losses) or in policyholder benefits and claims... -

Page 137

... cash flows from the business in-force at the acquisition date. VOBA is based on actuarially determined projections, by each block of business, of future policy and contract charges, premiums, mortality and morbidity, separate account performance, surrenders, operating expenses, investment returns... -

Page 138

.... Each period, the Company also reviews the estimated gross profits for each block of business to determine the recoverability of DAC and VOBA balances. Separate account rates of return on variable universal life contracts and variable deferred annuity contracts affect in-force account balances on... -

Page 139

... the mix of business, long term growth rates, comparative market multiples, the account value of in-force business, projections of new and renewal business as well as margins on such business, the level of interest rates, credit spreads, equity market levels and the discount rate management believes... -

Page 140

... period in which the changes occur. The Company establishes future policy benefit liabilities for minimum death and income benefit guarantees relating to certain annuity contracts and secondary and paid-up guarantees relating to certain life policies as follows: • Guaranteed minimum death benefit... -

Page 141

... to insurance in-force or, for annuities, the amount of expected future policy benefit payments. Premiums related to non-medical health and disability contracts are recognized on a pro rata basis over the applicable contract term. Deposits related to universal life-type and investment-type products... -

Page 142

... of in-force blocks, as well as amounts paid (received) related to new business, are recorded as ceded (assumed) premiums and ceded (assumed) future policy benefit liabilities are established. For prospective reinsurance of short-duration contracts that meet the criteria for reinsurance accounting... -

Page 143

... income. Additionally, these changes eliminated the additional minimum pension liability provisions of SFAS 87. Net periodic benefit cost is determined using management estimates and actuarial assumptions to derive service cost, interest cost, and expected return on plan assets for a particular year... -

Page 144

...exceeds the separate account liabilities. Assets within the Company's separate accounts primarily include: mutual funds, fixed maturity and equity securities, mortgage loans, derivatives, hedge funds, other limited partnership interests, short-term investments, and cash and cash MetLife, Inc. F-21 -

Page 145

... on fixed maturity and equity securities backing certain pension products sold in Brazil. Such securities will now be presented as trading securities in accordance with SFAS 115 on the consolidated balance sheet with subsequent changes in estimated fair value recognized in net investment income... -

Page 146

...sellers of credit derivatives by requiring additional information about the potential adverse effects of changes in their credit risk, financial performance, and cash flows. It also amends FIN No. 45, Guarantor's Accounting and Disclosure Requirements for Guarantees, Including Indirect Guarantees of... -

Page 147

... of benefit plan assets and obligations as of the date of the statement of financial position; and (v) disclosure of additional information about the effects on the employer's statement of financial position. The adoption of SFAS 158 resulted in a reduction of $744 million, net of income tax... -

Page 148

... Application of Accounting Principles to Loan Commitments . SAB 109 provides guidance on (i) incorporating expected net future cash flows when related to the associated servicing of a loan when measuring fair value; and (ii) broadening the SEC staff's view that internally-developed intangible assets... -

Page 149

..., with limited exceptions. • Acquisition costs are generally expensed as incurred; restructuring costs associated with a business combination are generally expensed as incurred subsequent to the acquisition date. • The fair value of the purchase price, including the issuance of equity securities... -

Page 150

... have been classified within equity securities in the consolidated financial statements of the Company at a cost basis of $157 million which is equivalent to the net book value of the shares. The cost basis will be adjusted to fair value at each subsequent reporting date. The Company has agreed to... -

Page 151

... Company made five acquisitions for $783 million. As a result of these acquisitions, MetLife's Institutional segment increased its product offering of dental and vision benefit plans, MetLife Bank within Corporate & Other entered the mortgage origination and servicing business and the International... -

Page 152

...the Company's fixed maturity and equity securities, and the percentage that each sector represents by the respective total holdings at: December 31, 2008 Cost or Amortized Cost Gross Unrealized Gain Loss (In millions) Estimated Fair Value % of Total U.S. corporate securities ...Residential mortgage... -

Page 153

... are credit enhanced by financial guarantee insurers are asset-backed securities which are backed by sub-prime mortgage loans. Concentrations of Credit Risk (Fixed Maturity Securities). The following section contains a summary of the concentrations of credit risk related to fixed maturity securities... -

Page 154

... the total holdings, respectively. Sub-prime mortgage lending is the origination of residential mortgage loans to customers with weak credit profiles. At December 31, 2008 and 2007, the Company had exposure to fixed maturity securities backed by sub-prime mortgage loans with estimated fair values of... -

Page 155

... Financial Statements - (Continued) The amortized cost and estimated fair value of fixed maturity securities, by contractual maturity date (excluding scheduled sinking funds), are as follows: December 31, 2008 Amortized Cost Estimated Fair Value Amortized Cost 2007 Estimated Fair Value (In millions... -

Page 156

... Financial Statements - (Continued) The changes in net unrealized investment gains (losses) are as follows: Years Ended December 31, 2008 2007 2006 (In millions) Balance, end of prior period ...Cumulative effect of change in accounting principles, net of income tax ...Balance, beginning of period... -

Page 157

...unrealized loss position ... Aging of Gross Unrealized Loss for Fixed Maturity and Equity Securities Available-for-Sale The following tables present the cost or amortized cost, gross unrealized loss and number of securities for fixed maturity and equity securities, where the estimated fair value had... -

Page 158

... resulted from a lack of market liquidity and a short-term market dislocation versus a longterm deterioration in credit quality, and the Company's current intent and ability to hold the fixed maturity and equity securities with unrealized losses for a period of time sufficient for them to recover... -

Page 159

... than for fixed maturity securities. An extended and severe unrealized loss position on a fixed maturity security may not have any impact on the ability of the issuer to service all scheduled interest and principal payments and the Company's evaluation of recoverability of all contractual cash flows... -

Page 160

...% Years Ended December 31, 2008 2007 2006 (In millions) Fixed maturity securities ...Equity securities ...Mortgage and consumer loans ...Real estate and real estate joint ventures ...Other limited partnership interests ...Freestanding derivatives ...Embedded derivatives ...Other ...Net investment... -

Page 161

...maturity securities ...Equity securities ...Trading securities ...Mortgage and consumer loans ...Policy loans ...Real estate and real estate joint ventures ...Other limited partnership interests ...Cash, cash equivalents and short-term investments ...International joint ventures(1) ...Other ...Total... -

Page 162

... within net investment income totaled ($193) million, $50 million and $71 million for the years ended December 31, 2008, 2007 and 2006, respectively. Included within unrealized gains (losses) on such trading securities and short sale agreement liabilities are changes in estimated fair value of... -

Page 163

..., mortgage loans held-for-sale also include $37 million and $5 million, respectively, of commercial and residential mortgage loans held-for-sale which are carried at the lower of amortized cost or estimated fair value. Mortgage and Consumer Loans by Geographic Region and Property Type - The Company... -

Page 164

... 2007 and 2006. Gross interest income that would have been recorded in accordance with the original terms of such loans also amounted to $1 million or less for each of the years ended December 31, 2008, 2007 and 2006. Mortgage and consumer loans with scheduled payments of 90 days or more past due on... -

Page 165

... for the purpose of investing in low-income housing and other social causes, where the primary return on investment is in the form of tax credits, and are accounted for under the equity method. Funding agreements represent arrangements where the Company has long-term interest bearing amounts on... -

Page 166

... These assets are reflected at estimated fair value, and consist of fixed maturity securities available-for-sale of $2,137 million and cash and cash equivalents of $224 million, of which $60 million is cash held-in-trust. Included within fixed maturity securities available-for-sale are MetLife, Inc... -

Page 167

... (1) See Note 1 for further discussion of the Company's significant accounting policies with regards to the carrying amounts of these investments. (2) The maximum exposure to loss relating to the fixed maturity securities available-for-sale and equity securities available-for-sale is equal to the... -

Page 168

... Current Market or Fair Value Assets Liabilities (In millions) Interest rate swaps ...Interest rate floors ...Interest rate caps ...Financial futures ...Foreign currency swaps ...Foreign currency forwards ...Options ...Financial forwards ...Credit default swaps ...Synthetic GICs ...Other ...Total... -

Page 169

...hedge minimum guarantees embedded in certain variable annuity products offered by the Company. To hedge against adverse changes in equity indices, the Company enters into contracts to sell the equity index options within a limited time at a contracted price. The contracts will be net settled in cash... -

Page 170

...) Total rate of return swaps ("TRRs") are swaps whereby the Company agrees with another party to exchange, at specified intervals, the difference between the economic risk and reward of an asset or a market index and LIBOR, calculated by reference to an agreed notional principal amount. No cash is... -

Page 171

...financial forwards to buy and sell securities to economically hedge its exposure to interest rates; (vii) synthetic guaranteed interest contracts; (viii) credit default swaps and total rate of return swaps to synthetically create investments; (ix) basis swaps to better match the cash flows of assets... -

Page 172

... or bond indexed crediting rates. The following table presents the estimated fair value of the Company's embedded derivatives at: December 31, 2008 2007 (In millions) Net embedded derivatives within asset host contracts: Ceded guaranteed minimum benefit riders ...Call options in equity securities... -

Page 173

... of the applicable ratings among Moody's, S&P, and Fitch. If no rating is available from a rating agency, then the MetLife rating is used. (2) Assumes the value of the referenced credit obligations is zero. (3) The weighted average years to maturity of the credit default swaps is calculated based on... -

Page 174

... Financial Statements - (Continued) 5. Deferred Policy Acquisition Costs and Value of Business Acquired Information regarding DAC and VOBA is as follows: DAC VOBA (In millions) Total Balance at January 1, 2006 ...Capitalizations ...Subtotal ...Less: Amortization related to: Net investment... -

Page 175

... Total 2007 Institutional: Group life ...Retirement & savings ...Non-medical health & other ...Subtotal ...Individual: Traditional life ...Variable & universal life ...Annuities ...Other ...Subtotal ...International: Latin America region ...European region ...Asia Pacific region ...Subtotal ...Auto... -

Page 176

...) Institutional: Group life ...Retirement & savings ...Non-medical health & other ...Subtotal ...Individual: Traditional life ...Variable & universal life ...Annuities ...Other ...Subtotal ...International: Latin America region ...European region ...Asia Pacific region ...Subtotal ...Auto & Home... -

Page 177

...31, 2008 (In millions) 2007 2008 2007 Other Policyholder Funds Institutional Group life ...Retirement & savings ...Non-medical health & other ...Individual Traditional life ...Variable & universal life ...Annuities ...Other ...International ...Auto & Home ...Corporate & Other ...Total ...$ 3,346 40... -

Page 178

... are included in interest credited to policyholder account balances, was $1.0 billion, $1.1 billion and $834 million, respectively. Obligations Under Funding Agreements MetLife Insurance Company of Connecticut is a member of the FHLB of Boston and holds $70 million of common stock of the FHLB of... -

Page 179

... types of guarantees relating to annuity contracts and universal and variable life contracts is as follows: December 31, 2008 In the Event of Death At Annuitization 2007 In the At Event of Death Annuitization (In millions) Annuity Contracts(1) Return of Net Deposits Separate account value ...Net... -

Page 180

... 173 126 (8) 291 676 (80) $887 Account balances of contracts with insurance guarantees are invested in separate account asset classes as follows: December 31, 2008 2007 (In millions) Mutual Fund Groupings Equity ...Balanced ...Bond ...Money Market ...Specialty ...Total ...8. $39,842 14,548 5,671... -

Page 181

... collected from policyholders and receives reimbursements for benefits paid or accrued in excess of account values, subject to certain limitations. The Company enters into similar agreements for new or in-force business depending on market conditions. The Institutional segment generally retains most... -

Page 182

...the reinsurance of investment-type contracts held by small market defined benefit contribution plans. The Company has secured certain reinsurance recoverable balances with various forms of collateral, including secured trusts, funds withheld accounts and irrevocable letters of credit. At December 31... -

Page 183

... dividend obligation ...Payables for collateral under securities loaned and other transactions ...Other liabilities ...Total closed block liabilities ...Assets Designated to the Closed Block Investments: Fixed maturity securities available-for-sale, at estimated fair value (amortized cost... -

Page 184

... Premiums ...Net investment income and other revenues ...Net investment gains (losses) ...Total revenues ...Expenses Policyholder benefits and claims ...Policyholder dividends ...Change in policyholder dividend obligation ...Other expenses ...Total expenses ...Revenues, net of expenses before income... -

Page 185

... the common equity units. See Notes 12, 13 and 25. The Holding Company repaid a $500 million 5.25% senior note which matured in December 2006. Repurchase Agreements with the Federal Home Loan Bank of New York MetLife Bank, National Association ("MetLife Bank") is a member of the FHLB of NY and holds... -

Page 186

... Consolidated Financial Statements - (Continued) December 31, 2008, MetLife Bank's liability for advances from the Federal Reserve Bank of New York was $950 million, which is included in short-term debt. The estimated fair value of loan and investment security collateral pledged by MetLife Bank to... -

Page 187

..., to investors placed by an unaffiliated financial institution, $2.5 billion of 35-year surplus notes to provide statutory reserve support for the assumed closed block liabilities. Interest on the surplus notes accrues at an annual rate of 3-month LIBOR plus 0.55%, payable quarterly. The ability of... -

Page 188

... trust with a estimated fair value of $2.4 billion and $2.3 billion, respectively, associated with this transaction. The assets are principally invested in fixed maturity securities and are presented as such within the Company's consolidated balance sheet, with the related income included within net... -

Page 189

...issuance date of the 2008 Trust Securities until their scheduled redemption. Interest expense on the 2008 Trust Securities was $51 million for the year ended December 31, 2008. In December 2007, MetLife Capital Trust IV, a VIE consolidated by the Company, issued exchangeable surplus trust securities... -

Page 190

... million in proceeds in a registered public offering on June 21, 2005. As described below, the common equity units consisted of interests in trust preferred securities issued by MetLife Capital Trusts II and III, and stock purchase contracts issued by the Holding Company. The only assets of MetLife... -

Page 191

... equity unit to purchase, and the Holding Company to sell, for $12.50, on each of the initial stock purchase date and the subsequent stock purchase date, a number of newly issued or treasury shares of the Holding Company's common stock, par value $0.01 per share, equal to the applicable settlement... -

Page 192

... over the period from issuance date of the common equity units to the initial and subsequent stock purchase date. The remaining $49.5 million of costs related to the common stock issuance under the stock purchase contracts and were recorded as a reduction of additional paid-in capital. Earnings Per... -

Page 193

...: December 31, 2008 2007 (In millions) Deferred income tax assets: Policyholder liabilities and receivables ...Net operating loss carryforwards ...Employee benefits ...Capital loss carryforwards ...Tax credit carryforwards ...Net unrealized investment losses ...Litigation-related and government... -

Page 194

...$20 million was paid in 2008 and $133 million will be paid in 2009. The Company's liability for unrecognized tax benefits will change in the next 12 months pending the outcome of remaining issues associated with the current IRS audit including tax-exempt income and tax credits. Management is working... -

Page 195

... statements. In 2007, the Company received $39 million upon the resolution of an indemnification claim associated with the 2000 acquisition of General American Life Insurance Company ("GALIC"), and the Company reduced legal liabilities by $38 million after the settlement of certain cases. The review... -

Page 196

... annual periods in which they are recorded, based on information currently known by management, management does not believe any such charges are likely to have a material adverse effect on the Company's financial position. During 1998, MLIC paid $878 million in premiums for excess insurance policies... -

Page 197

... customers, incentive agreements entered into with brokers, or compensation paid to intermediaries. Regulators also have requested information relating to market timing and late trading of mutual funds and variable insurance products and, generally, the marketing of products. The Company has... -

Page 198

... several years, MLIC, New England, GALIC, Walnut Street Securities and MSI have faced numerous claims, including class action lawsuits, alleging improper marketing or sales of individual life insurance policies, annuities, mutual funds or other products. Some of the current cases seek substantial... -

Page 199

...resulting in the $8 million, net of income tax, reduction of certain tax liabilities during the year ended December 31, 2006. In 2007, pension reform legislation in Argentina was enacted which relieved the Company of its obligation to provide death and disability policy coverages and resulted in the... -

Page 200

... future policyholder benefits was an increase to net income of $34 million, net of income tax, during the year ended December 31, 2008. As part of Nationalization, the Company may receive compensation from the Argentine government for the loss of the pension business in the form of government bonds... -

Page 201

...postretirement employee benefit plans covering employees and sales representatives who meet specified eligibility requirements. Pension benefits are provided utilizing either a traditional formula or cash balance formula. The traditional formula provides benefits based upon years of credited service... -

Page 202

... benefit plans. Obligations, Funded Status and Net Periodic Benefit Costs Pension Benefits 2008 December 31, Other Postretirement Benefits 2007 2007 2008 (In millions) Change in benefit obligation: Benefit obligation at beginning of Service cost ...Interest cost ...Plan participants' contributions... -

Page 203

... periodic benefit cost and other changes in plan assets and benefit obligations recognized in other comprehensive income (loss) were as follows: Years Ended December 31, Pension Benefits 2008 2007 2006 Other Postretirement Benefits 2008 2007 2006 (In millions) Net Periodic Benefit Cost Service cost... -

Page 204

... A summary of the reduction to the APBO and related reduction to the components of net periodic other postretirement benefit plan cost is as follows: December 31, 2008 2007 (In millions) 2006 Cumulative reduction in benefit Balance, beginning of year . Service cost ...Interest cost ...Net actuarial... -

Page 205

... to make additional discretionary contributions of $150 million in 2009. Benefit payments due under the non-qualified pension plans are funded from the Subsidiaries' general assets as they become due under the provision of the plans. These payments totaled $43 million and $48 million for the years... -

Page 206

...or provided for. The Holding Company is prohibited from declaring dividends on the Preferred Shares if it fails to meet specified capital adequacy, net income and shareholders' equity levels. In addition, under Federal Reserve Bank of New York Board policy, the Holding Company may not be able to pay... -

Page 207

... cost of $750 million under an accelerated common stock repurchase agreement with a major bank. The bank borrowed the common stock sold to the Company from third parties and purchased common stock in the open market to return to such third parties. In June 2007, the Company paid a cash adjustment... -

Page 208

... a net book value of $1,716 million resulting in a loss on disposition, including transaction costs, of $458 million. Future common stock repurchases will be dependent upon several factors, including the Company's capital position, its financial strength and credit ratings, general market conditions... -

Page 209

... closing price of the Company's common stock as reported on the New York Stock Exchange on the date of grant, and have a maximum term of ten years. Certain Stock Options granted under the Stock Incentive Plan and the 2005 Stock Plan have or will become exercisable over a three year period commencing... -

Page 210

... change in annual net operating earnings per share, as defined; and (ii) the proportionate total shareholder return, as defined, with reference to the three-year performance period relative to other companies in the S&P Insurance Index with reference to the same three-year period. Performance Share... -

Page 211

... equity award, based upon the grant date fair value, was recognized into expense ratably over the respective three-year performance period. The portion of the Opportunity Award settled in cash was accounted for as a liability and was remeasured using the closing price of the Holding Company's common... -

Page 212

... the distribution within 30 days of its filing. Under New York State Insurance Law, the Superintendent has broad discretion in determining whether the financial condition of a stock life insurance company would support the payment of such dividends to its shareholders. The New York State Department... -

Page 213

...date of sale ...Deferred income tax on unrealized investment loss of subsidiary at date of sale ...Net unrealized investment gains (losses), net of income Foreign currency translation adjustment ...Minimum pension liability adjustment, net of income tax Defined benefit plan adjustment, net of income... -

Page 214

...management continues to execute its restructuring plans. Restructuring charges associated with this enterprise-wide initiative were as follows: Year Ended December 31, 2008 (In millions) Balance as of beginning of the period ...Severance charges ...Change in severance charge estimates Cash payments... -

Page 215

... operations, net of income tax ...Net income ...Net income available to common shareholders ...2007 Total revenues ...Total expenses ...Income from continuing operations ...Income from discontinued operations, net of income tax ...Net income ...Net income available to common shareholders ...Basic... -

Page 216

... as short and long-term disability, long-term care, and dental insurance, and other insurance products and services. Individual offers a wide variety of protection and asset accumulation products, including life insurance, annuities and mutual funds. International provides life insurance, accident... -

Page 217

...& Other. For the Year Ended December 31, 2008 Institutional Individual International Auto & Home Corporate & Other Total (In millions) Statement of Income: Revenues Premiums ...Universal life and investment-type product policy Net investment income ...Other revenues ...Net investment gains (losses... -

Page 218

MetLife, Inc. Notes to the Consolidated Financial Statements - (Continued) For the Year Ended December 31, 2007 Institutional Individual Auto & International Home (In millions) Corporate & Other Total Statement of Income: Revenues Premiums ...Universal life and investment-type Net investment income... -

Page 219

MetLife, Inc. Notes to the Consolidated Financial Statements - (Continued) For the Year Ended December 31, 2006 Institutional Individual Auto & International Home (In millions) Corporate & Other Total Statement of Income: Revenues Premiums ...Universal life and investment-type product Net ... -

Page 220

... together make up the largest apartment complex in Manhattan, New York totaling over 11,000 units, spread over 80 contiguous acres. The properties were owned by the Company's subsidiary, MTL. Net investment income on these properties was $73 million for the year ended December 31, 2006. The sale... -

Page 221

... ...Accrued investment income ...Premiums and other receivables ...Deferred policy acquisition costs and VOBA ...Goodwill ...Other assets ...Separate account assets ...Total assets held-for-sale ...Future policy benefits ...Policyholder account balances ...Other policyholder funds ...Long-term debt... -

Page 222

... investment income ...Premiums and other receivables ...Deferred policy acquisition costs and VOBA ...Deferred income tax asset ...Other assets ...Total assets held-for-sale ...Future policy benefits ...Policyholder account balances ...Other policyholder funds ...Policyholder dividends payable... -

Page 223

...$328 million in cash and stock. The Company reported the operations of SSRM in discontinued operations. Under the terms of the sale agreement, MetLife had an opportunity to receive additional payments based on, among other things, certain revenue retention and growth measures. The purchase price was... -

Page 224

...Value Assets: Fixed maturity securities ...Equity securities ...Trading securities ...Mortgage and consumer loans ...Policy loans ...Short-term investments ...Cash and cash equivalents ...Accrued investment income ...Assets of subsidiaries held-for-sale ...Liabilities: Policyholder account balances... -

Page 225

...short-term and long-term debt, collateral financing arrangements and junior subordinated debt securities are determined by discounting expected future cash flows using risk rates currently available for debt with similar terms and remaining maturities. Payables for Collateral Under Securities Loaned... -

Page 226

... ...Accrued investment income ...Premiums and other receivables(1) ...Other assets(1) ...Assets of subsidiaries held-for-sale(1) ...Separate account assets ...Net embedded derivatives within asset host contracts(2) ...Liabilities: Policyholder account balances(1) ...Short-term debt ...Long-term debt... -

Page 227

... current interest rates for similar loans with similar credit risk. • Mortgage Loans Held-for-Sale - Mortgage loans held-for-sale principally includes residential mortgages for which the fair value option was elected and which are carried at estimated fair value. Generally, quoted market prices... -

Page 228

...are limited. As such, the Company relies primarily on a discounted cash flow model to estimate the fair value of the mortgage servicing rights. The model requires inputs such as type of loan (fixed vs. variable and agency vs. other), age of loan, loan interest rates and current market interest rates... -

Page 229

...maturity securities, equity securities, mortgage loans, derivatives, hedge funds, other limited partnership interests, short-term investments and cash and cash equivalents. The estimated fair value of mutual funds is based upon quoted prices or reported net assets values provided by the fund manager... -

Page 230

... investment contracts with equity or bond indexed crediting rates. Embedded derivatives are recorded in the financial statements at estimated fair value with changes in estimated fair value adjusted through net income. The Company issues certain variable annuity products with guaranteed minimum... -

Page 231

... are included, along with their guaranteed investment contract host, within policyholder account balances with changes in estimated fair value recorded in net investment gains (losses). Changes in equity and bond indices, interest rates and the Company's credit standing may result in significant... -

Page 232

...redeemable preferred stock ...Total equity securities ...Trading securities ...Short-term investments(1) ...Mortgage and consumer loans(2) ...Derivative assets(3) ...Net embedded derivatives within asset Mortgage servicing rights(5) ...Separate account assets(6) ...host contracts(4) ... Total assets... -

Page 233

...-traded common stock; and certain short-term money market securities. As it relates to derivatives, this level includes financial futures including exchange-traded equity and interest rate futures, as well as financial forwards to sell residential mortgage-backed securities. Separate account assets... -

Page 234

... of Period Earnings(2, 3) Income (Loss) Settlements(4) of Level 3(5) Period 2007 (In millions) Fixed maturity securities ...Equity securities ...Trading securities ...Short-term investments ...Mortgage and consumer loans Net derivatives(6) ...Mortgage servicing rights(7),(8) Separate account assets... -

Page 235

... Policyholder Investment Other Benefits and Gains (Losses) Revenues Claims (In millions) Net Investment Income Total Fixed maturity securities ...Equity securities ...Trading securities ...Short-term investments ...Mortgage and consumer loans ...Net derivatives ...Mortgage servicing rights ...Net... -

Page 236

... own cash to satisfy the payment obligations under the stock purchase contract, the terms of the debt are the same as the remarketed debt. The subsequent settlement of the stock purchase contracts occurred on February 17, 2009, providing proceeds to the Holding Company of $1,035 million in exchange... -

Page 237

... CASTRO-WRIGHT Partner, Centerview Partners Management, LLC Chair, Compensation Committee Member, Finance and Risk Policy Committee and Governance Committee HUGH B. PRICE Executive Vice President and Chief Investment Officer JAMES L. LIPSCOMB Chief Executive Officer, Tupelo Capital Management LLC... -

Page 238

... million customers around the world and MetLife is the largest life insurer in the United States (based on life insurance in-force). The MetLife companies offer life insurance, annuities, auto and home insurance, retail banking and other financial services to individuals, as well as group insurance... -

Page 239

....12(a) of the New York Stock Exchange Listed Company Manual was submitted to the NYSE in 2008. MetLife, Inc. has filed the CEO and CFO Certifications required by Sections 302 and 906 of the Sarbanes-Oxley Act of 2002 as exhibits to its Annual Report on Form 10-K for the year ended December 31, 2008... -

Page 240

MetLife, Inc. 200 Park Avenue New York, NY 10166-0188 www.metlife.com 0710-6222 © 2008 METLIFE, INC. PEANUTS © United Feature Syndicate, Inc.