MetLife 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

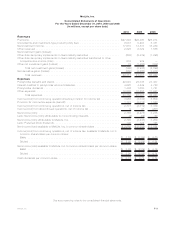

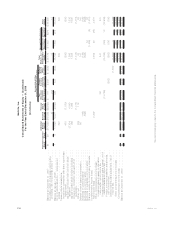

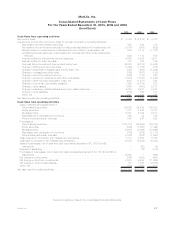

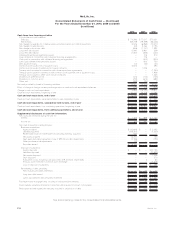

MetLife, Inc.

Consolidated Statements of Cash Flows

For the Years Ended December 31, 2010, 2009 and 2008

(In millions)

2010 2009 2008

Cash flows from operating activities

Netincome(loss) ..................................................... $ 2,786 $ (2,278) $ 3,278

Adjustments to reconcile net income (loss) to net cash provided by operating activities:

Depreciationandamortizationexpenses ................................... 585 520 375

Amortization of premiums and accretion of discounts associated with investments, net . . . . . (1,078) (967) (939)

(Gains) losses on investments and derivatives and from sales of businesses, net . . . . . . . . . 854 7,715 (1,127)

Undistributed equity earnings of real estate joint ventures and other limited partnership

interests....................................................... (430) 1,118 679

Interestcreditedtopolicyholderaccountbalances............................. 4,925 4,852 4,911

Interestcreditedtobankdeposits........................................ 137 163 166

Universallifeandinvestment-typeproductpolicyfees........................... (6,037) (5,218) (5,462)

Changeintradingandothersecurities..................................... (1,369) (1,152) (418)

Changeinresidentialmortgageloansheld-for-sale,net.......................... (487) (800) (1,946)

Changeinmortgageservicingrights...................................... (165) (687) (185)

Changeinaccruedinvestmentincome .................................... (206) (110) 428

Changeinpremiums,reinsuranceandotherreceivables ......................... (1,023) (1,653) (1,929)

Changeindeferredpolicyacquisitioncosts,net .............................. (541) (1,837) 545

Changeinincometaxrecoverable(payable)................................. 1,292 (2,614) 920

Changeinotherassets .............................................. 1,948 (660) 5,737

Changeininsurance-relatedliabilitiesandpolicy-relatedbalances................... 6,489 6,401 5,307

Changeinotherliabilities ............................................. (315) 865 163

Other,net ....................................................... 631 145 199

Netcashprovidedbyoperatingactivities...................................... 7,996 3,803 10,702

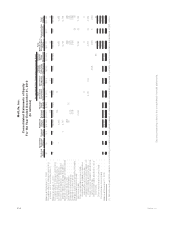

Cash flows from investing activities

Sales, maturities and repayments of:

Fixedmaturitysecurities.............................................. 86,529 64,428 102,250

Equitysecurities................................................... 1,371 2,545 2,707

Mortgageloans.................................................... 6,361 5,769 6,077

Realestateandrealestatejointventures................................... 322 43 140

Otherlimitedpartnershipinterests........................................ 522 947 593

Purchases of:

Fixed maturity securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (100,713) (83,940) (86,874)

Equitysecurities................................................... (949) (1,986) (1,494)

Mortgageloans.................................................... (8,967) (4,692) (10,096)

Realestateandrealestatejointventures................................... (786) (579) (1,170)

Otherlimitedpartnershipinterests........................................ (1,008) (803) (1,643)

Cashreceivedinconnectionwithfreestandingderivatives ......................... 1,814 3,292 8,168

Cashpaidinconnectionwithfreestandingderivatives ............................ (2,548) (5,393) (6,454)

Sales of businesses, net of cash and cash equivalents disposed of $0, $180 and $0,

respectively...................................................... — (50) (4)

Disposalofsubsidiary................................................. — (19) (313)

Purchases of businesses, net of cash and cash equivalents acquired of $4,175, $0 and $314,

respectively...................................................... (3,021) — (469)

Netchangeinpolicyloans.............................................. (225) (259) (467)

Netchangeinshort-terminvestments ...................................... 3,033 5,534 (11,269)

Netchangeinotherinvestedassets ....................................... 137 1,388 (2,206)

Other,net......................................................... (186) (160) (147)

Netcashusedininvestingactivities ......................................... $ (18,314) $(13,935) $ (2,671)

See accompanying notes to the consolidated financial statements.

F-7MetLife, Inc.