MetLife 2010 Annual Report Download - page 215

Download and view the complete annual report

Please find page 215 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

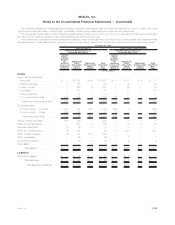

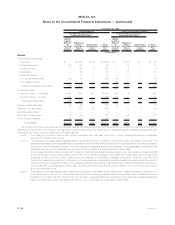

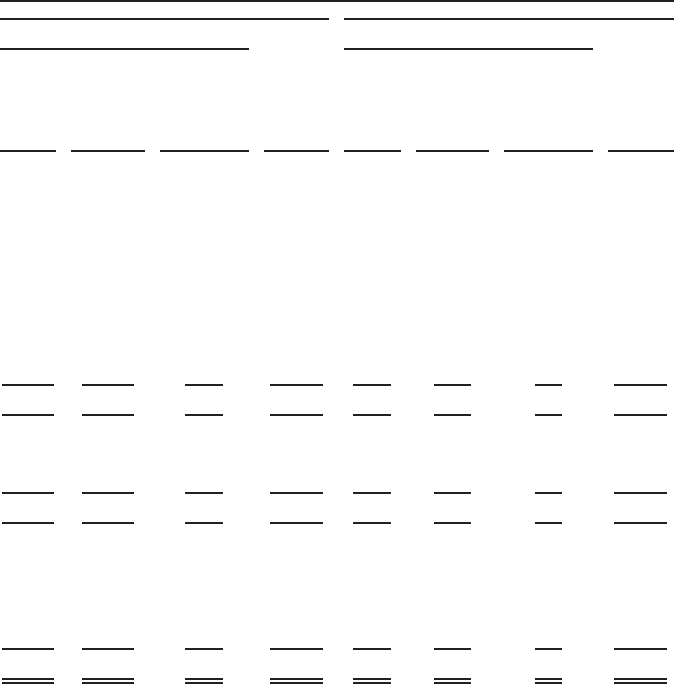

Quoted

Prices

In Active

Markets

for

Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Estimated

Fair

Value

Quoted

Prices

In Active

Markets

for

Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Estimated

Fair

Value

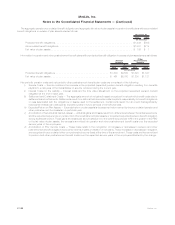

Fair Value Measurements at

Reporting Date Using Fair Value Measurements at

Reporting Date Using

Pension Benefits Other Postretirement Benefits

December 31, 2009

(In millions)

Assets

Fixed maturity securities:

Corporate .................... $ — $1,458 $ 68 $1,526 $ — $ 48 $— $ 48

Federalagencies ............... (41) 140 — 99 — 30 — 30

Foreignbonds ................. 1 195 5 201 — 6 — 6

Municipals.................... — 56 — 56 — 21 — 21

Preferredstocks................ — 2 — 2 — — — —

U.S. government bonds . . . . . . . . . . . 319 50 — 369 45 — — 45

U.S.treasurynotes.............. — — — — 12 — — 12

Total fixed maturity securities . . . . . . 279 1,901 73 2,253 57 105 — 162

Equity securities:

Common stock — domestic . . . . . . . . 1,565 238 241 2,044 342 6 — 348

Commonstock—foreign.......... 393 — — 393 72 — — 72

Total equity securities . . . . . . . . . . . 1,958 238 241 2,437 414 6 — 420

Moneymarketsecurities ............ 72 56 — 128 12 1 — 13

Pass-throughsecurities............. 1 376 69 446 — 75 9 84

Derivativesecurities ............... 3 — — 3 — — — —

Short-term investments . . . . . . . . . . . . . 2 115 — 117 — 442 — 442

Otherinvestedassets.............. 13 — 373 386 — — — —

Total assets . . . . . . . . . . . . . . . . $2,328 $2,686 $756 $5,770 $483 $629 $ 9 $1,121

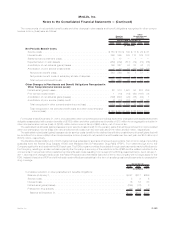

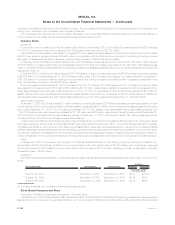

The pension and other postretirement benefit plan assets are categorized into the three-level fair value hierarchy, as defined in Note 1,

based upon the priority of the inputs to the respective valuation technique. The following summarizes the types of assets included within the

three-level fair value hierarchy presented in the table above.

Level 1 This category includes investments in liquid securities, such as cash, short-term money market and bank time deposits,

expected to mature within a year.

Level 2 This category includes certain separate accounts that are primarily invested in liquid and readily marketable securities. The

estimated fair value of such separate account is based upon reported NAV provided by fund managers and this value represents

the amount at which transfers into and out of the respective separate account are effected. These separate accounts provide

reasonable levels of price transparency and can be corroborated through observable market data.

Certain separate accounts are invested in investment partnerships designated as hedge funds. The values for these separate

accounts is determined monthly based on the NAV of the underlying hedge fund investment. Additionally, such hedge funds

generally contain lock out or other waiting period provisions for redemption requests to be filled. While the reporting and

redemption restrictions may limit the frequency of trading activity in separate accounts invested in hedge funds, the reported

NAV, and thus the referenced value of the separate account, provides a reasonable level of price transparency that can be

corroborated through observable market data. Directly held investments are primarily invested in U.S. and foreign government

and corporate securities.

Level 3 This category includes separate accounts that are invested in real estate and private equity investments that provide little or no

price transparency due to the infrequency with which the underlying assets trade and generally require additional time to

liquidate in an orderly manner. Accordingly, the values for separate accounts invested in these alternative asset classes are

based on inputs that cannot be readily derived from or corroborated by observable market data.

F-126 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)