MetLife 2010 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

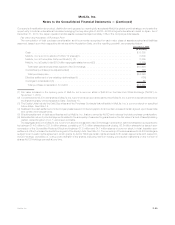

Recording of Assets Acquired and Liabilities Assumed

The following table summarizes the amounts recognized at fair value for each major class of assets acquired and liabilities assumed and

the resulting goodwill as of the Acquisition Date.

November 1, 2010

(In millions)

Assets acquired:

Totalinvestments........................................................ $101,036

Cashandcashequivalents.................................................. 4,175

Accruedinvestmentincome ................................................. 948

Premiums,reinsuranceandotherreceivables...................................... 1,971

VOBA ............................................................... 9,210

Otherassets........................................................... 1,146

Separateaccountassets................................................... 244

Totalassets .......................................................... $118,730

Liabilities assumed:

Futurepolicybenefits ..................................................... $ 31,811

Policyholderaccountbalances ............................................... 66,652

Otherpolicy-relatedbalances................................................ 7,306

Current and deferred income tax liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 336

Otherliabilities.......................................................... 2,918

Separateaccountliabilities.................................................. 244

Totalliabilities......................................................... $109,267

Redeemable noncontrolling interests in partially owned consolidated subsidiaries

assumed ........................................................... $ 109

Noncontrollinginterests.................................................... (21)

Goodwill.............................................................. 6,959

Netassetsacquired ...................................................... $ 16,292

Goodwill

Goodwill is calculated as the excess of the consideration transferred over the net assets recognized and represents the future economic

benefits arising from other assets acquired and liabilities assumed that could not be individually identified. The goodwill recorded as part of

the Acquisition includes the expected synergies and other benefits that management believes will result from combining the operations of

ALICO with the operations of MetLife, including further diversification in geographic mix and product offerings and an increase in distribution

strength.

Of the $7.0 billion of goodwill, approximately $4.0 billion is estimated to be deductible for tax purposes. Of the $4.0 billion, approximately

$573 million is estimated to be deductible for U.S. tax purposes prior to the completion of the anticipated restructuring of American Life’s

foreign branches. See “—Branch Restructuring”. The goodwill resulting from the Acquisition was presented within the Company’s Inter-

national segment.

Identified Intangibles

VOBA reflects the estimated fair value of in-force contracts acquired and represents the portion of the purchase price that is allocated to

the value of future profits embedded in acquired insurance annuity and investment-type contracts in-force at the Acquisition Date.

The value of VODA and VOCRA, included in other assets, reflects the estimated fair value of ALICO’s distribution agreements and

customer relationships acquired at November 1, 2010 and will be amortized over the useful lives. Each year the Company will review VODA

and VOCRA to determine the recoverability of these balances.

The use of discount rates was necessary to establish the fair value of VOBA and the identifiable intangibles. In selecting the appropriate

discount rates, management considered its weighted average cost of capital, as well as the weighted average cost of capital required by

market participants. The fair value of acquired liabilities was determined using risk free rates adjusted for a nonperformance risk premium. The

nonperformance adjustment was determined by taking into consideration publicly available information relating to spreads in the secondary

market for the Holding Company’s debt, including related credit default swaps. These observable spreads were then adjusted to reflect the

priority of these liabilities, the claims paying ability of the insurance subsidiaries compared to the Holding Company and, as necessary, the

relative credit spreads of the liabilities’ currencies of denomination as compared to USD spreads.

F-30 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)