MetLife 2010 Annual Report Download - page 205

Download and view the complete annual report

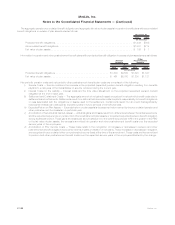

Please find page 205 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MLIC reevaluates on a quarterly and annual basis its exposure from asbestos litigation, including studying its claims experience, reviewing

external literature regarding asbestos claims experience in the United States, assessing relevant trends impacting asbestos liability and

considering numerous variables that can affect its asbestos liability exposure on an overall or per claim basis. These variables include

bankruptcies of other companies involved in asbestos litigation, legislative and judicial developments, the number of pending claims involving

serious disease, the number of new claims filed against it and other defendants and the jurisdictions in which claims are pending. As

previously disclosed, in 2002 MLIC increased its recorded liability for asbestos-related claims by $402 million from approximately $820 million

to $1,225 million. Based upon its regular reevaluation of its exposure from asbestos litigation, MLIC has updated its liability analysis for

asbestos-related claims through December 31, 2010.

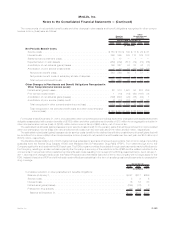

Regulatory Matters

The Company receives and responds to subpoenas or other inquiries from state regulators, including state insurance commissioners;

state attorneys general or other state governmental authorities; federal regulators, including the SEC; federal governmental authorities,

including congressional committees; and the Financial Industry Regulatory Authority (“FINRA”) seeking a broad range of information. The

issues involved in information requests and regulatory matters vary widely. The Company cooperates in these inquiries.

Attorneys general from 50 states and several state banking and mortgage regulators announced a multistate joint investigation of

mortgage servicers to determine whether inaccurate affidavits or other documents were submitted in support of foreclosure proceedings.

MetLife Bank, and specifically its mortgage servicing department within MetLife Home Loans, received requests for information from some of

these state attorneys general and other regulators. Also, the Acting Comptroller of the Currency disclosed in testimony before Congress that

14 mortgage servicing businesses affiliated with banking organizations, including that of MetLife Bank, have been the subject of an intra-

agency confidential “horizontal examination” of mortgage servicing and foreclosure activities. The Acting Comptroller also testified that

federal banking regulators expect to issue administrative enforcement orders to such businesses and to seek civil money penalties. The

Acting Comptroller’s testimony also indicated that other federal agencies, including the Department of Justice and the Federal Trade

Commission, were examining potential actions with respect to such businesses. MetLife is cooperating with its regulators in connection with

their review of these matters but cannot predict the outcome of these matters. It is possible that additional state or federal regulators or

legislative bodies may pursue similar investigations or make related inquiries. Management believes that the Company’s financial statements

as a whole will not be materially affected by the MetLife Bank regulatory matters.

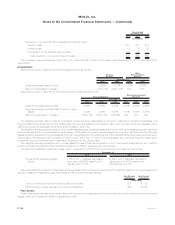

United States of America v. EME Homer City Generation, L.P., et al. (W.D. Pa., filed January 4, 2011). On January 4, 2011, the United

States commenced a civil action in United States District Court for the Western District of Pennsylvania against EME Homer City Generation

L.P. (“EME Homer City”), Homer City OL6 LLC, and other defendants regarding the operations of the Homer City Generating Station, an

electricity generating facility. Homer City OL6 LLC, an entity owned by MLIC, is a passive investor with a noncontrolling interest in the

electricity generating facility, which is solely operated by the lessee, EME Homer City. The complaint seeks injunctive relief and assessment of

civil penalties for alleged violations of the federal Clean Air Act and Pennsylvania’s State Implementation Plan. The alleged violations were the

subject of Notices of Violations (“NOVs”) that the Environmental Protection Agency (“EPA”) issued to EME Homer City, Homer City OL6 LLC,

and others in June 2008 and May 2010. On January 7, 2011, the United States District Court for the Western District of Pennsylvania granted

the motion by the Pennsylvania Department of Environmental Protection and the State of New York to intervene in the lawsuit as additional

plaintiffs. On January 7, 2011, two plaintiffs filed a putative class action titled Scott Jackson and Maria Jackson v. EME Homer City Generation

L.P., et. al. in the United States District Court for the Western District of Pennsylvania on behalf of a putative class of persons who have

allegedly incurred damage to their persons and/or property because of the violations alleged in the action brought by the United States.

Homer City OL6 LLC is a defendant in this action. EME Homer City has acknowledged its obligation to indemnify Homer City OL6 LLC for any

claims relating to the NOVs.

In the Matter of Chemform, Inc. Site, Pompano Beach, Broward County, Florida. In July 2010, the EPA advised MLIC that it believed

payments were due under two settlement agreements, known as “Administrative Orders on Consent,” that New England Mutual Life

Insurance Company (“New England Mutual”) signed in 1989 and 1992 with respect to the cleanup of a Superfund site in Florida (the

“Chemform Site”). The EPA originally contacted MLIC (as successor to New England Mutual) and a third party in 2001, and advised that they

owed additional clean-up costs for the Chemform Site. The matter was not resolved at that time. The EPA is requesting payment of an amount

under $1 million from MLIC and a third party for past costs and for future environmental testing costs at the Chemform Site.

Regulatory authorities in a small number of states and FINRA, and occasionally the SEC, have had investigations or inquiries relating to

sales of individual life insurance policies or annuities or other products by MLIC, MICC, New England Life Insurance Company and GALIC, and

the four Company broker-dealers, which are MetLife Securities, Inc. (“MSI”), New England Securities Corporation, Walnut Street Securities,

Inc. and Tower Square Securities, Inc. These investigations often focus on the conduct of particular financial services representatives and the

sale of unregistered or unsuitable products or the misuse of client assets. Over the past several years, these and a number of investigations

by other regulatory authorities were resolved for monetary payments and certain other relief, including restitution payments. The Company

maycontinuetoresolveinvestigationsinasimilarmanner.TheCompanybelievesadequateprovisionhasbeenmadeinitsconsolidated

financial statements for all probable and reasonably estimable losses for these sales practices-related investigations or inquiries.

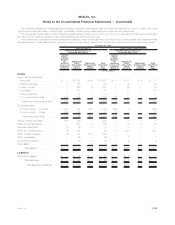

Retained Asset Account Matters

The New York Attorney General announced on July 29, 2010 that his office had launched a major fraud investigation into the life insurance

industry for practices related to the use of retained asset accounts as a settlement option for death benefits and that subpoenas requesting

comprehensive data related to retained asset accounts had been served on MetLife and other insurance carriers. The Company received the

subpoena on July 30, 2010. The Company also has received requests for documents and information from U.S. congressional committees

and members as well as various state regulatory bodies, including the New York Insurance Department. It is possible that other state and

federal regulators or legislative bodies may pursue similar investigations or make related inquiries. Management cannot predict what effect

any such investigations might have on the Company’s earnings or the availability of the Company’s retained asset account known as the Total

Control Account (“TCA”), but management believes that the Company’s consolidated financial statements taken as a whole would not be

F-116 MetLife, Inc.

MetLife, Inc.

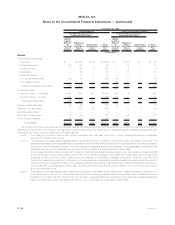

Notes to the Consolidated Financial Statements — (Continued)