MetLife 2010 Annual Report Download - page 180

Download and view the complete annual report

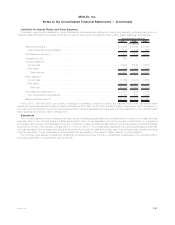

Please find page 180 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.investment purposes and are principally carried at amortized cost, while those originated for sale and not carried under the FVO are carried at

the lower of cost or estimated fair value. The estimated fair values of these mortgage loans are determined as follows:

Mortgage loans held-for-investment. — For commercial and agricultural mortgage loans held-for-investment and carried at amortized

cost, estimated fair value was primarily determined by estimating expected future cash flows and discounting them using current interest

rates for similar mortgage loans with similar credit risk. For residential mortgage loans held-for-investment and carried at amortized cost,

estimated fair value was primarily determined from observable pricing for similar loans.

Mortgage loans held-for-sale. — Certain mortgage loans previously classified as held-for-investment have been designated as

held-for-sale. For these mortgage loans, estimated fair value is determined using independent broker quotations or, when the mortgage

loan is in foreclosure or otherwise determined to be collateral dependent, the fair value of the underlying collateral is estimated using

internal models. For residential mortgage loans originated for sale, the estimated fair value is determined principally from observable

market pricing or from internal models.

Policy Loans

For policy loans with fixed interest rates, estimated fair values are determined using a discounted cash flow model applied to groups of

similar policy loans determined by the nature of the underlying insurance liabilities. Cash flow estimates are developed applying a weighted-

average interest rate to the outstanding principal balance of the respective group of policy loans and an estimated average maturity

determined through experience studies of the past performance of policyholder repayment behavior for similar loans. These cash flows are

discounted using current risk-free interest rates with no adjustment for borrower credit risk as these loans are fully collateralized by the cash

surrender value of the underlying insurance policy. The estimated fair value for policy loans with variable interest rates approximates carrying

value due to the absence of borrower credit risk and the short time period between interest rate resets, which presents minimal risk of a

material change in estimated fair value due to changes in market interest rates.

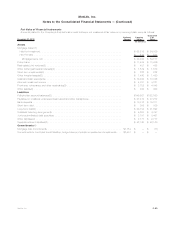

Real Estate Joint Ventures and Other Limited Partnership Interests

Real estate joint ventures and other limited partnership interests included in the preceding tables consist of those investments accounted

for using the cost method. The remaining carrying value recognized in the consolidated balance sheets represents investments in real estate

carried at cost less accumulated depreciation, or real estate joint ventures and other limited partnership interests accounted for using the

equity method, which do not meet the definition of financial instruments for which fair value is required to be disclosed.

The estimated fair values for other limited partnership interests and real estate joint ventures accounted for under the cost method are

generally based on the Company’s share of the NAV as provided in the financial statements of the investees. In certain circumstances,

management may adjust the NAV by a premium or discount when it has sufficient evidence to support applying such adjustments.

Short-term Investments

Certain short-term investments do not qualify as securities and are recognized at amortized cost in the consolidated balance sheets. For

these instruments, the Company believes that there is minimal risk of material changes in interest rates or credit of the issuer such that

estimated fair value approximates carrying value. In light of recent market conditions, short-term investments have been monitored to ensure

there is sufficient demand and maintenance of issuer credit quality and the Company has determined additional adjustment is not required.

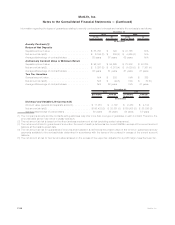

Other Invested Assets

Other invested assets within the preceding tables are principally comprised of an investment in a funding agreement, funds withheld,

various interest-bearing assets held in foreign subsidiaries and certain amounts due under contractual indemnifications.

The estimated fair value of the investment in funding agreements is estimated by discounting the expected future cash flows using current

market rates and the credit risk of the note issuer. For funds withheld and the various interest-bearing assets held in foreign subsidiaries, the

Company evaluates the specific facts and circumstances of each instrument to determine the appropriate estimated fair values. These

estimated fair values were not materially different from the recognized carrying values.

Cash and Cash Equivalents

Due to the short-term maturities of cash and cash equivalents, the Company believes there is minimal risk of material changes in interest

rates or credit of the issuer such that estimated fair value generally approximates carrying value. In light of recent market conditions, cash and

cash equivalent instruments have been monitored to ensure there is sufficient demand and maintenance of issuer credit quality, or sufficient

solvency in the case of depository institutions, and the Company has determined additional adjustment is not required.

Accrued Investment Income

Due to the short term until settlement of accrued investment income, the Company believes there is minimal risk of material changes in

interest rates or credit of the issuer such that estimated fair value approximates carrying value. In light of recent market conditions, the

Company has monitored the credit quality of the issuers and has determined additional adjustment is not required.

Premiums, Reinsurance and Other Receivables

Premiums, reinsurance and other receivables in the preceding tables are principally comprised of certain amounts recoverable under

reinsurance contracts, amounts on deposit with financial institutions to facilitate daily settlements related to certain derivative positions and

amounts receivable for securities sold but not yet settled.

Premiums receivable and those amounts recoverable under reinsurance treaties determined to transfer sufficient risk are not financial

instruments subject to disclosure and thus have been excluded from the amounts presented in the preceding tables. Amounts recoverable

under ceded reinsurance contracts, which the Company has determined do not transfer sufficient risk such that they are accounted for using

the deposit method of accounting, have been included in the preceding tables. The estimated fair value is determined as the present value of

expected future cash flows under the related contracts, which were discounted using an interest rate determined to reflect the appropriate

credit standing of the assuming counterparty.

F-91MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)