MetLife 2010 Annual Report Download - page 228

Download and view the complete annual report

Please find page 228 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Capitalization of DAC and Amortization of DAC and VOBA

See Note 6 for DAC and VOBA by segment and a rollforward of each including impacts of capitalization and amortization. See also Note 10

for a description of the DAC amortization impact associated with the closed block. Amortization of DAC and VOBA includes amortization of

negative VOBA related to the Acquisition of $64 million for the year ended December 31, 2010. Negative VOBA is recorded in other policy-

related balances (see Note 2) and therefore, the amortization of negative VOBA is an offset to the VOBA amortization in Note 6.

Interest Expense on Debt and Debt Issue Costs

See Notes 11, 12, 13 and 14 for attribution of interest expense by debt issuance. Interest expense on debt and debt issue costs includes

interest expense related to CSEs of $411 million for the year ended December 31, 2010, and $0 for both of the years ended December 31,

2009 and 2008. See Note 3.

Lease Impairments

See Note 16 for description of lease impairments included within other expenses.

Costs Related to the Acquisition

See Note 2 for transaction costs and integration-related expenses related to the Acquisition which were included in other expenses.

Restructuring Charges

In September 2008, the Company began an enterprise-wide cost reduction and revenue enhancement initiative which is expected to be

fully implemented by December 31, 2011. This initiative is focused on reducing complexity, leveraging scale, increasing productivity and

improving the effectiveness of the Company’s operations, as well as providing a foundation for future growth. These restructuring costs were

included in other expenses. As the expenses relate to an enterprise-wide initiative, they were incurred within Banking, Corporate & Other.

Estimated restructuring costs may change as management continues to execute its restructuring plans. Restructuring charges associated

with this enterprise-wide initiative were as follows:

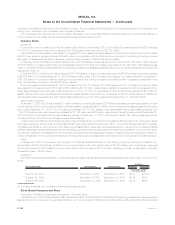

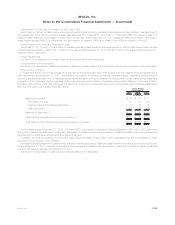

2010 2009 2008

Years Ended

December 31,

(In millions)

BalanceatJanuary1,................................................. $ 36 $ 86 $ —

Severancecharges................................................. 17 84 109

Changeinseverancechargeestimates.................................... (1) (8) (8)

Cashpayments ................................................... (45) (126) (15)

BalanceatDecember31, .............................................. $ 7 $ 36 $ 86

Restructuringchargesincurredincurrentperiod ............................... $ 16 $ 76 $101

Totalrestructuringchargesincurredsinceinceptionofprogram...................... $193 $177 $101

For the years ended December 31, 2010, 2009 and 2008, the change in severance charge estimates of ($1) million, ($8) million and

($8) million, respectively, was due to changes in estimates for variable incentive compensation, COBRA benefits, employee outplacement

services and for employees whose severance status changed.

In addition to the above charges, the Company has recognized lease charges of $28 million associated with the consolidation of office

space since the inception of the initiative.

Management anticipates further restructuring charges, including severance, lease and asset impairments, will be incurred during the year

ending December 31, 2011. However, such restructuring plans were not sufficiently developed to enable the Company to make an estimate

of such restructuring charges at December 31, 2010.

See Note 2 for discussion of restructuring charges related to the Acquisition.

F-139MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)