MetLife 2010 Annual Report Download - page 122

Download and view the complete annual report

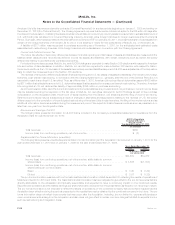

Please find page 122 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The pro forma information primarily reflects the following pro forma adjustments:

• reduction in net investment income to reflect the amortization or accretion associated with the new cost basis of the acquired fixed

maturities available-for-sale portfolio;

• elimination of amortization associated with the elimination of ALICO’s historical DAC;

• amortization of VOBA, VODA and VOCRA associated with the establishment of VOBA, VODA and VOCRA arising from the Acquisition;

• reduction in other expenses associated with the amortization of negative VOBA;

• reduction in revenues associated with the elimination of ALICO’s historical unearned revenue liability;

• interest expense associated with the issuance of the Debt Securities to ALICO Holdings and the public issuance of senior notes in

connection with the financing of the Acquisition;

• certain adjustments to conform to MetLife’s accounting policies; and

• reversal of investment and derivative gains (losses) associated with certain transactions that were completed prior to the Acquisition

Date (conditions of closing).

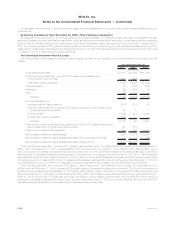

Costs Related to Acquisition

Transaction and Integration-Related Expenses. The Company incurred $100 million of transaction costs for the year ended Decem-

ber 31, 2010. Transaction costs represent costs directly related to effecting the Acquisition and primarily include banking and legal expenses.

Such costs have been expensed as incurred and are included in other expenses. These expenses have been reported within Banking,

Corporate & Other.

Integration-related expenses incurred for the year ended December 31, 2010 and included in other expenses were $176 million.

Integration costs represent incremental costs directly related to integrating ALICO, including expenses for consulting, rebranding and the

integration of information systems. As the integration of ALICO is an enterprise-wide initiative, these expenses have been reported within

Banking, Corporate & Other.

Restructuring Costs and Other Charges. As part of the integration of ALICO’s operations, management has initiated restructuring plans

focused on increasing productivity and improving the efficiency of the Company’s operations. For the year ended December 31, 2010, the

Company recognized a severance-related restructuring charge of $4 million associated with the termination of certain employees in

connection with this initiative which were reflected within other expenses. The Company did not make any cash payments related to these

severance costs as of December 31, 2010.

Estimated restructuring costs may change as management continues to execute its restructuring plans. Management anticipates further

restructuring charges including severance, contract termination costs and other associated costs through the year ended December 31,

2011. However, such restructuring plans are not sufficiently developed to enable the Company to make an estimate of such restructuring

charges at December 31, 2010.

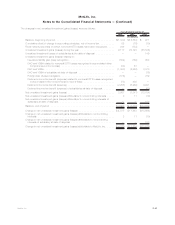

2010 Pending Disposition

In October 2010, the Company and its joint venture partner, MS&AD Insurance Group Holdings, Inc. (“MS&AD”), reached an agreement

under which the Company intends to sell its 50% interest in Mitsui Sumitomo MetLife Insurance Co., Ltd. (“MSI MetLife”), a Japan domiciled

life insurance company, to MS&AD for approximately $275 million (¥22.5 billion). During the year ended December 31, 2010, the Company

recorded an investment loss of $136 million, net of income tax, to record its investment in MSI MetLife at its estimated recoverable amount. It

is anticipated that the sale will close on or about April 1, 2011, subject to customary closing conditions, including obtaining required

regulatory approvals.

2009 Disposition

In March 2009, the Company sold Cova Corporation (“Cova”), the parent company of Texas Life Insurance Company (“Texas Life”) to a

third-party for $130 million in cash consideration, excluding $1 million of transaction costs. The net assets sold were $101 million, resulting in

a gain on disposal of $28 million, net of income tax. The Company also reclassified $4 million, net of income tax, of the 2009 operations of

Texas Life into discontinued operations in the consolidated financial statements. As a result, the Company recognized income from

discontinued operations of $32 million, net of income tax, during the year ended December 31, 2009. See Note 23.

2009 Disposition through Assumption Reinsurance

On October 30, 2009, the Company completed the disposal, through assumption reinsurance, of substantially all of the insurance

business of MetLife Canada, a wholly-owned indirect subsidiary, to a third-party. Pursuant to the assumption reinsurance agreement, the

consideration paid by the Company was $259 million, comprised of cash of $14 million and fixed maturity securities, mortgage loans and

other assets totaling $245 million. At the date of the assumption reinsurance agreement, the carrying value of insurance liabilities transferred

was $267 million, resulting in a gain of $5 million, net of income tax. The gain was recognized in net investment gains (losses).

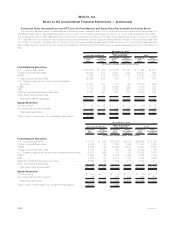

2008 Acquisitions and Disposition

During 2008, the Company made five acquisitions for $783 million. As a result of these acquisitions, MetLife’s Insurance Products

segment increased its product offering of dental and vision benefit plans, MetLife Bank, National Association (“MetLife Bank”) within Banking,

Corporate & Other entered the mortgage origination and servicing business and the International segment increased its presence in Mexico

and Brazil. The acquisitions were each accounted for using the purchase method of accounting and, accordingly, commenced being

included in the operating results of the Company upon their respective closing dates. Total consideration paid by the Company for these

acquisitions consisted of $763 million in cash and $20 million in transaction costs. The net fair value of assets acquired and liabilities assumed

totaled $527 million, resulting in goodwill of $256 million. Goodwill increased by $122 million, $73 million and $61 million in the International

segment, Insurance Products segment and Banking, Corporate & Other, respectively. The goodwill is deductible for tax purposes. VOCRA,

VOBA and other intangibles increased by $137 million, $7 million and $6 million, respectively, as a result of these acquisitions. Further

information on VOBA, goodwill and VOCRA is provided in Notes 6, 7 and 8, respectively.

F-33MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)