MetLife 2010 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

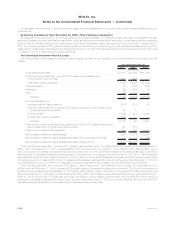

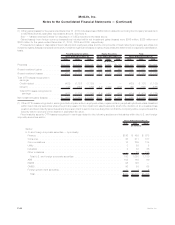

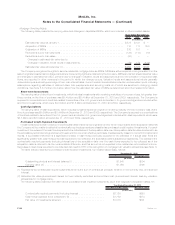

Elements of the securities lending programs are presented below at:

2010 2009

December 31,

(In millions)

Securities on loan:

Amortizedcost ..................................................... $23,715 $21,012

Estimatedfairvalue .................................................. $24,230 $20,949

Aging of cash collateral liability:

Open(1).......................................................... $ 2,752 $ 3,290

Lessthanthirtydays ................................................. 12,301 13,605

Thirtydaysorgreaterbutlessthansixtydays ................................. 4,399 3,534

Sixtydaysorgreaterbutlessthanninetydays................................. 2,291 92

Ninetydaysorgreater ................................................ 2,904 995

Totalcashcollateralliability............................................ $24,647 $21,516

Securitycollateralondepositfromcounterparties ................................ $ — $ 6

Reinvestmentportfolio—estimatedfairvalue................................... $24,177 $20,339

(1) Open — meaning that the related loaned security could be returned to the Company on the next business day requiring the Company to

immediately return the cash collateral.

The estimated fair value of the securities on loan related to the cash collateral on open at December 31, 2010 was $2.7 billion, of which

$2.3 billion were U.S. Treasury, agency and government guaranteed securities which, if put to the Company, can be immediately sold to

satisfy the cash requirements. The remainder of the securities on loan were primarily U.S. Treasury, agency and government guaranteed

securities, and very liquid RMBS. The reinvestment portfolio acquired with the cash collateral consisted principally of fixed maturity securities

(including RMBS, U.S. corporate, U.S. Treasury, agency and government guaranteed and ABS).

Security collateral on deposit from counterparties in connection with the securities lending transactions may not be sold or repledged,

unless the counterparty is in default, and is not reflected in the consolidated financial statements. Separately, the Company had $49 million

and $46 million, at estimated fair value, of cash and security collateral on deposit from a counterparty to secure its interest in a pooled

investment that is held by a third-party trustee, as custodian, at December 31, 2010 and 2009, respectively. This pooled investment is

included within fixed maturity securities and had an estimated fair value of $49 million and $51 million at December 31, 2010 and 2009,

respectively.

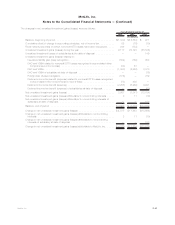

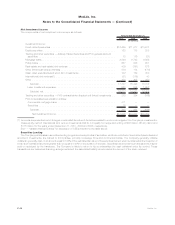

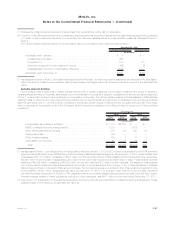

Invested Assets on Deposit, Held in Trust and Pledged as Collateral

The invested assets on deposit, invested assets held in trust and invested assets pledged as collateral are presented in the table below.

The amounts presented in the table below are at estimated fair value for cash and cash equivalents, short-term investments, fixed maturity,

equity, trading and other securities and at carrying value for mortgage loans.

2010 2009

December 31,

(In millions)

Invested assets on deposit:

Regulatoryagencies(1)................................................ $ 2,110 $ 1,383

Invested assets held in trust:

Collateralfinancingarrangements(2) ....................................... 5,340 5,653

Reinsurancearrangements(3)............................................ 3,090 2,719

Invested assets pledged as collateral:

Fundingagreementsandadvances—FHLBofNY(4) ............................ 21,975 20,612

Fundingagreements—FHLBofBoston(4) ................................... 211 419

Fundingagreements—FarmerMac(5)...................................... 3,159 2,871

FederalReserveBankofNewYork(6)....................................... 1,822 1,537

Collateralfinancingarrangements(7) ....................................... 112 80

Derivativetransactions(8) .............................................. 1,726 1,671

Shortsaleagreements(9)............................................... 465 496

Totalinvestedassetsondeposit,heldintrustandpledgedascollateral ................ $40,010 $37,441

(1) The Company has investment assets on deposit with regulatory agencies consisting primarily of cash and cash equivalents, short-term

investments, fixed maturity securities and equity securities.

(2) The Company held in trust cash and securities, primarily fixed maturity and equity securities, to satisfy collateral requirements.

F-49MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)