MetLife 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

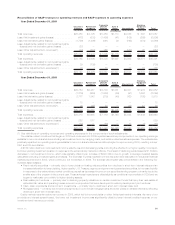

future expected policy assessments based on the level of guaranteed minimum benefits generated using multiple scenarios of separate

account returns. The scenarios use best estimate assumptions consistent with those used to amortize DAC. Because separate account

balances have had positive returns relative to the prior year, current estimates of future benefits are lower than that previously projected which

resulted in a decrease in this liability in the current period. Partially offsetting these increases, higher DAC amortization of $49 million resulted

from business growth and favorable investment results.

Latin America. The decrease in operating earnings was primarily driven by lower net investment income. Net investment income

decreased by $297 million due to a decrease of $383 million from lower yields, partially offset by an increase of $86 million due to an increase

in average invested assets. The decrease in yields was due, in part, to the impact of changes in assumptions for measuring the effects of

inflation on certain inflation-indexed fixed maturity securities. This decrease was partially offset by a reduction of $221 million in the related

insurance liability primarily due to lower inflation. The increase in net investment income attributable to an increase in average invested assets

was primarily due to business growth and, as such, was largely offset by increases in policyholder benefits and interest credited expense.

Higher claims experience in Mexico resulted in a $45 million decline in operating earnings. The nationalization and reform of the pension

business in Argentina impacted both years earnings, resulting in a net $36 million decline in operating earnings. In addition, operating

earnings decreased due to a net income tax increase of $8 million in Mexico, resulting from a change in assumption regarding the repatriation

of earnings, partially offset by the favorable impact of a lower effective tax rate in 2009.

Partially offsetting these decreases in operating earnings was the combination of growth in Mexico’s individual and institutional businesses

and higher premium rates in its institutional business, which increased operating earnings by $51 million. Pesification in Argentina impacted

both the current year and prior year earnings, resulting in a net $73 million increase in operating earnings. This benefit was largely due to a

reassessment of our approach in managing existing and potential future claims related to certain social security pension annuity contract

holders in Argentina resulting in a liability release. Lower expenses of $8 million resulted primarily from the impact of operational efficiencies

achieved through our enterprise-wide cost reduction and revenue enhancement initiative.

Europe and Middle East. The impact of foreign currency transaction gains and a tax benefit, both of which occurred in the prior year,

contributed $12 million to the decline in operating earnings. Our investment of $9 million in our distribution capability and growth initiatives in

2009 also reduced operating earnings. There was an increase in net investment income of $76 million, which was due to an increase of

$65 million from an improvement in yields and $11 million from an increase in average invested assets. The increase in yields was primarily due

to favorable results on the trading and other securities portfolio, stemming from the equity markets experiencing some recovery in 2009. As

our trading and other securities portfolio backs unit-linked policyholder liabilities, the trading and other securities portfolio results were entirely

offset by a corresponding increase in interest credited expense. The increase in net investment income attributable to an increase in average

invested assets was primarily due to business growth and was largely offset by increases in policyholder benefits and interest credited

expense, also due to business growth.

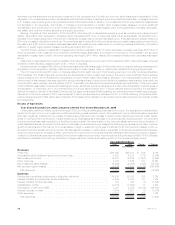

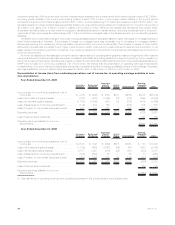

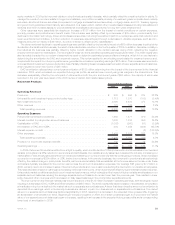

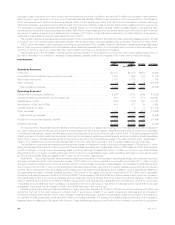

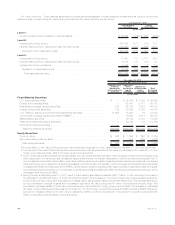

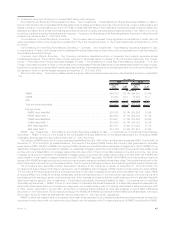

Banking, Corporate & Other

2009 2008 Change % Change

Years Ended December 31,

(In millions)

Operating Revenues

Premiums .................................................... $ 19 $ 27 $ (8) (29.6)%

Netinvestmentincome............................................ 477 808 (331) (41.0)%

Otherrevenues................................................. 1,092 184 908 493.5%

Totaloperatingrevenues ......................................... 1,588 1,019 569 55.8%

Operating Expenses

Policyholderbenefitsanddividends.................................... 4 46 (42) (91.3)%

Interestcreditedtopolicyholderaccountbalances.......................... — 7 (7) (100.0)%

Interestcreditedtobankdeposits..................................... 163 166 (3) (1.8)%

CapitalizationofDAC............................................. — (3) 3 100.0%

AmortizationofDACandVOBA ...................................... 3 5 (2) (40.0)%

Interestexpenseondebt .......................................... 1,027 1,033 (6) (0.6)%

Otherexpenses ................................................ 1,336 699 637 91.1%

Totaloperatingexpenses......................................... 2,533 1,953 580 29.7%

Provisionforincometaxexpense(benefit) ............................... (617) (495) (122) (24.6)%

Operatingearnings .............................................. (328) (439) 111 25.3%

Less:Preferredstockdividends...................................... 122 125 (3) (2.4)%

Operatingearningsavailabletocommonshareholders ....................... $ (450) $ (564) $114 20.2%

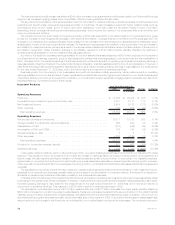

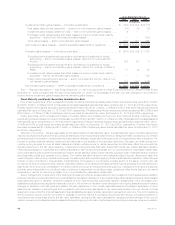

Banking, Corporate & Other recognized the full year impact of our forward and reverse residential mortgage platform acquisitions, a strong

residential mortgage refinance market, healthy growth in the reverse mortgage arena, and a favorable interest spread environment. Our

forward and reverse residential mortgage production of $37.4 billion in 2009 was up 484% compared to 2008 production. The increase in

mortgage production drove higher investments in residential mortgage loans held-for-sale and MSRs. At December 31, 2009, our residential

mortgage loans servicing portfolio was $64.1 billion comprised of agency (FNMA, FHLMC, and GNMA) portfolios. Transaction and time

deposits, which provide a relatively stable source of funding and liquidity and are used to fund loans and fixed income securities purchases,

grew 48% in 2009 to $10.2 billion. Borrowings decreased 10% in 2009 to $2.4 billion. During 2009, we participated in the Federal Reserve

Bank of New York Term Auction Facility, which provided short term liquidity with low funding costs.

In response to the economic crisis and unusual financial market events that occurred in 2008 and continued into 2009, we decided to utilize excess

debt capacity. The Holding Company completed three debt issuances in 2009. The Holding Company issued $397 million of floating rate senior notes

in March 2009, $1.3 billion of senior notes in May 2009, and $500 million of junior subordinated debt securities in July 2009. In February 2009, in

connection with the initial settlement of the stock purchase contracts issued as part of the common equity units sold in June 2005, the Holding

37MetLife, Inc.