MetLife 2010 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

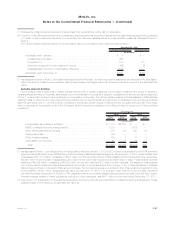

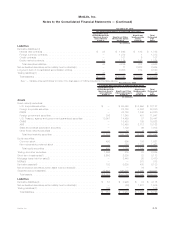

Net

Derivative

Gains (Losses)

Net

Investment

Income(1)

Policyholder

Benefits

and Claims(2) Other

Revenues(3) Other

Expenses(4)

(In millions)

Varianceswaps....................... (276) (13) — — —

Swapspreadlocks..................... (38) — — — —

Creditdefaultswaps ................... (243) (11) — — —

Totalrateofreturnswaps............... 63 — — — —

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(6,757) $(158) $(376) $(165) $ (3)

For the Year Ended December 31, 2008 . . . . $ 6,688 $ 240 $ 331 $ 146 $—

(1) Changes in estimated fair value related to economic hedges of equity method investments in joint ventures, and changes in estimated fair

value related to derivatives held in relation to trading portfolios.

(2) Changes in estimated fair value related to economic hedges of variable annuity guarantees included in future policy benefits.

(3) Changes in estimated fair value related to derivatives held inconnectionwiththeCompany’smortgagebankingactivities.

(4) Changes in estimated fair value related to economic hedges of foreign currency exposure associated with the Company’s international

subsidiaries.

Credit Derivatives

In connection with synthetically created investment transactions and credit default swaps held in relation to the trading portfolio, the

Company writes credit default swaps for which it receives a premium to insure credit risk. Such credit derivatives are included within the non-

qualifying derivatives and derivatives for purposes other than hedging table. If a credit event occurs, as defined by the contract, generally the

contract will require the Company to pay the counterparty the specified swap notional amount in exchange for the delivery of par quantities of

the referenced credit obligation. The Company’s maximum amount at risk, assuming the value of all referenced credit obligations is zero, was

$5,089 million and $3,101 million at December 31, 2010 and 2009, respectively. The Company can terminate these contracts at any time

through cash settlement with the counterparty at an amount equal to the then current fair value of the credit default swaps. At December 31,

2010 and 2009, the Company would have received $62 million and $53 million, respectively, to terminate all of these contracts.

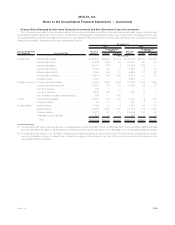

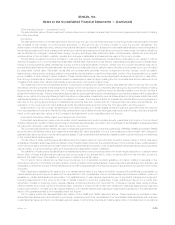

The following table presents the estimated fair value, maximum amount of future payments and weighted average years to maturity of

written credit default swaps at December 31, 2010 and 2009:

Rating Agency Designation of Referenced

Credit Obligations (1)

Estimated

Fair

Value of Credit

Default

Swaps

Maximum

Amount

of Future

Payments under

Credit Default

Swaps(2)

Weighted

Average

Years to

Maturity(3)

Estimated

Fair Value

of Credit

Default

Swaps

Maximum

Amount of

Future

Payments under

Credit Default

Swaps(2)

Weighted

Average

Years to

Maturity(3)

2010 2009

December 31,

(In millions)

Aaa/Aa/A

Single name credit default swaps (corporate) . . . $ 5 $ 470 3.8 $ 5 $ 175 4.3

Credit default swaps referencing indices . . . . . . 45 2,928 3.7 46 2,676 3.4

Subtotal........................... 50 3,398 3.7 51 2,851 3.5

Baa

Single name credit default swaps (corporate) . . . 5 735 4.3 2 195 4.8

Credit default swaps referencing indices . . . . . . 7 931 5.0 — 10 5.0

Subtotal........................... 12 1,666 4.7 2 205 4.8

Ba

Single name credit default swaps (corporate) . . . — 25 4.4 — 25 5.0

Credit default swaps referencing indices . . . . . . — — — — — —

Subtotal........................... — 25 4.4 — 25 5.0

B

Single name credit default swaps (corporate) . . . — — — — — —

Credit default swaps referencing indices . . . . . . — — — — 20 5.0

Subtotal........................... — — — — 20 5.0

Total ............................. $62 $5,089 4.1 $53 $3,101 3.6

(1) The rating agency designations are based on availability and the midpoint of the applicable ratings among Moody’s, S&P and Fitch. If no

rating is available from a rating agency, then an internally developed rating is used.

F-67MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)