MetLife 2010 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

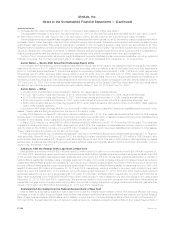

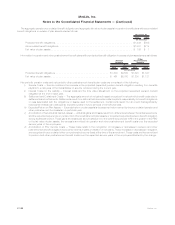

The approximate total number of asbestos personal injury claims pending against MLIC as of the dates indicated, the approximate number

of new claims during the years ended on those dates and the approximate total settlement payments made to resolve asbestos personal

injury claims at or during those years are set forth in the following table:

2010 2009 2008

December 31,

(In millions, except number of

claims)

Asbestospersonalinjuryclaimsatyearend ............................ 68,513 68,804 74,027

Numberofnewclaimsduringtheyear................................ 5,670 3,910 5,063

Settlementpaymentsduringtheyear(1) ............................... $ 34.9 $ 37.6 $ 99.0

(1) Settlement payments represent payments made by MLIC during the year in connection with settlements made in that year and in prior

years. Amounts do not include MLIC’s attorneys’ fees and expenses and do not reflect amounts received from insurance carriers.

In 2007, MLIC received approximately 7,161 new claims, ending the year with a total of approximately 79,717 claims, and paid

approximately $28.2 million for settlements reached in 2007 and prior years. In 2006, MLIC received approximately 7,870 new claims, ending

the year with a total of approximately 87,070 claims, and paid approximately $35.5 million for settlements reached in 2006 and prior years. In

2005, MLIC received approximately 18,500 new claims, ending the year with a total of approximately 100,250 claims, and paid approximately

$74.3 million for settlements reached in 2005 and prior years. In 2004, MLIC received approximately 23,900 new claims, ending the year with

a total of approximately 108,000 claims, and paid approximately $85.5 million for settlements reached in 2004 and prior years. In 2003, MLIC

received approximately 58,750 new claims, ending the year with a total of approximately 111,700 claims, and paid approximately

$84.2 million for settlements reached in 2003 and prior years. The number of asbestos cases that may be brought, the aggregate amount

of any liability that MLIC may incur, and the total amount paid in settlements in any given year are uncertain and may vary significantly from year

to year.

The ability of MLIC to estimate its ultimate asbestos exposure is subject to considerable uncertainty, and the conditions impacting its

liability can be dynamic and subject to change. The availability of reliable data is limited and it is difficult to predict with any certainty the

numerous variables that can affect liability estimates, including the number of future claims, the cost to resolve claims, the disease mix and

severity of disease in pending and future claims, the impact of the number of new claims filed in a particular jurisdiction and variations in the

law in the jurisdictions in which claims are filed, the possible impact of tort reform efforts, the willingness of courts to allow plaintiffs to pursue

claims against MLIC when exposure to asbestos took place after the dangers of asbestos exposure were well known, and the impact of any

possible future adverse verdicts and their amounts.

The ability to make estimates regarding ultimate asbestos exposure declines significantly as the estimates relate to years further in the

future. In the Company’s judgment, there is a future point after which losses cease to be probable and reasonably estimable. It is reasonably

possible that the Company’s total exposure to asbestos claims may be materially greater than the asbestos liability currently accrued and that

future charges to income may be necessary. While the potential future charges could be material in the particular quarterly or annual periods in

which they are recorded, based on information currently known by management, management does not believe any such charges are likely to

have a material adverse effect on the Company’s financial position.

During 1998, MLIC paid $878 million in premiums for excess insurance policies for asbestos-related claims. The excess insurance

policies for asbestos-related claims provided for recovery of losses up to $1.5 billion in excess of a $400 million self-insured retention. The

Company’s initial option to commute the excess insurance policies for asbestos-related claims would have arisen at the end of 2008. On

September 29, 2008, MLIC entered into agreements commuting the excess insurance policies at September 30, 2008. As a result of the

commutation of the policies, MLIC received cash and securities totaling $632 million. Of this total, MLIC received $115 million in fixed maturity

securities on September 26, 2008, $200 million in cash on October 29, 2008, and $317 million in cash on January 29, 2009. MLIC

recognized a loss on commutation of the policies in the amount of $35.3 million during 2008.

In the years prior to commutation, the excess insurance policies for asbestos-related claims were subject to annual and per claim

sublimits. Amounts exceeding the sublimits during 2007, 2006 and 2005 were approximately $16 million, $8 million and $0, respectively.

Amounts were recoverable under the policies annually with respect to claims paid during the prior calendar year. Each asbestos-related

policy contained an experience fund and a reference fund that provided for payments to MLIC at the commutation date if the reference fund

was greater than zero at commutation or pro rata reductions from time to time in the loss reimbursements to MLIC if the cumulative return on

the reference fund was less than the return specified in the experience fund. The return in the reference fund was tied to performance of the

S&P 500 Index and the Lehman Brothers Aggregate Bond Index. A claim with respect to the prior year was made under the excess insurance

policies in each year from 2003 through 2008 for the amounts paid with respect to asbestos litigation in excess of the retention. The foregone

loss reimbursements were approximately $62.2 million with respect to claims for the period of 2002 through 2007. Because the policies were

commuted at September 30, 2008, there will be no claims under the policies or forgone loss reimbursements with respect to payments made

in 2008 and thereafter.

The Company believes adequate provision has been made in its consolidated financial statements for all probable and reasonably

estimable losses for asbestos-related claims. MLIC’s recorded asbestos liability is based on its estimation of the following elements, as

informed by the facts presently known to it, its understanding of current law and its past experiences: (i) the probable and reasonably

estimable liability for asbestos claims already asserted against MLIC, including claims settled but not yet paid; (ii) the probable and reasonably

estimable liability for asbestos claims not yet asserted against MLIC, but which MLIC believes are reasonably probable of assertion; and

(iii) the legal defense costs associated with the foregoing claims. Significant assumptions underlying MLIC’s analysis of the adequacy of its

recorded liability with respect to asbestos litigation include: (i) the number of future claims; (ii) the cost to resolve claims; and (iii) the cost to

defend claims.

F-115MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)