MetLife 2010 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As discussed further in Note 2, an indemnification asset has been established in connection with certain investments acquired from

American Life.

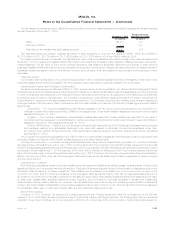

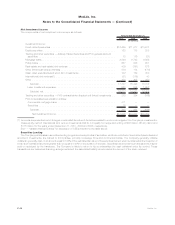

Evaluating Available-for-Sale Securities for Other-Than-Temporary Impairment

As described more fully in Note 1, the Company performs a regular evaluation, on a security-by-security basis, of its available-for-sale

securities holdings, including fixed maturity securities, equity securities and perpetual hybrid securities, in accordance with its impairment

policy in order to evaluate whether such investments are other-than-temporarily impaired. As described more fully in Note 1, effective April 1,

2009, the Company adopted OTTI guidance that amends the methodology for determining for fixed maturity securities whether an OTTI

exists, and for certain fixed maturity securities, changes how the amount of the OTTI loss that is charged to earnings is determined. There was

no change in the OTTI methodology for equity securities.

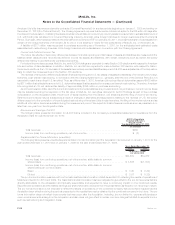

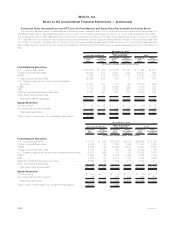

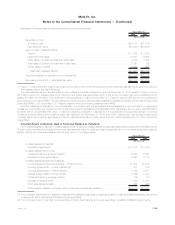

Net Unrealized Investment Gains (Losses)

The components of net unrealized investment gains (losses), included in accumulated other comprehensive income (loss), were as

follows:

2010 2009 2008

Years Ended December 31,

(In millions)

Fixed maturity securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 7,817 $(1,208) $(21,246)

Fixed maturity securities with noncredit OTTI losses in accumulated other

comprehensiveincome(loss)..................................... (601) (859) —

Totalfixedmaturitysecurities..................................... 7,216 (2,067) (21,246)

Equitysecurities............................................... (3) (103) (934)

Derivatives .................................................. (59) (144) (2)

Other...................................................... 42 71 53

Subtotal................................................. 7,196 (2,243) (22,129)

Amounts allocated from:

Insuranceliabilitylossrecognition.................................. (672) (118) 42

DAC and VOBA related to noncredit OTTI losses recognized in accumulated other

comprehensiveincome(loss) ................................... 38 71 —

DACandVOBA.............................................. (1,205) 145 3,025

Policyholderdividendobligation ................................... (876) — —

Subtotal................................................. (2,715) 98 3,067

Deferred income tax benefit (expense) related to noncredit OTTI losses recognized in

accumulatedothercomprehensiveincome(loss) ........................ 197 275 —

Deferredincometaxbenefit(expense) ................................ (1,692) 539 6,508

Netunrealizedinvestmentgains(losses)............................... 2,986 (1,331) (12,554)

Net unrealized investment gains (losses) attributable to noncontrolling interests . . . . . . 4 1 (10)

Net unrealized investment gains (losses) attributable to MetLife, Inc. . . . . . . . . . . . . . $ 2,990 $(1,330) $(12,564)

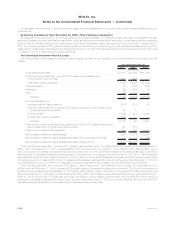

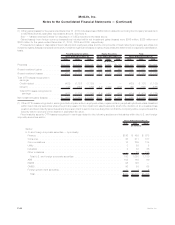

Fixed maturity securities with noncredit OTTI losses in accumulated other comprehensive income (loss), as presented above of

($601) million at December 31, 2010, includes ($859) million recognized prior to January 1, 2010, ($212) million (($202) million, net of

DAC) of noncredit OTTI losses recognized in the year ended December 31, 2010, $16 million transferred to retained earnings in connection

with the adoption of guidance related to the consolidation of VIEs (see Note 1) for the year ended December 31, 2010, $137 million related to

securities sold during the year ended December 31, 2010 for which a noncredit OTTI loss was previously recognized in accumulated other

comprehensive income (loss) and $317 million of subsequent increases in estimated fair value during the year ended December 31, 2010 on

such securities for which a noncredit OTTI loss was previously recognized in accumulated other comprehensive income (loss).

Fixed maturity securities with noncredit OTTI losses in accumulated other comprehensive income (loss), as presented above of

($859) million at December 31, 2009, includes ($126) million related to the transition adjustment recorded in 2009 upon the adoption of

guidance on the recognition and presentation of OTTI, ($939) million (($857) million, net of DAC) of noncredit OTTI losses recognized in the

year ended December 31, 2009 (as more fully described in Note 1), $20 million related to securities sold during the year ended December 31,

2009 for which a noncredit OTTI loss was previously recognized in accumulated comprehensive income (loss) and $186 million of

subsequent increases in estimated fair value during the year ended December 31, 2009 on such securities for which a noncredit OTTI

loss was previously recognized in accumulated other comprehensive income (loss).

F-40 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)