MetLife 2010 Annual Report Download - page 222

Download and view the complete annual report

Please find page 222 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

under Section 422A of the Code or are non-qualified. By December 31, 2009 all awards under the 2000 Stock Plan had either vested or been

forfeited. No awards were made under the 2000 Stock Plan in 2010.

Under the MetLife, Inc. 2005 Stock and Incentive Compensation Plan (the “2005 Stock Plan”), awards granted to employees and agents

may be in the form of Stock Options, Stock Appreciation Rights, Restricted Stock or Restricted Stock Units, Performance Shares or

Performance Share Units, Cash-Based Awards and Stock-Based Awards (each as defined in the 2005 Stock Plan with reference to MetLife,

Inc. common stock).

The aggregate number of shares authorized for issuance under the 2005 Stock Plan is 68,000,000, plus those shares available but not

utilized under the 2000 Stock Plan and those shares utilized under the 2000 Stock Plan that are recovered due to forfeiture of Stock Options.

Each share issued under the 2005 Stock Plan in connection with a Stock Option or Stock Appreciation Right reduces the number of shares

remaining for issuance under that plan by one, and each share issued under the 2005 Stock Plan in connection with awards other than Stock

Options or Stock Appreciation Rights reduces the number of shares remaining for issuance under that plan by 1.179 shares. At December 31,

2010, the aggregate number of shares remaining available for issuance pursuant to the 2005 Stock Plan was 40,477,451. Stock Option

exercises and other awards settled in shares are satisfied through the issuance of shares held in treasury by the Company or by the issuance

of new shares.

Compensation expense related to awards under the 2005 Stock Plan is recognized based on the number of awards expected to vest,

which represents the awards granted less expected forfeitures over the life of the award, as estimated at the date of grant. Unless a material

deviation from the assumed forfeiture rate is observed during the term in which the awards are expensed, any adjustment necessary to reflect

differences in actual experience is recognized in the period the award becomes payable or exercisable.

Compensation expense related to awards under the 2005 Stock Plan is principally related to the issuance of Stock Options, Performance

Shares and Restricted Stock Units. The majority of the awards granted each year under the 2005 Stock Plan are made in the first quarter of

each year.

Description of Plans for Directors — General Terms

The MetLife, Inc. 2000 Directors Stock Plan, as amended (the “2000 Directors Stock Plan”) authorized the granting of awards in the form of

MetLife, Inc. common stock, non-qualified Stock Options, or a combination of the foregoing to non-management Directors of MetLife, Inc. As

of December 31, 2009, all awards under the 2000 Directors Stock Plan had either vested or been forfeited. No awards were made under the

2000 Directors Stock Plan in 2010.

Under the MetLife, Inc. 2005 Non-Management Director Stock Compensation Plan (the “2005 Directors Stock Plan”), awards granted may

be in the form of non-qualified Stock Options, Stock Appreciation Rights, Restricted Stock or Restricted Stock Units, or Stock-Based Awards

(each as defined in the 2005 Directors Stock Plan with reference to MetLife, Inc. common stock) to non-management Directors of MetLife,

Inc. The number of shares authorized for issuance under the 2005 Directors Stock Plan is 2,000,000. There were no shares carried forward

from the 2000 Directors Stock Plan to the 2005 Directors Stock Plan. At December 31, 2010, the aggregate number of shares remaining

available for issuance pursuant to the 2005 Directors Stock Plan was 1,808,114. Stock Option exercises and other awards settled in shares

are satisfied through the issuance of shares held in treasury by the Company or by the issuance of new shares.

Compensation expense related to awards under the 2005 Directors Plan is recognized based on the number of shares awarded. The

Stock-Based Awards granted under the 2005 Directors Plan have vested immediately. The majority of the awards granted each year under the

2005 Directors Stock Plan are made in the second quarter of each year.

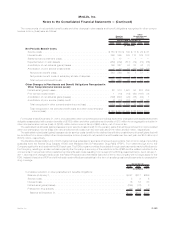

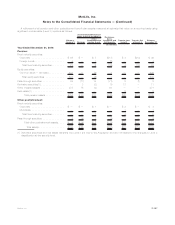

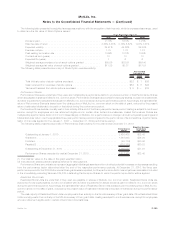

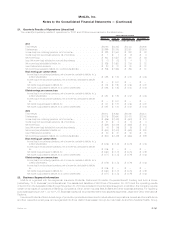

Compensation Expense Related to Stock-Based Compensation

The components of compensation expense related to stock-based compensation, excluding the insignificant compensation expense

related to the 2005 Directors Stock Plan, is as follows:

2010 2009 2008

Years Ended

December 31,

(In millions)

StockOptions ....................................................... $45 $55 $ 51

PerformanceShares(1).................................................. 29 11 70

RestrictedStockUnits .................................................. 10 3 2

TotalcompensationexpensesrelatedtotheIncentivePlans.......................... $84 $69 $123

Incometaxbenefits.................................................... $29 $24 $ 43

(1) Performance Shares expected to vest and the related compensation expenses may be further adjusted by the performance factor most

likely to be achieved, as estimated by management, at the end of the performance period.

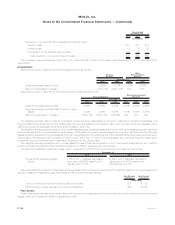

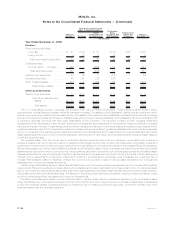

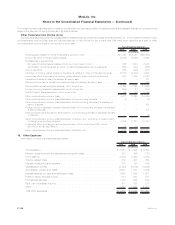

The following table presents the total unrecognized compensation expense related to stock-based compensation and the expected

weighted average period over which these expenses will be recognized at:

Expense Weighted Average

Period

December 31, 2010

(In millions) (Years)

StockOptions ................................................. $39 1.73

PerformanceShares............................................. $30 1.74

RestrictedStockUnits............................................ $14 1.87

F-133MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)