MetLife 2010 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

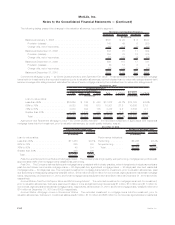

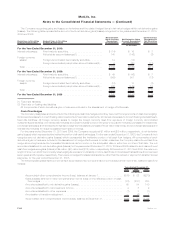

The following table presents the gross notional amount of derivative financial instruments by maturity at December 31, 2010:

One Year or

Less

After One Year

Through Five

Years

After Five Years

Through Ten

Years After Ten

Years Total

Remaining Life

(In millions)

Interest rate swaps . . . . . . . . . . . . . . . . . . . . . $ 4,970 $14,491 $16,403 $18,939 $ 54,803

Interest rate floors . . . . . . . . . . . . . . . . . . . . . — 13,048 7,318 3,500 23,866

Interest rate caps . . . . . . . . . . . . . . . . . . . . . . 5,000 28,436 1,976 — 35,412

Interestratefutures..................... 9,385 — — — 9,385

Interest rate options . . . . . . . . . . . . . . . . . . . . 1,853 5,206 1,702 — 8,761

Interest rate forwards . . . . . . . . . . . . . . . . . . . 9,409 860 105 — 10,374

SyntheticGICs........................ 4,397 — — — 4,397

Foreign currency swaps . . . . . . . . . . . . . . . . . . 3,262 5,857 5,999 2,508 17,626

Foreign currency forwards . . . . . . . . . . . . . . . . 10,337 24 20 62 10,443

Currencyfutures ...................... 493 — — — 493

Currencyoptions ...................... 5,426 — — — 5,426

Non-derivativehedginginstruments .......... 169 — — — 169

Credit default swaps . . . . . . . . . . . . . . . . . . . . 111 10,197 649 — 10,957

Creditforwards ....................... 90 — — — 90

Equityfutures ........................ 8,794 — — — 8,794

Equity options . . . . . . . . . . . . . . . . . . . . . . . . 20,856 3,346 9,486 — 33,688

Variance swaps . . . . . . . . . . . . . . . . . . . . . . . 1,411 1,795 14,493 323 18,022

Totalrateofreturnswaps................. 1,492 55 — — 1,547

Total............................. $87,455 $83,315 $58,151 $25,332 $254,253

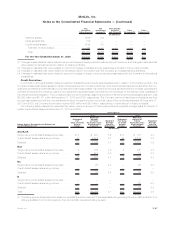

Interest rate swaps are used by the Company primarily to reduce market risks from changes in interest rates and to alter interest rate

exposure arising from mismatches between assets and liabilities (duration mismatches). In an interest rate swap, the Company agrees with

another party to exchange, at specified intervals, the difference between fixed rate and floating rate interest amounts as calculated by

reference to an agreed notional principal amount. These transactions are entered into pursuant to master agreements that provide for a single

net payment to be made by the counterparty at each due date. The Company utilizes interest rate swaps in fair value, cash flow and non-

qualifying hedging relationships.

The Company also enters into basis swaps to better match the cash flows from assets and related liabilities. In a basis swap, both legs of

the swap are floating with each based on a different index. Generally, no cash is exchanged at the outset of the contract and no principal

payments are made by either party. A single net payment is usually made by one counterparty at each due date. Basis swaps are included in

interest rate swaps in the preceding table. The Company utilizes basis swaps in non-qualifying hedging relationships.

Inflation swaps are used as an economic hedge to reduce inflation risk generated from inflation-indexed liabilities. Inflation swaps are

included in interest rate swaps in the preceding table. The Company utilizes inflation swaps in non-qualifying hedging relationships.

Implied volatility swaps are used by the Company primarily as economic hedges of interest rate risk associated with the Company’s

investments in mortgage-backed securities. In an implied volatility swap, the Company exchanges fixed payments for floating payments that

are linked to certain market volatility measures. If implied volatility rises, the floating payments that the Company receives will increase, and if

implied volatility falls, the floating payments that the Company receives will decrease. Implied volatility swaps are included in interest rate

swaps in the preceding table. The Company utilizes implied volatility swaps in non-qualifying hedging relationships.

The Company purchases interest rate caps and floors primarily to protect its floating rate liabilities against rises in interest rates above a

specified level, and against interest rate exposure arising from mismatches between assets and liabilities (duration mismatches), as well as to

protect its minimum rate guarantee liabilities against declines in interest rates below a specified level, respectively. In certain instances, the

Company locks in the economic impact of existing purchased caps and floors by entering into offsetting written caps and floors. The

Company utilizes interest rate caps and floors in non-qualifying hedging relationships.

In exchange-traded interest rate (Treasury and swap) futures transactions, the Company agrees to purchase or sell a specified number of

contracts, the value of which is determined by the different classes of interest rate securities, and to post variation margin on a daily basis in an

amount equal to the difference in the daily market values of those contracts. The Company enters into exchange- traded futures with

regulated futures commission merchants that are members of the exchange. Exchange-traded interest rate (Treasury and swap) futures are

used primarily to hedge mismatches between the duration of assets in a portfolio and the duration of liabilities supported by those assets, to

hedge against changes in value of securities the Company owns or anticipates acquiring and to hedge against changes in interest rates on

anticipated liability issuances by replicating Treasury or swap curve performance. The Company utilizes exchange-traded interest rate futures

in non-qualifying hedging relationships.

Swaptions are used by the Company to hedge interest rate risk associated with the Company’s long-term liabilities and invested assets. A

swaption is an option to enter into a swap with a forward starting effective date. In certain instances, the Company locks in the economic

impact of existing purchased swaptions by entering into offsetting written swaptions. The Company pays a premium for purchased swaptions

F-60 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)