MetLife 2010 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

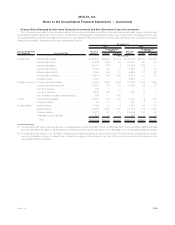

(2) Assumes the value of the referenced credit obligations is zero.

(3) The weighted average years to maturity of the credit default swaps is calculated based on weighted average notional amounts.

The Company has also entered into credit default swaps to purchase credit protection on certain of the referenced credit obligations in the

table above. As a result, the maximum amounts of potential future recoveries available to offset the $5,089 million and $3,101 million from the

table above were $120 million and $31 million at December 31, 2010 and 2009, respectively.

Credit Risk on Freestanding Derivatives

The Company may be exposed to credit-related losses in the event of nonperformance by counterparties to derivative financial

instruments. Generally, the current credit exposure of the Company’s derivative contracts is limited to the net positive estimated fair value

of derivative contracts at the reporting date after taking into consideration the existence of netting agreements and any collateral received

pursuant to credit support annexes.

The Company manages its credit risk related to over-the-counter derivatives by entering into transactions with creditworthy counter-

parties, maintaining collateral arrangements and through the use of master agreements that provide for a single net payment to be made by

one counterparty to another at each due date and upon termination. Because exchange-traded futures are effected through regulated

exchanges, and positions are marked to market on a daily basis, the Company has minimal exposure to credit-related losses in the event of

nonperformance by counterparties to such derivative instruments. See Note 5 for a description of the impact of credit risk on the valuation of

derivative instruments.

The Company enters into various collateral arrangements, which require both the pledging and accepting of collateral in connection with

its derivative instruments. At December 31, 2010 and 2009, the Company was obligated to return cash collateral under its control of

$2,625 million and $2,680 million, respectively. This unrestricted cash collateral is included in cash and cash equivalents or in short-term

investments and the obligation to return it is included in payables for collateral under securities loaned and other transactions in the

consolidated balance sheets. At December 31, 2010 and 2009, the Company had also accepted collateral consisting of various securities

with a fair market value of $984 million and $221 million, respectively, which were held in separate custodial accounts. The Company is

permitted by contract to sell or repledge this collateral, but at December 31, 2010, none of the collateral had been sold or repledged.

The Company’s collateral arrangements for its over-the-counter derivatives generally require the counterparty in a net liability position,

after considering the effect of netting agreements, to pledge collateral when the fair value of that counterparty’s derivatives reaches a pre-

determined threshold. Certain of these arrangements also include credit-contingent provisions that provide for a reduction of these

thresholds (on a sliding scale that converges toward zero) in the event of downgrades in the credit ratings of the Company and/or the

counterparty. In addition, certain of the Company’s netting agreements for derivative instruments contain provisions that require the Company

to maintain a specific investment grade credit rating from at least one of the major credit rating agencies. If the Company’s credit ratings were

to fall below that specific investment grade credit rating, it would be in violation of these provisions, and the counterparties to the derivative

instruments could request immediate payment or demand immediate and ongoing full overnight collateralization on derivative instruments

that are in a net liability position after considering the effect of netting agreements.

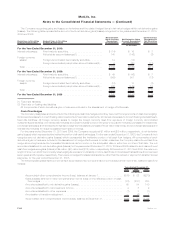

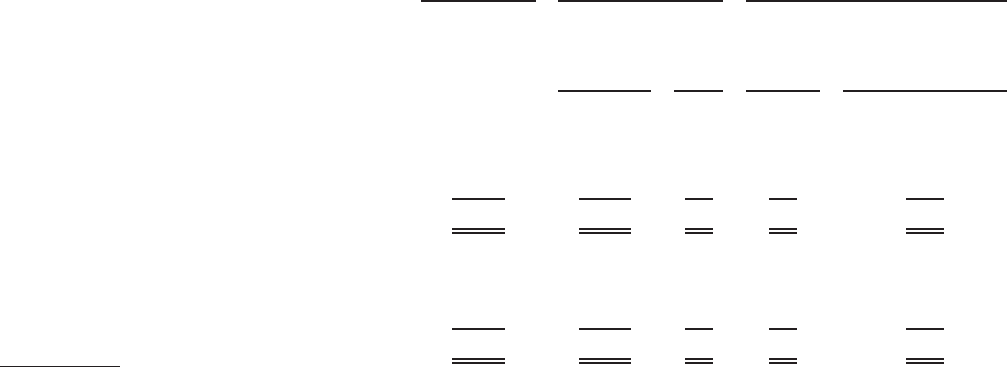

The following table presents the estimated fair value of the Company’s over-the-counter derivatives that are in a net liability position after

considering the effect of netting agreements, together with the estimated fair value and balance sheet location of the collateral pledged. The

table also presents the incremental collateral that the Company would be required to provide if there was a one notch downgrade in the

Company’s credit rating at the reporting date or if the Company’s credit rating sustained a downgrade to a level that triggered full overnight

collateralization or termination of the derivative position at the reporting date. Derivatives that are not subject to collateral agreements are not

included in the scope of this table.

Fixed Maturity

Securities(2) Cash(3)

One Notch

Downgrade

in the

Company’s

Credit

Rating

Downgrade in the

Company’s Credit Rating

to a Level that Triggers

Full Overnight

Collateralization or

Termina tion

of the Derivative Position

Estimated

Fair Value(1) of

Derivatives in Net

Liability Position

Estimated

Fair Value of

Collateral

Provided: Fair Value of Incremental Collateral

Provided Upon:

(In millions)

December 31, 2010:

Derivatives subject to credit-contingent provisions . . . $1,167 $1,024 $— $99 $231

Derivatives not subject to credit-contingent

provisions............................ 22 — 43 — —

Total ............................... $1,189 $1,024 $43 $99 $231

December 31, 2009:

Derivatives subject to credit-contingent provisions . . . $1,163 $1,017 $— $90 $218

Derivatives not subject to credit-contingent

provisions............................ 48 42 — — —

Total ............................... $1,211 $1,059 $— $90 $218

(1) After taking into consideration the existence of netting agreements.

(2) Included in fixed maturity securities in the consolidated balance sheets. The counterparties are permitted by contract to sell or repledge

this collateral.

F-68 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)