MetLife 2010 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

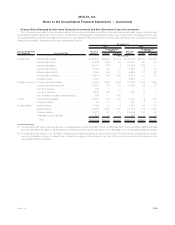

(3) Included in premiums, reinsurance and other receivables in the consolidated balance sheets.

Without considering the effect of netting agreements, the estimated fair value of the Company’s over-the-counter derivatives with credit-

contingent provisions that were in a gross liability position at December 31, 2010 was $1,742 million. At December 31, 2010, the Company

provided securities collateral of $1,024 million in connection with these derivatives. In the unlikely event that both: (i) the Company’s credit

rating was downgraded to a level that triggers full overnight collateralization or termination of all derivative positions; and (ii) the Company’s

netting agreements were deemed to be legally unenforceable, then the additional collateral that the Company would be required to provide to

its counterparties in connection with its derivatives in a gross liability position at December 31, 2010 would be $718 million. This amount does

not consider gross derivative assets of $575 million for which the Company has the contractual right of offset.

The Company also has exchange-traded futures and options, which require the pledging of collateral. At December 31, 2010 and 2009,

the Company pledged securities collateral for exchange-traded futures and options of $40 million and $50 million, respectively, which is

included in fixed maturity securities. The counterparties are permitted by contract to sell or repledge this collateral. At December 31, 2010

and 2009, the Company provided cash collateral for exchange-traded futures and options of $662 million and $562 million, respectively,

which is included in premiums, reinsurance and other receivables.

Embedded Derivatives

The Company has certain embedded derivatives that are required to be separated from their host contracts and accounted for as

derivatives. These host contracts principally include: variable annuities with guaranteed minimum benefits, including GMWBs, GMABs and

certain GMIBs; ceded reinsurance contracts of guaranteed minimum benefits related to GMABs and certain GMIBs; and funding agreements

with equity or bond indexed crediting rates.

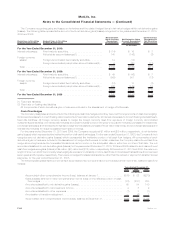

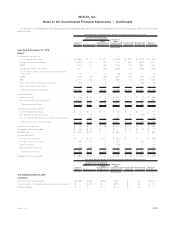

The following table presents the estimated fair value of the Company’s embedded derivatives at:

2010 2009

December 31,

(In millions)

Net embedded derivatives within asset host contracts:

Cededguaranteedminimumbenefits......................................... $ 185 $ 76

Optionsembeddedindebtorequitysecurities .................................. (57) (37)

Netembeddedderivativeswithinassethostcontracts ............................ $ 128 $ 39

Net embedded derivatives within liability host contracts:

Directguaranteedminimumbenefits......................................... $2,556 $1,500

Other............................................................. 78 5

Netembeddedderivativeswithinliabilityhostcontracts ........................... $2,634 $1,505

The following table presents changes in estimated fair value related to embedded derivatives:

2010 2009 2008

Years Ended December 31,

(In millions)

Netderivativegains(losses)(1)........................................ $(387) $1,758 $(2,650)

Policyholderbenefitsandclaims....................................... $ 8 $ (114) $ 182

(1) The valuation of guaranteed minimum benefits includes an adjustment for nonperformance risk. Included in net derivative gains (losses),

in connection with this adjustment, were gains (losses) of ($96) million, ($1,932) million and $2,994 million for the years ended

December 31, 2010, 2009 and 2008, respectively. Net derivative gains (losses) for the year ended December 31, 2010 included a

loss of $955 million relating to a refinement for estimating nonperformance risk in fair value measurements implemented at June 30, 2010.

SeeNote5.

F-69MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)