MetLife 2010 Annual Report Download - page 64

Download and view the complete annual report

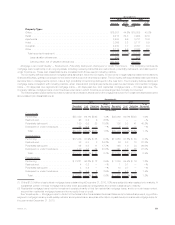

Please find page 64 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other Policy-related Balances

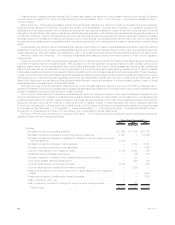

Other policy-related balances include policy and contract claims, unearned revenue liabilities, premiums received in advance, policy-

holder dividends due and unpaid, and policyholder dividends left on deposit.

The liability for policy and contract claims generally relates to incurred but not reported death, disability, LTC and dental claims, as well as

claims that have been reported but not yet settled. The liability for these claims is based on the Company’s estimated ultimate cost of settling

all claims. The Company derives estimates for the development of incurred but not reported claims principally from actuarial analyses of

historical patterns of claims and claims development for each line of business. The methods used to determine these estimates are

continually reviewed. Adjustments resulting from this continuous review process and differences between estimates and payments for claims

are recognized in policyholder benefits and claims expense in the period in which the estimates are changed or payments are made.

The unearned revenue liability relates to universal life-type and investment-type products and represents policy charges for services to be

provided in future periods. The charges are deferred as unearned revenue and amortized using the product’s estimated gross profits and

margins, similar to deferred acquisition costs. Such amortization is recorded in universal life and investment-type product policy fees.

Also included in other policy-related balances are policyholder dividends due and unpaid on participating policies and policyholder

dividends left on deposit. Such liabilities are presented at amounts contractually due to policyholders.

Policyholder Dividends Payable

Policyholder dividends payable consists of liabilities related to dividends payable in the following calendar year on participating policies.

Liquidity and Capital Resources

Overview

Our business and results of operations are materially affected by conditions in the global capital markets and the economy, generally, both

in the U.S. and elsewhere around the world. The global economy and markets are now recovering from a period of significant stress that

began in the second half of 2007 and substantially increased through the first quarter of 2009. This disruption adversely affected the financial

services industry, in particular. Consequently, financial institutions paid higher spreads over benchmark U.S. Treasury securities than before

the market disruption began. The U.S. economy entered a recession in late 2007. This recession ended in mid-2009, but the recovery from

the recession has been below historic averages and the unemployment rate is expected to remain high for some time. Although conditions in

the financial markets continued to materially improve in 2010, there is still some uncertainty as to whether the stressed conditions that

prevailed during the market disruption could recur, which could affect the Company’s ability to meet liquidity needs and obtain capital.

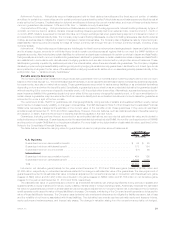

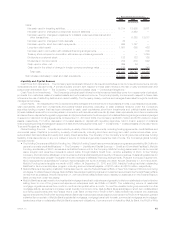

Liquidity Management

Based upon the strength of its franchise, diversification of its businesses and strong financial fundamentals, we continue to believe the

Company has ample liquidity to meet business requirements under current market conditions and unlikely but reasonably possible stress

scenarios. The Company’s short-term liquidity position (cash and cash equivalents, short-term investments, excluding cash collateral

received under the Company’s securities lending program that has been reinvested in cash, cash equivalents, short-term investments and

publicly-traded securities, and cash collateral received from counterparties in connection with derivative instruments) was $17.6 billion and

$11.7 billion at December 31, 2010 and 2009, respectively. We continuously monitor and adjust our liquidity and capital plans for the Holding

Company and its subsidiaries in light of changing needs and opportunities.

The Company

Liquidity

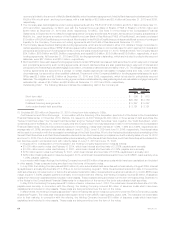

Liquidity refers to a company’s ability to generate adequate amounts of cash to meet its needs. Liquidity needs are determined from a

rolling 6-month forecast by portfolio of investment assets and are monitored daily. Asset mix and maturities are adjusted based on the

forecast. Cash flow testing and stress testing provide additional perspectives on liquidity, which include various scenarios of the potential risk

of early contractholder and policyholder withdrawal. The Company includes provisions limiting withdrawal rights on many of its products,

including general account institutional pension products (generally group annuities, including funding agreements, and certain deposit fund

liabilities) sold to employee benefit plan sponsors. Certain of these provisions prevent the customer from making withdrawals prior to the

maturity date of the product.

In the event of significant cash requirements beyond anticipated liquidity needs, the Company has various alternatives available

depending on market conditions and the amount and timing of the liquidity need. These options include cash flows from operations, the

sale of liquid assets, global funding sources and various credit facilities.

Under certain stressful market and economic conditions, the Company’s access to, or cost of, liquidity may deteriorate. If the Company

requires significant amounts of cash on short notice in excess of anticipated cash requirements, the Company may have difficulty selling

investment assets in a timely manner, be forced to sell them for less than the Company otherwise would have been able to realize, or both. In

addition, in the event of such forced sale, accounting rules require the recognition of a loss for certain securities in an unrealized loss position

and may require the impairment of other securities based upon the Company’s ability to hold such securities, which may negatively impact the

Company’s financial condition.

In extreme circumstances, all general account assets — other than those which may have been pledged to a specific purpose — within a

statutory legal entity are available to fund obligations of the general account within that legal entity.

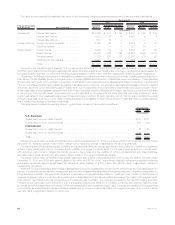

Capital

The Company’s capital position is managed to maintain its financial strength and credit ratings and is supported by its ability to generate

strong cash flows at the operating companies, borrow funds at competitive rates and raise additional capital to meet its operating and growth

needs.

The Company raised new capital from its debt issuances during the difficult market conditions prevailing since the second half of 2008, as

well as during the rebound and recovery periods beginning in the second quarter of 2009 (see “— The Company — Liquidity and Capital

Sources — Debt Issuances and Other Borrowings”). The increase in credit spreads experienced since then has resulted in an increase in the

cost of such new capital, as well as increases in facility fees. Conversely, as a result of reductions in interest rates, the Company’s interest

expense and dividends on floating rate securities have been lower.

61MetLife, Inc.