MetLife 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

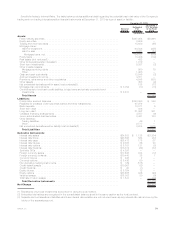

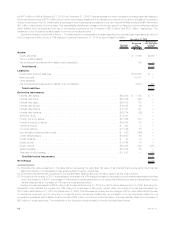

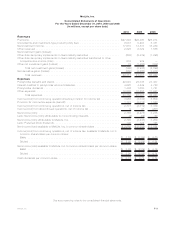

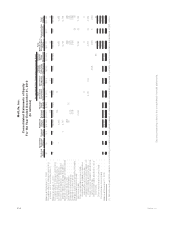

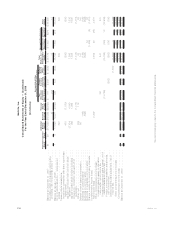

MetLife, Inc.

Consolidated Balance Sheets

December 31, 2010 and 2009

(In millions, except share and per share data)

2010 2009

Assets

Investments:

Fixed maturity securities available-for-sale, at estimated fair value (amortized cost: $320,008 and $229,709, respectively;

includes$3,330and$3,171,respectively,relatingtovariableinterestentities).............................. $327,284 $227,642

Equitysecuritiesavailable-for-sale,atestimatedfairvalue(cost:$3,625and$3,187,respectively)................... 3,606 3,084

Trading and other securities, at estimated fair value (includes $463 and $420 of actively traded securities, respectively; and

$387 and $0, respectively, relating to variable interest entities) . . . .................................... 18,589 2,384

Mortgage loans:

Held-for-investment, principally at amortized cost (net of valuation allowances of $664 and $721, respectively; includes

$6,840and$0,respectively,atestimatedfairvalue,relatingtovariableinterestentities)....................... 59,055 48,181

Held-for-sale,principallyatestimatedfairvalue................................................. 3,321 2,728

Mortgageloans,net................................................................ 62,376 50,909

Policyloans....................................................................... 11,914 10,061

Realestateandrealestatejointventures(includes$10and$18,respectively,relatingtovariableinterestentities).......... 8,030 6,896

Other limited partnership interests (includes $298 and $236, respectively, relating to variable interest entities) . ........... 6,416 5,508

Short-terminvestments,principallyatestimatedfairvalue............................................ 9,387 8,374

Otherinvestedassets,principallyatestimatedfairvalue(includes$104and$137,respectively,relatingtovariableinterestentities)........ . . 15,430 12,709

Totalinvestments .................................................................. 463,032 327,567

Cash and cash equivalents, principally at estimated fair value (includes $69 and $68, respectively, relating to variable interest

entities).......................................................................... 13,046 10,112

Accruedinvestmentincome(includes$34and$0,respectively,relatingtovariableinterestentities) ................... 4,381 3,173

Premiums,reinsuranceandotherreceivables(includes$2and$0,respectively,relatingtovariableinterestentities).......... 19,830 16,752

Deferredpolicyacquisitioncostsandvalueofbusinessacquired ........................................ 27,307 19,256

Currentincometaxrecoverable............................................................. — 316

Deferredincometaxassets............................................................... — 1,228

Goodwill .......................................................................... 11,781 5,047

Other assets (includes $6 and $16, respectively, relating to variable interest entities) . . . .......................... 8,192 6,822

Separateaccountassets ................................................................ 183,337 149,041

Totalassets...................................................................... $730,906 $539,314

Liabilities and Equity

Liabilities

Futurepolicybenefits ................................................................. $173,373 $135,879

Policyholderaccountbalances............................................................ 211,020 138,673

Otherpolicy-relatedbalances ............................................................ 15,806 8,446

Policyholderdividendspayable............................................................ 830 761

Policyholderdividendobligation ........................................................... 876 —

Payablesforcollateralundersecuritiesloanedandothertransactions .................................... 27,272 24,196

Bankdeposits...................................................................... 10,316 10,211

Short-termdebt..................................................................... 306 912

Long-termdebt(includes$6,902and$64,respectively,atestimatedfairvalue,relatingtovariableinterestentities)......... 27,586 13,220

Collateralfinancingarrangements .......................................................... 5,297 5,297

Juniorsubordinateddebtsecurities......................................................... 3,191 3,191

Currentincometaxpayable.............................................................. 316 —

Deferredincometaxliability.............................................................. 1,881 —

Otherliabilities(includes$93and$26,respectively,relatingtovariableinterestentities) ......................... 20,386 15,989

Separateaccountliabilities.............................................................. 183,337 149,041

Totalliabilities..................................................................... 681,793 505,816

Contingencies, Commitments and Guarantees (Note 16)

Redeemablenoncontrollinginterestsinpartiallyownedconsolidatedsubsidiaries............................... 117 —

Equity

MetLife, Inc.’s stockholders’ equity:

Preferred stock, par value $0.01 per share; 200,000,000 shares authorized:

Preferredstock,84,000,000sharesissuedandoutstanding;$2,100aggregateliquidationpreference................. 1 1

Convertiblepreferredstock,6,857,000sharesissuedandoutstandingatDecember31,2010 ..................... — —

Common stock, par value $0.01 per share; 3,000,000,000 shares authorized; 989,031,704 and 822,359,818 shares issued at

December 31, 2010 and 2009, respectively; 985,837,817 and 818,833,810 shares outstanding at December 31, 2010 and

2009,respectively ................................................................... 10 8

Additionalpaid-incapital................................................................. 26,423 16,859

Retainedearnings..................................................................... 21,363 19,501

Treasury stock, at cost; 3,193,887 and 3,526,008 shares at December 31, 2010 and 2009, respectively ................ (172) (190)

Accumulatedothercomprehensiveincome(loss) .................................................. 1,000 (3,058)

TotalMetLife,Inc.’sstockholders’equity..................................................... 48,625 33,121

Noncontrollinginterests ................................................................. 371 377

Totalequity ...................................................................... 48,996 33,498

Totalliabilitiesandequity.............................................................. $730,906 $539,314

See accompanying notes to the consolidated financial statements.

F-2 MetLife, Inc.