MetLife 2010 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

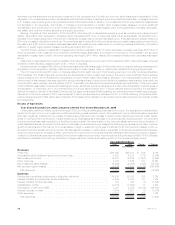

nonperformance risk. Both long-term and mid-term interest rates increased in the current period which had a positive impact of $2.2 billion.

Improving equity markets in the current period had a positive impact of $1.5 billion. Lower equity market volatility in the current period

compared to the prior period had a positive impact of $817 million, and the weakening U.S. dollar had a positive impact of $456 million. The

favorable results from these hedged risks was partially offset by an unfavorable change related to the adjustment for nonperformance risk of

$3.2 billion, from gains of $1.9 billion in 2008 to losses of $1.3 billion in 2009. Gains on the freestanding derivatives that hedged these

embedded derivative risks more than offset the change in liabilities attributable to market factors, excluding the adjustment for nonperfor-

mance risk. Finally, there was a favorable change of $1.1 billion for all other unhedged risks on the variable annuity minimum benefit guarantee

liabilities.

The $525 million unfavorable change in net investment gains (losses) was primarily attributable to higher net losses on mortgage loans and

otherlimitedpartnershipinterests.Theincreaseinlossesonmortgageloanswasprincipallyduetoincreasesinmortgagevaluation

allowances resulting from weakening of the real estate market and other economic fundamentals. The increase in losses on other limited

partnership interests was principally due to higher impairments on certain cost method investments which experienced a reduction in net

asset values of the underlying portfolio companies. The underlying valuations of the portfolio companies have decreased due to the current

economic environment.

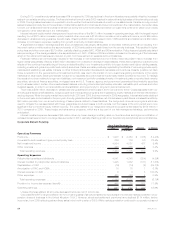

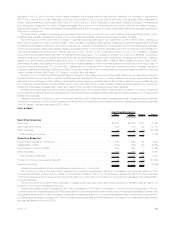

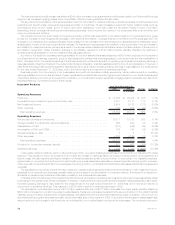

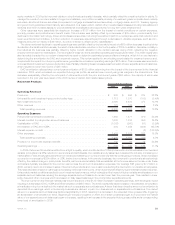

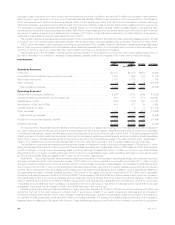

As more fully described in the discussion of performance measures above, operating earnings is the measure of segment profit or loss we

use to evaluate performance and allocate resources. Consistent with GAAP accounting guidance for segment reporting, it is our measure of

performance, as reported below. Operating earnings is not determined in accordance with GAAP and should not be viewed as a substitute for

GAAP income (loss) from continuing operations, net of income tax. We believe that the presentation of operating earnings enhances the

understanding of our performance by highlighting the results of operations and the underlying profitability drivers of the business. Operating

earnings available to common shareholders decreased by $329 million to $2.4 billion in 2009 from $2.7 billion in 2008.

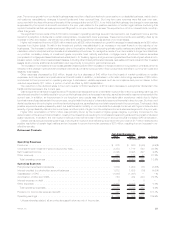

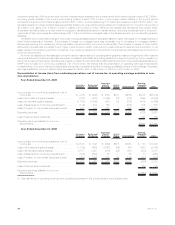

Reconciliation of income (loss) from continuing operations, net of income tax, to operating earnings available to com-

mon shareholders

Year Ended December 31, 2009

Insurance

Products Retirement

Products

Corporate

Benefit

Funding Auto &

Home International

Banking,

Corporate

&Other Total

(In millions)

Income (loss) from continuing operations, net of

income tax . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (418) $ (628) $ (581) $321 $(280) $(733) $(2,319)

Less: Net investment gains (losses) . . . . . . . . . . . . . (472) (533) (1,486) (41) (105) (269) (2,906)

Less: Net derivative gains (losses) . . . . . . . . . . . . . (1,786) (1,426) (421) 39 (798) (474) (4,866)

Less: Adjustments to continuing operations(1) . . . . . . (139) 519 125 — (206) (16) 283

Less: Provision for income tax (expense) benefit . . . . 837 504 621 1 366 354 2,683

Operatingearnings ....................... $1,142 $ 308 $ 580 $322 $463 (328) 2,487

Less:Preferredstockdividends ............... 122 122

Operating earnings available to common

shareholders.......................... $(450) $2,365

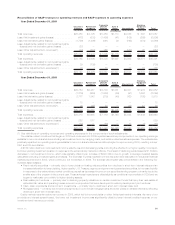

Year Ended December 31, 2008

Insurance

Products Retirement

Products

Corporate

Benefit

Funding Auto &

Home International

Banking,

Corporate

&Other Total

(In millions)

Income (loss) from continuing operations, net of

incometax ........................... $2,195 $ 539 $ (256) $275 $553 $ 173 $3,479

Less: Net investment gains (losses) . . . . . . . . . . . . . (1,219) (669) (1,682) (89) (91) 1,652 (2,098)

Less: Net derivative gains (losses) . . . . . . . . . . . . . 2,777 1,842 (219) (45) 260 (705) 3,910

Less: Adjustments to continuing operations(1) . . . . . . (193) (622) 82 — 52 17 (664)

Less: Provision for income tax (expense) benefit . . . . (480) (192) 637 46 (147) (352) (488)

Operatingearnings ....................... $1,310 $ 180 $ 926 $363 $479 (439) 2,819

Less:Preferredstockdividends ............... 125 125

Operating earnings available to common

shareholders.......................... $ (564) $2,694

(1) See definitions of operating revenues and operating expenses for the components of such adjustments.

30 MetLife, Inc.