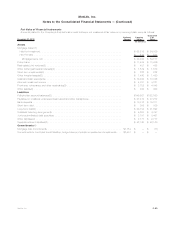

MetLife 2010 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

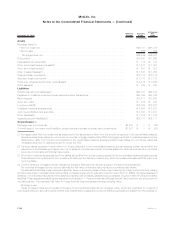

Net

Investment

Income

Net

Investment

Gains

(Losses)

Net

Derivative

Gains

(Losses) Other

Revenues

Policyholder

Benefits and

Claims Other

Expenses Total

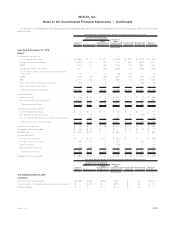

Classification of Realized/Unrealized Gains

(Losses) included in Earnings

Total Gains and Losses

(In millions)

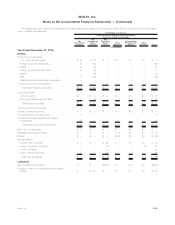

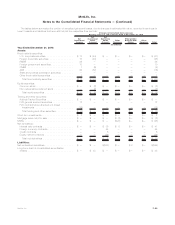

Year Ended December 31, 2009:

Assets:

Fixed maturity securities:

U.S. corporate securities . . . . . . . . . . . . . . . . $ 15 $(444) $ — $ — $ — $— $ (429)

Foreigncorporatesecurities .............. (4) (326) — — — — (330)

RMBS............................. 30 1 — — — — 31

Foreigngovernmentsecurities............. 12 (52) — — — — (40)

CMBS ............................ 1 (37) — — — — (36)

ABS.............................. 8 (129) — — — — (121)

State and political subdivision securities . . . . . . — — — — — — —

Otherfixedmaturitysecurities ............. 1 — — — — — 1

Total fixed maturity securities . . . . . . . . . . . . $ 63 $(987) $ — $ — $ — $— $ (924)

Equity securities:

Commonstock....................... $— $ (2) $ — $ — $ — $— $ (2)

Non-redeemablepreferredstock ........... — (357) — — — — (357)

Total equity securities . . . . . . . . . . . . . . . . . $ — $(359) $ — $ — $ — $— $ (359)

Tradingandothersecurities................ $16 $ — $ — $ — $ — $— $ 16

Short-terminvestments................... $— $ (21) $ — $ — $ — $— $ (21)

Mortgageloansheld-for-sale ............... $— $ — $ — $ (3) $ — $— $ (3)

MSRs .............................. $— $ — $ — $172 $ — $— $ 172

Netderivatives ........................ $(13) $ — $ (225) $(33) $ — $(2) $ (273)

Liabilities:

Net embedded derivatives . . . . . . . . . . . . . . . . . $ — $ — $1,716 $ — $(114) $— $1,602

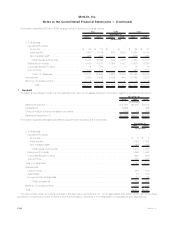

Net

Investment

Income

Net

Investment

Gains

(Losses)

Net

Derivative

Gains

(Losses) Other

Revenues

Policyholder

Benefits and

Claims Other

Expenses Total

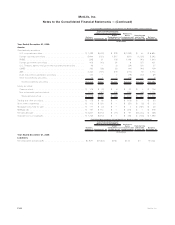

Classification of Realized/Unrealized Gains

(Losses) included in Earnings

Total Gains and Los ses

(In millions)

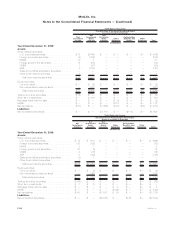

Year Ended December 31, 2008:

Assets:

Fixed maturity securities:

U.S.corporatesecurities................ $ 15 $ (711) $ — $ — $ — $— $ (696)

Foreigncorporatesecurities.............. 123 (135) — — — — (12)

RMBS ............................ 3 1 — — — — 4

Foreigngovernmentsecurities............. 27 (8) — — — — 19

CMBS............................ 4 (76) — — — — (72)

ABS ............................. 4 (129) — — — — (125)

State and political subdivision securities . . . . . . (1) 1 — — — — —

Otherfixedmaturitysecurities............. 1 — — — — — 1

Totalfixedmaturitysecurities............ $176 $(1,057) $ — $ — $ — $— $ (881)

Equity securities:

Commonstock ...................... $ — $ (2) $ — $ — $ — $— $ (2)

Non-redeemablepreferredstock........... — (195) — — — — (195)

Totalequitysecurities................. $ — $ (197) $ — $ — $ — $— $ (197)

Tradingandothersecurities ............... $(26) $ — $ — $ — $ — $— $ (26)

Short-terminvestments .................. $ 1 $ (1) $ — $ — $ — $— $ —

Mortgageloansheld-for-sale............... $ — $ — $ — $ 4 $ — $— $ 4

MSRs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ — $ — $(149) $ — $— $ (149)

Netderivatives........................ $103 $ — $1,587 $ 39 $ — $— $1,729

Liabilities:

Netembeddedderivatives................. $ — $ — $(2,682) $ — $182 $— $(2,500)

F-84 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)