MetLife 2010 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

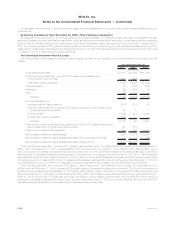

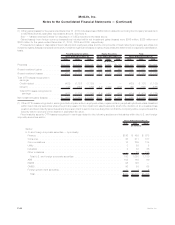

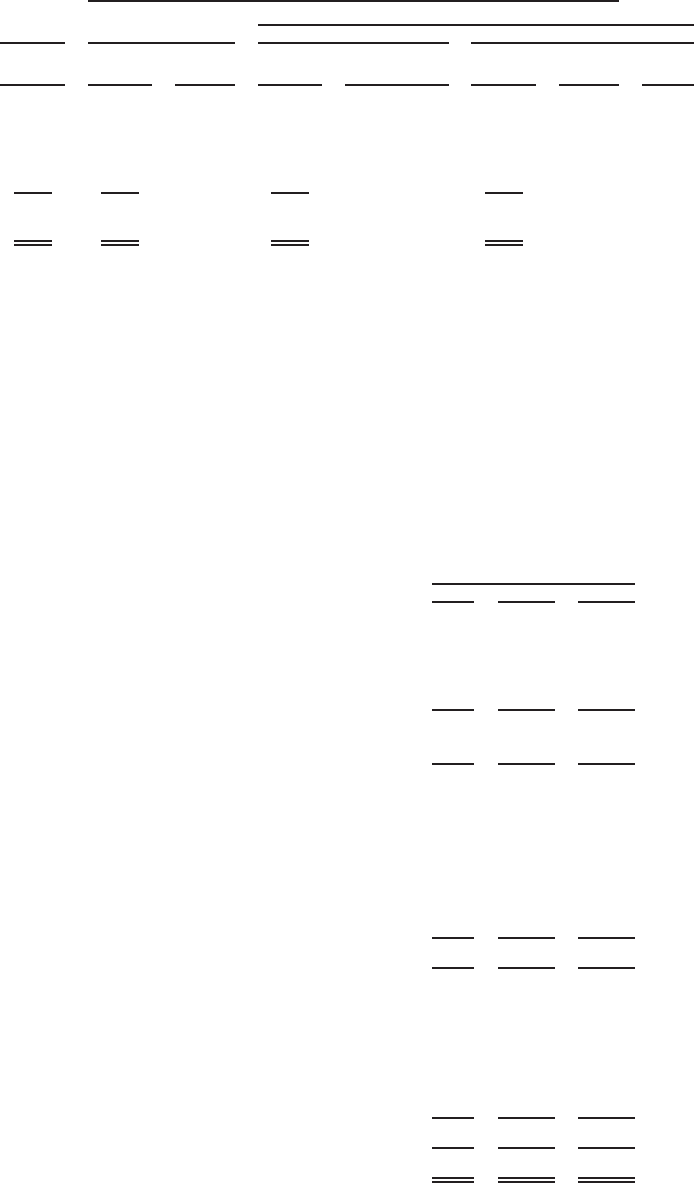

The following table presents certain information about the Company’s equity securities available-for-sale with a gross unrealized loss of

20% or more at December 31, 2010:

Gross

Unrealized

Loss

Gross

Unrealized

Loss

%ofAll

Equity

Securities

Gross

Unrealized

Loss

%ofAll

Non-Redeemable

Preferred Stock

Gross

Unrealized

Loss %ofAll

Industries

%A

Rated or

Better

All Equity

Securities

All Types of

Non-Redeemable

Preferred Stock All Industries Financial Services Industry

Investment Grade

Non-Redeemable Preferred Stock

(In millions)

Less than six months . . . . . . . . . . . . . $ 22 $ 18 82% $ 9 50% $ 9 100% 100%

Six months or greater but less than

twelvemonths................ 32 32 100% 32 100% 32 100% 50%

Twelve months or greater . . . . . . . . . . 116 116 100% 115 99% 115 100% 77%

All equity securities with a gross

unrealized loss of 20% or more . . . . . $170 $166 98% $156 94% $156 100% 73%

In connection with the equity securities impairment review process, the Company evaluated its holdings in non-redeemable preferred

stock, particularly those companies in the financial services industry. The Company considered several factors including whether there has

been any deterioration in credit of the issuer and the likelihood of recovery in value of non-redeemable preferred stock with a severe or an

extended unrealized loss. The Company also considered whether any issuers of non-redeemable preferred stock with an unrealized loss held

by the Company, regardless of credit rating, have deferred any dividend payments. No such dividend payments had been deferred.

With respect to common stock holdings, the Company considered the duration and severity of the unrealized losses for securities in an

unrealized loss position of 20% or more; and the duration of unrealized losses for securities in an unrealized loss position of less than 20% in

an extended unrealized loss position (i.e., 12 months or greater).

Future OTTIs will depend primarily on economic fundamentals, issuer performance (including changes in the present value of future cash

flows expected to be collected), changes in credit rating, changes in collateral valuation, changes in interest rates and changes in credit

spreads. If economic fundamentals and any of the above factors deteriorate, additional OTTIs may be incurred in upcoming quarters.

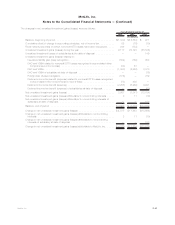

Net Investment Gains (Losses)

See “— Evaluating Available-for-Sale Securities for Other-Than-Temporary Impairment” for a discussion of changes in guidance adopted

April 1, 2009 that impacted how fixed maturity security OTTI losses that are charged to earnings are measured.

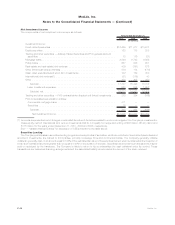

The components of net investment gains (losses) were as follows:

2010 2009 2008

Years Ended December 31,

(In millions)

Total gains (losses) on fixed maturity securities:

Total OTTI losses recognized . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(682) $(2,439) $(1,296)

Less: Noncredit portion of OTTI losses transferred to and recognized in other

comprehensiveincome(loss)....................................... 212 939 —

Net OTTI losses on fixed maturity securities recognized in earnings . . . . . . . . . . . . . . (470) (1,500) (1,296)

Fixedmaturitysecurities—netgains(losses)onsalesanddisposals............. 215 (163) (657)

Totalgains(losses)onfixedmaturitysecurities .......................... (255) (1,663) (1,953)

Other net investment gains (losses):

Equitysecurities ............................................... 104 (399) (253)

Mortgageloans................................................ 22 (442) (136)

Realestateandrealestatejointventures ............................... (54) (164) (18)

Otherlimitedpartnershipinterests.................................... (18) (356) (140)

Otherinvestmentportfoliogains(losses)................................ (6) (26) 134

Subtotal—investmentportfoliogains(losses)........................... (207) (3,050) (2,366)

FVO consolidated securitization entities:

Commercialmortgageloans........................................ 758 — —

Securities.................................................... (78) — —

Long-termdebt—relatedtocommercialmortgageloans..................... (722) — —

Long-termdebt—relatedtosecurities................................. 48 — —

Othergains(losses)(1)............................................. (191) 144 268

Subtotal FVO consolidated securitization entities and other gains (losses) . . . . . . . . . (185) 144 268

Total net investment gains (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(392) $(2,906) $(2,098)

F-45MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)