MetLife 2010 Annual Report Download - page 51

Download and view the complete annual report

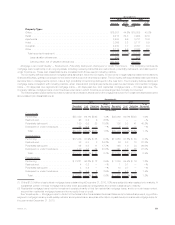

Please find page 51 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the Company expects to receive payments in accordance with the contractual terms of the securities that are considered temporarily

impaired.

CMBS. There have been disruptions in the CMBS market due to market perceptions that default rates will increase in part as a result of

weakness in commercial real estate market fundamentals and in part to relaxed underwriting standards by some originators of commercial

mortgage loans within the more recent vintage years (i.e., 2006 and later). These factors caused a pull-back in market liquidity, increased

credit spreads and repricing of risk, which has led to higher levels of unrealized losses as compared to historical levels through the first quarter

of 2010. However, in the second quarter of 2010, market conditions continued to improve and interest rates continue to decrease, causing

our portfolio to be in a net unrealized gain position of 2% of amortized cost at December 31, 2010.

CMBS in which the present value of projected future cash flows expected to be collected is less than amortized cost are reviewed for

impairment in accordance with our impairment policy. Based upon the analysis of the Company’s exposure to CMBS, the Company expects to

receive payments in accordance with the contractual terms of the securities that are considered temporarily impaired.

The Company’s holdings in CMBS were $20.7 billion and $15.6 billion, at estimated fair value at December 31, 2010 and 2009,

respectively. See “Investments — Fixed Maturity and Equity Securities Available-for-Sale — Concentrations of Credit Risk (Fixed Maturity

Securities) — CMBS” in Note 3 of the Notes to the Consolidated Financial Statements for tables that present the amortized cost and

estimated fair value, rating agency designation by Moody’s, S&P, Fitch or Realpoint, LLC and holdings by vintage year of such securities held

by the Company at December 31, 2010 and 2009. The Company had no exposure to CMBS index securities at December 31, 2010 or 2009.

The Company’s holdings of commercial real estate collateralized debt obligations securities were $138 million and $111 million at estimated

fair value at December 31, 2010 and 2009, respectively. The weighted average credit enhancement of the Company’s CMBS holdings was

26% and 28% at December 31, 2010 and 2009, respectively. This credit enhancement percentage represents the current weighted average

estimated percentage of outstanding capital structure subordinated to the Company’s investment holding that is available to absorb losses

before the security incurs the first dollar of loss of principal. The credit protection does not include any equity interest or property value in

excess of outstanding debt.

ABS. The Company’s ABS are diversified both by collateral type and by issuer. See “Investments — Fixed Maturity and Equity Securities

Available-for-Sale — Concentrations of Credit Risk (Fixed Maturity Securities) — ABS” in Note 3 of the Notes to the Consolidated Financial

Statements for a table that presents the Company’s ABS by collateral type, portion rated Aaa/AAA, portion rated NAIC 1, and portion credit

enhanced held by the Company at December 31, 2010 and 2009.

The slowing U.S. housing market, greater use of affordable mortgage products and relaxed underwriting standards for some originators of

sub-prime mortgage loans have recently led to higher delinquency and loss rates, especially within the 2006 and 2007 vintage years. These

factors have caused a pull-back in market liquidity and repricing of risk, which has led to higher levels of unrealized losses on securities

backed by sub-prime mortgage loans as compared to historical levels. However, in 2010, market conditions improved, credit spreads

narrowed on mortgage-backed and asset-backed securities and net unrealized losses on ABS backed by sub-prime mortgage loans

decreased from 36% to 22% of amortized cost from December 31, 2009 to December 31, 2010.

ABS in which the present value of projected future cash flows expected to be collected is less than amortized cost are reviewed for

impairment in accordance with our impairment policy. Based upon the analysis of the Company’s ABS, including sub-prime mortgage loans

through its exposure to ABS, the Company expects to receive payments in accordance with the contractual terms of the securities that are

considered temporarily impaired.

See “Investments— Fixed Maturity and Equity Securities Available-for-Sale — Concentrations of Credit Risk (Fixed Maturity Securities) —

ABS” in Note 3 of the Notes to the Consolidated Financial Statements for tables that present the Company’s holdings of ABS supported by

sub-prime mortgage loans by rating agency designation and by vintage year and by NAIC rating at December 31, 2010 and 2009.

The Company had ABS supported by sub-prime mortgage loans with estimated fair values of $1,119 million and $1,044 million and

unrealized losses of $317 million and $593 million at December 31, 2010 and 2009, respectively. Approximately 54% of this portfolio was

rated Aa or better, of which 88% was in vintage year 2005 and prior at December 31, 2010. Approximately 61% of this portfolio was rated Aa or

better, of which 91% was in vintage year 2005 and prior at December 31, 2009. These older vintages from 2005 and prior benefit from better

underwriting, improved enhancement levels and higher residential property price appreciation. All of the $1,119 million and $1,044 million of

ABS supported by sub-prime mortgage loans were classified as Level 3 fixed maturity securities in the fair value hierarchy at December 31,

2010 and 2009, respectively.

ABS also include collateralized debt obligations backed by sub-prime mortgage loans at an aggregate cost of $18 million with an

estimated fair value of $17 million at December 31, 2010 and an aggregate cost of $22 million with an estimated fair value of $8 million at

December 31, 2009.

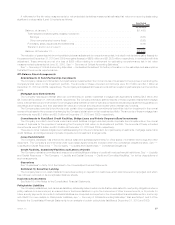

Evaluating Available-for-Sale Securities for Other-Than-Temporary Impairment

See “Investments — Evaluating Available-for-Sale Securities for Other-Than-Temporary Impairment” in Note 3 of the Notes to the

Consolidated Financial Statements for a discussion of the regular evaluation of available-for-sale securities holdings in accordance with

our impairment policy, whereby we evaluate whether such investments are other-than-temporarily impaired, new OTTI guidance adopted in

2009 and factors considered by security classification in the regular OTTI evaluation.

See “— Summary of Critical Accounting Estimates.”

Net Unrealized Investment Gains (Losses)

See “Investments — Net Unrealized Investment Gains (Losses)” in Note 3 of the Notes to the Consolidated Financial Statements for the

components of net unrealized investment gains (losses), included in accumulated other comprehensive income (loss) and the changes in net

unrealized investment gains (losses) at December 31, 2010 and 2009 and for the years ended December 31, 2010, 2009 and 2008,

respectively.

Fixed maturity securities with noncredit OTTI losses in accumulated other comprehensive income (loss) of ($601) million at December 31,

2010, includes ($859) million recognized prior to January 1, 2010, ($212) million (($202) million, net of DAC) of noncredit OTTI losses

recognized in the year ended December 31, 2010, $16 million transferred to retained earnings in connection with the adoption of guidance

relatedtotheconsolidationofVIEs(seeNote1oftheNotestotheConsolidated Financial Statements) for the year ended December 31, 2010,

$137 million related to securities sold for the year ended December 31, 2010, for which a noncredit OTTI loss was previously recognized in

accumulated other comprehensive income (loss) and $317 million of subsequent increases in estimated fair value during the year ended

48 MetLife, Inc.