MetLife 2010 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

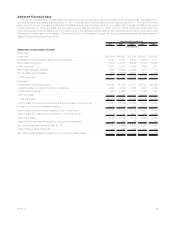

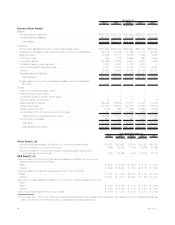

2010 2009 2008

Years Ended December 31,

(In millions)

Income(loss)fromcontinuingoperations,netofincometax................ $2,777 $(2,319) $3,479

Less:Netinvestmentgains(losses)................................ (392) (2,906) (2,098)

Less:Netderivativegains(losses) ................................ (265) (4,866) 3,910

Less:Adjustmentstocontinuingoperations(1)......................... (981) 283 (664)

Less:Provisionforincometax(expense)benefit ....................... 401 2,683 (488)

Operatingearnings .......................................... 4,014 2,487 2,819

Less:Preferredstockdividends .................................. 122 122 125

Operatingearningsavailabletocommonshareholders.................... $3,892 $2,365 $2,694

(1) See definitions of operating revenues and operating expenses for the components of such adjustments.

Year Ended December 31, 2010 compared with the Year Ended December 31, 2009

Unless otherwise stated, all amounts discussed below are net of income tax.

During the year ended December 31, 2010, MetLife’s income (loss) from continuing operations, net of income tax increased $5.1 billion to

a gain of $2.8 billion from a loss of $2.3 billion in 2009, of which $2 million in losses is from the inclusion of ALICO results for one month in 2010

and the impact of financing costs for the Acquisition. The change was predominantly due to a $4.6 billion favorable change in net derivative

gains (losses), before income tax, and a $2.5 billion favorable change in net investment gains (losses), before income tax. Offsetting these

favorable variances were unfavorable changes in adjustments related to continuing operations of $1.3 billion, before income tax, and

$2.2 billion of income tax, resulting in a total favorable variance of $3.6 billion. In addition, operating earnings available to common

shareholders increased $1.5 billion to $3.9 billion in the current year from $2.4 billion in the prior year.

The favorable change in net derivative gains (losses) of $3.0 billion was primarily driven by net gains on freestanding derivatives in the

current year compared to net losses in the prior year, partially offset by an unfavorable change in embedded derivatives from gains in the prior

year to losses in the current year. The favorable change in freestanding derivatives was primarily attributable to market factors, including falling

long-term and mid-term interest rates, a stronger recovery in equity markets in the prior year than the current year, equity volatility, which

decreased more in the prior year as compared to the current year, a strengthening U.S. dollar and widening corporate credit spreads in the

financial services sector. The favorable change in net investment gains (losses) of $1.6 billion was primarily driven by a decrease in

impairments and a decrease in the provision for credit losses on mortgage loans. These favorable changes in net derivative and net

investment gains (losses) were partially offset by an unfavorable change of $514 million in related adjustments.

The improvement in the financial markets, which began in the second quarter of 2009 and continued into 2010, was a key driver of the

$1.5 billion increase in operating earnings available to common shareholders. Such market improvement was most evident in higher net

investment income and policy fees, as well as a decrease in variable annuity guarantee benefit costs. These increases were partially offset by

an increase in amortization of DAC, VOBA and deferred sales inducements (“DSI”) as a result of an increase in average separate account

balances and higher current year gross margins in the closed block driven by increased investment yields and the impact of dividend scale

reductions. The 2010 period also includes one month of ALICO results, contributing $114 million to the increase in operating earnings. The

favorable impact of a reduction in discretionary spending associated with our enterprise-wide cost reduction and revenue enhancement

initiative was more than offset by an increase in other expenses related to our International business. This increase primarily stemmed from the

impact of a benefit recorded in the prior year related to the pesification in Argentina, as well as current year business growth in the segment.

Year Ended December 31, 2009 compared with the Year Ended December 31, 2008

Unless otherwise stated, all amounts discussed below are net of income tax.

During the year ended December 31, 2009, MetLife’s income (loss) from continuing operations, net of income tax, decreased $5.8 billion

to a loss of $2.3 billion from income of $3.5 billion in the comparable 2008 period. The year over year change is predominantly due to an

$8.8 billion unfavorable change in net derivative gains (losses), before income tax, to losses of $4.9 billion in 2009 from gains of $3.9 billion in

2008. In addition, there was an $808 million unfavorable change in net investment gains (losses), before income tax. Offsetting these

variances were favorable changes in adjustments related to continuing operations of $947 million, before income tax, and $3.2 billion of

income tax, resulting in a total unfavorable variance of $5.5 billion. In addition, operating earnings available to common shareholders

decreased by $329 million to $2.4 billion in 2009 from $2.7 billion in 2008.

The unfavorable change in net derivative gains (losses) of $8.8 billion was primarily driven by losses on freestanding derivatives, partially

offset by gains on embedded derivatives, most of which were associated with variable annuity minimum benefit guarantees, and lower losses

on fixed maturity securities. The unfavorable change in net investment gains (losses) of $808 million was primarily driven by an increase in

impairments. These unfavorable changes in gains (losses) were partially offset by a favorable change of $947 million in related adjustments.

The positive impact of business growth and favorable mortality in several of our businesses was more than offset by a decline in net

investment income, resulting in a decrease in operating earnings of $329 million. The decrease in net investment income caused significant

declines in the operating earnings of many of our businesses, especially the interest spread businesses. Also contributing to the decline in

operating earnings was an increase in net guaranteed annuity benefit costs and a charge related to our closed block of business, a specific

group of participating life policies that were segregated in connection with the demutualization of Metropolitan Life Insurance Company

(“MLIC”). The favorable impact of our enterprise-wide cost reduction and revenue enhancement initiative, was more than offset by higher

pension and postretirement benefit costs, driving the increase in other expenses. The declines in operating earnings were partially offset by a

change in amortization related to DAC, DSI and unearned revenue.

7MetLife, Inc.