MetLife 2010 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

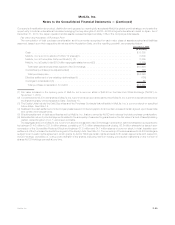

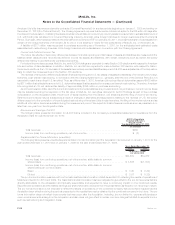

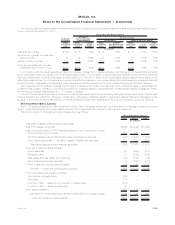

Cost or

Amortized

Cost Gain Temporary

Loss OTTI

Loss

Estimated

Fair

Value %of

Total

Gross Unrealized

December 31, 2009

(In millions)

Fixed Maturity Securities:

U.S. corporate securities . . . . . . . . . . . . . . . . . . . . $ 72,075 $2,821 $2,699 $ 10 $ 72,187 31.7%

Foreign corporate securities . . . . . . . . . . . . . . . . . . 37,254 2,011 1,226 9 38,030 16.7

RMBS ................................ 45,343 1,234 1,957 600 44,020 19.3

Foreign government securities . . . . . . . . . . . . . . . . . 11,010 1,076 139 — 11,947 5.2

U.S. Treasury, agency and government guaranteed

securities(1) ........................... 25,712 745 1,010 — 25,447 11.2

CMBS ................................ 16,555 191 1,106 18 15,622 6.9

ABS.................................. 14,272 189 1,077 222 13,162 5.8

State and political subdivision securities . . . . . . . . . . 7,468 151 411 — 7,208 3.2

Otherfixedmaturitysecurities ................. 20 1 2 — 19 —

Total fixed maturity securities(2), (3) . . . . . . . . . . . . $229,709 $8,419 $9,627 $859 $227,642 100.0%

Equity Securities:

Commonstock........................... $ 1,537 $ 92 $ 8 $ — $ 1,621 52.6%

Non-redeemable preferred stock(2). . . . . . . . . . . . . . 1,650 80 267 — 1,463 47.4

Total equity securities(4) . . . . . . . . . . . . . . . . . . . $ 3,187 $ 172 $ 275 $ — $ 3,084 100.0%

(1) The Company has classified within the U.S. Treasury, agency and government guaranteed securities caption certain corporate fixed

maturity securities issued by U.S. financial institutions that were guaranteed by the Federal Deposit Insurance Corporation (“FDIC”)

pursuant to the FDIC’s Temporary Liquidity Guarantee Program (“FDIC Program”) of $223 million and $407 million at estimated fair value

with unrealized gains of $4 million and $2 million at December 31, 2010 and 2009, respectively.

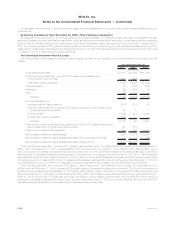

(2) Upon acquisition, the Company classifies perpetual securities that have attributes of both debt and equity as fixed maturity securities if

the security has an interest rate step-up feature which, when combined with other qualitative factors, indicates that the security has more

debt-like characteristics. The Company classifies perpetual securities with an interest rate step-up feature which, when combined with

other qualitative factors, indicates that the security has more equity-like characteristics, as equity securities within non-redeemable

preferred stock. Many of such securities have been issued by non-U.S. financial institutions that are accorded Tier 1 and Upper Tier 2

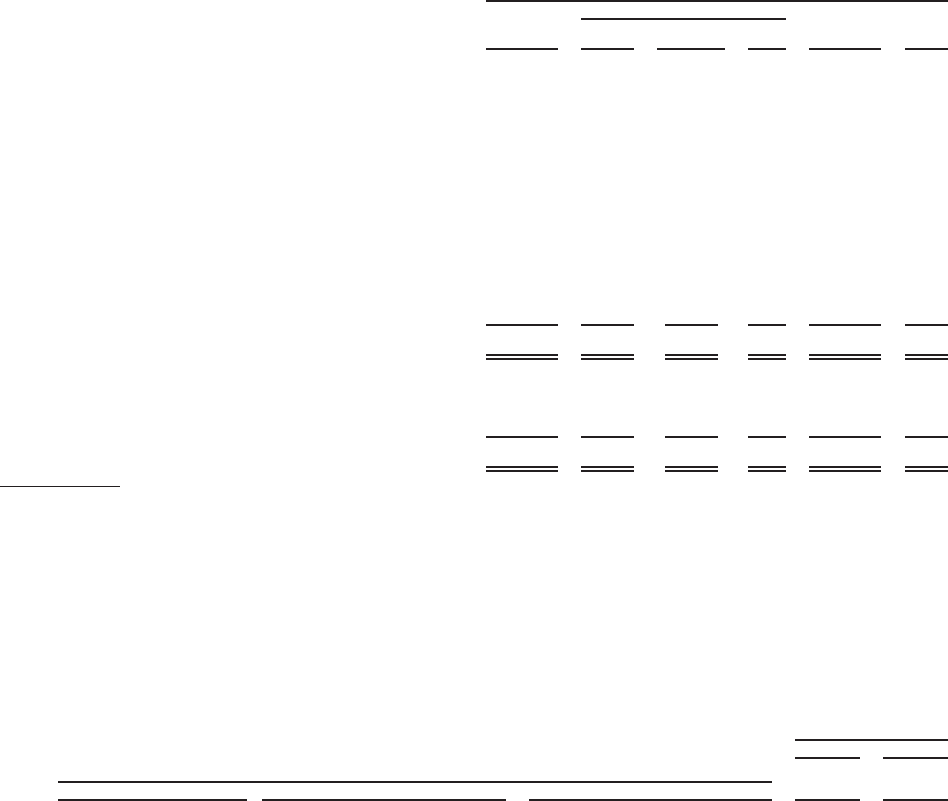

capital treatment by their respective regulatory bodies and are commonly referred to as “perpetual hybrid securities.” The following table

presents the perpetual hybrid securities held by the Company at:

Consolidated Balance Sheets Sector Table Primary Issuers

Estimated

Fair

Value

Estimated

Fair

Value

Classification

2010 2009

December 31,

(In millions)

Equity securities Non-redeemable preferred stock Non-U.S. financial institutions $1,046 $ 988

Equity securities Non-redeemable preferred stock U.S. financial institutions $ 236 $ 349

Fixed maturity securities Foreign corporate securities Non-U.S. financial institutions $2,038 $2,626

Fixed maturity securities U.S. corporate securities U.S. financial institutions $ 83 $ 91

(3) The Company’s holdings in redeemable preferred stock with stated maturity dates, commonly referred to as “capital securities”, were

primarily issued by U.S. financial institutions and have cumulative interest deferral features. The Company held $2.7 billion and

$2.5 billion at estimated fair value of such securities at December 31, 2010 and 2009, respectively, which are included in the U.S. and

foreign corporate securities sectors within fixed maturity securities.

(4) Equity securities primarily consist of investments in common and preferred stocks, including certain perpetual hybrid securities and

mutual fund interests. Privately-held equity securities were $1.3 billion and $1.0 billion at estimated fair value at December 31, 2010 and

2009, respectively.

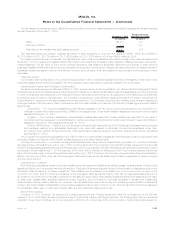

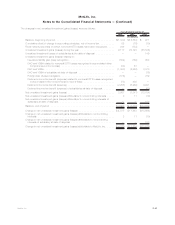

The Company held foreign currency derivatives with notional amounts of $12.2 billion and $9.1 billion to hedge the exchange rate risk

associated with foreign denominated fixed maturity securities at December 31, 2010 and 2009, respectively.

The below investment grade and non-income producing amounts presented below are based on rating agency designations and

equivalent designations of the National Association of Insurance Commissioners (“NAIC”), with the exception of certain structured securities

described below held by the Company’s insurance subsidiaries that file NAIC statutory financial statements. Non-agency RMBS, including

RMBS backed by sub-prime mortgage loans reported within ABS, CMBS and all other ABS held by the Company’s insurance subsidiaries that

file NAIC statutory financial statements are presented based on final ratings from the revised NAIC rating methodologies which became

effective December 31, 2009 for non-agency RMBS, including RMBS backed by sub-prime mortgage loans reported within ABS, and

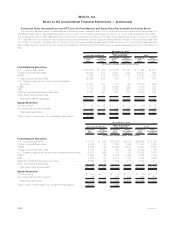

F-35MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)