MetLife 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

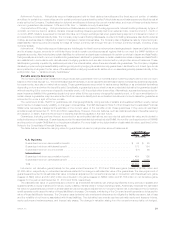

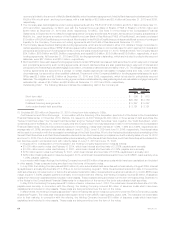

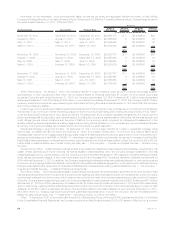

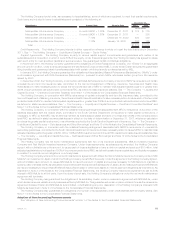

Information on the declaration, record and payment dates, as well as per share and aggregate dividend amounts, for the Holding

Company’s Floating Rate Non-Cumulative Preferred Stock, Series A and 6.500% Non-Cumulative Preferred Stock, Series B is as follows for

the years ended December 31, 2010, 2009 and 2008:

Declaration Date Record Date Payment Date Series A

Per Share Series A

Aggregate Series B

per Share Series B

Aggregate

Dividend

(In millions, except per share data)

November 15, 2010 . . . . . . . . . . November 30, 2010 December 15, 2010 $0.2527777 $ 7 $0.4062500 $24

August 16, 2010 . . . . . . . . . . . . August 31, 2010 September 15, 2010 $0.2555555 6 $0.4062500 24

May 17, 2010 . . . . . . . . . . . . . . May 31, 2010 June 15, 2010 $0.2555555 7 $0.4062500 24

March 5, 2010 . . . . . . . . . . . . . February 28, 2010 March 15, 2010 $0.2500000 6 $0.4062500 24

$26 $96

November 16, 2009 . . . . . . . . . . November 30, 2009 December 15, 2009 $0.2527777 $ 7 $0.4062500 $24

August 17, 2009 . . . . . . . . . . . . August 31, 2009 September 15, 2009 $0.2555555 6 $0.4062500 24

May 15, 2009 . . . . . . . . . . . . . . May 31, 2009 June 15, 2009 $0.2555555 7 $0.4062500 24

March 5, 2009 . . . . . . . . . . . . . February 28, 2009 March 16, 2009 $0.2500000 6 $0.4062500 24

$26 $96

November 17, 2008 . . . . . . . . . . November 30, 2008 December 15, 2008 $0.2527777 $ 7 $0.4062500 $24

August 15, 2008 . . . . . . . . . . . . August 31, 2008 September 15, 2008 $0.2555555 6 $0.4062500 24

May 15, 2008 . . . . . . . . . . . . . . May 31, 2008 June 16, 2008 $0.2555555 7 $0.4062500 24

March 5, 2008 . . . . . . . . . . . . . February 29, 2008 March 17, 2008 $0.3785745 9 $0.4062500 24

$29 $96

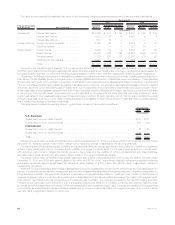

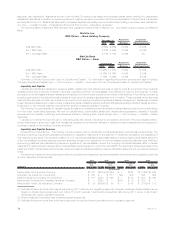

Share Repurchases. At January 1, 2008, the Company had $511 million remaining under its common stock repurchase program

authorizations. In both January and April 2008, the Company’s Board of Directors authorized $1.0 billion common stock repurchase

programs. During the year ended December 31, 2008, the Company repurchased 19,716,418 shares for $1.2 billion under accelerated

share repurchases and 1,550,000 shares for $88 million in open market repurchases. At December 31, 2008, the Company had $1.3 billion

remaining under its common stock repurchase program authorizations. During the years ended December 31, 2010 and 2009, the Company

did not repurchase any shares.

Under these common stock repurchase program authorizations, the Holding Company may purchase its common stock from the MetLife

Policyholder Trust, in the open market (including pursuant to the terms of a pre-set trading plan meeting the requirements of Rule 10b5-1

under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and in privately negotiated transactions. Any future common

stock repurchases will be dependent upon several factors, including the Company’s capital position, its liquidity, its financial strength and

credit ratings, general market conditions and the price of MetLife, Inc.’s common stock compared to management’s assessment of the

stock’s underlying value and applicable regulatory, legal and accounting factors. Whether or not to purchase any common stock and the size

and timing of any such purchases will be determined in the Company’s complete discretion.

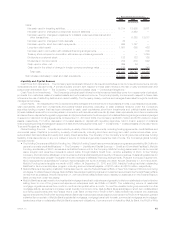

Residential Mortgage Loans Held-for-Sale. At December 31, 2010, the Company held $3,321 million in residential mortgage loans

held-for-sale, compared with $2,728 million at December 31, 2009, an increase of $593 million. From time to time, MetLife Bank has an

increased cash need to fund mortgage loans that it generally holds for a relatively short period before selling them to one of the government-

sponsored enterprises such as FNMA or FHLMC. To meet these increased funding requirements, as well as to increase overall liquidity,

MetLife Bank takes advantage of collateralized borrowing opportunities with the Federal Reserve Bank of New York and the FHLB of NY. For

further detail on MetLife Bank’s use of these funding sources, see “— The Company — Liquidity and Capital Sources — Global Funding

Sources.”

Investment and Other. Additional cash outflows include those related to obligations of securities lending activities, investments in real

estate, limited partnerships and joint ventures, as well as litigation-related liabilities. Also, the Company pledges collateral to, and has

collateral pledged to it by, counterparties under the Company’s current derivative transactions. With respect to derivative transactions with

credit ratings downgrade triggers, a two-notch downgrade would have increased the Company’s derivative collateral requirements by

$159 million at December 31, 2010. In addition, the Company has pledged collateral and has had collateral pledged to it, and may be required

from time to time to pledge additional collateral or be entitled to have additional collateral pledged to it, in connection with collateral financing

arrangements related to the reinsurance of closed block liabilities and universal life secondary guarantee liabilities. See “— The Company —

Liquidity and Capital Sources — Collateral Financing Arrangements.”

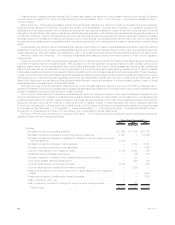

Securities Lending. The Company participates in a securities lending program whereby blocks of securities, which are included in fixed

maturity securities and short-term investments, are loaned to third parties, primarily brokerage firms and commercial banks, and the Company

receives cash collateral from the borrower, which must be returned to the borrower when the loaned securities are returned to the Company.

Under the Company’s securities lending program, the Company was liable for cash collateral under its control of $24.6 billion and $21.5 billion

at December 31, 2010 and 2009, respectively. Of these amounts, $2.8 billion and $3.3 billion at December 31, 2010 and 2009, respectively,

were on open terms, meaning that the related loaned security could be returned to the Company on the next business day upon return of cash

collateral. Of the $2.7 billion of estimated fair value of the securities related to the cash collateral on open terms at December 31, 2010,

$2.3 billion were U.S. Treasury, agency and government guaranteed securities which, if put to the Company, can be immediately sold to

satisfy the cash requirements. See “— Investments — Securities Lending” for further information.

Other. In September 2008, in connection with the split-off of Reinsurance Group of America (“RGA”) as described in Note 2 of the Notes

to the Consolidated Financial Statements, the Company received from MetLife stockholders 23,093,689 shares of MetLife, Inc.’s common

68 MetLife, Inc.