MetLife 2010 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chairman’s Letter

To my fellow shareholders:

Most certainly, 2010 will be a year that people will look back upon as a time of significant

transformation and accomplishment for MetLife. This is no small statement given the

tremendous milestones of growth and innovation that define MetLife’s 143-year history.

But it is also fitting in that we truly demonstrated the power of this great company and our

focus on ensuring that we deliver on the promises we have made to our customers, who

now total 90 million around the globe.

Without a doubt, our acquisition of American Life Insurance Company (Alico) was a tremendous accomplishment in 2010 as

it transformed MetLife into a global life insurance and employee benefits powerhouse. At its core, this acquisition benefits us in

many ways, giving MetLife leadership positions in key markets, including Japan, Europe and the Middle East. Furthermore, it will

be accretive to both our earnings and return on equity in 2011 and provides opportunities to expand the strong relationships we

have built with FORTUNE 500»clients in the U.S. But even more noteworthy is that we were able to pursue and complete this

$16.4 billion acquisition because of the high priority we placed on our financial strength before and during the financial crisis. The

foresight, experience and risk management expertise that define the culture of MetLife have truly served us, our customers and

our shareholders very well.

Strong, Diverse Businesses

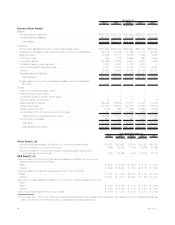

In 2010, we continued our focus on growth, even as we completed the largest acquisition in MetLife’s history. Total revenues

grew 28% over 2009 to $52.7 billion as premiums grew 4%, fees increased 16% and net investment income recovered

significantly, growing 19%. We have demonstrated industry-leading strength in growing our top line over the past two years — a

time during which there has clearly been considerable economic uncertainty. We are pleased to be a top provider in our chosen

markets, but we will only pursue revenue growth where we know we can generate bottom line growth as well.

To that end, bottom line improvements were very impressive in 2010, with earnings increasing significantly over

2009. Book value per common share rose 16% over year-end 2009 to $44.18 as our investment portfolio moved

from being in a net unrealized loss position to having net unrealized gains at year-end 2010.

Briefly, I would like to share some highlights of our businesses’ performance this year.

Our U.S. Business is an industry leader that meets consumers’ protection and savings needs wherever it is

convenient for them — at the workplace, through a MetLife or third-party representative and, more recently, by

offering term life insurance online as well. In 2010, U.S. Business premiums, fees and other revenues increased

slightly over 2009 to $28.9 billion while earnings grew considerably. Results within U.S. Business included:

• Premiums, fees and other revenues in Insurance Products were $20.2 billion, which is consistent with

2009’s performance. Top line results in this business benefited from growth in our group life and dental

businesses — two product lines in which MetLife is a leader. We also made further progress on our efforts to

help consumers address their life insurance protection needs by making it easier for the underserved middle

market to purchase term life insurance through metlife.com. Also, in early 2011, we launched MetLife Promise

Whole Life, a new permanent insurance product that offers long-term protection and the advantages of

guaranteed cash value that grows each year, tax-deferred, along with dividend participation.

•Retirement Products premiums, fees and other revenues were $3.3 billion, up 19% due to strong growth in

fee income as profits in the segment more than doubled. Annuity deposits also were strong at $20.1 billion

and assets grew 14% over 2009 to reach a record $162.7 billion. We continue to be a leader in the annuity

business, with clients valuing the guaranteed income these products generate in retirement.

•InCorporate Benefit Funding — which specializes in structured risk solutions — premiums, fees and

other revenues were $2.4 billion. At the same time, the business experienced strong growth in profitability and

a higher return on equity over 2009. During the year, we had solid sales of both structured settlements and