MetLife 2010 Annual Report Download - page 227

Download and view the complete annual report

Please find page 227 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Commissioner has broad discretion in determining whether the financial condition of a stock property and casualty insurance company would

support the payment of such dividends to its shareholders.

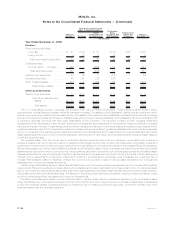

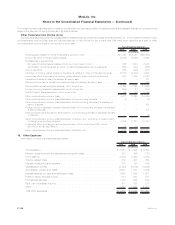

Other Comprehensive Income (Loss)

The following table sets forth the reclassification adjustments required for the years ended December 31, 2010, 2009 and 2008 in other

comprehensive income (loss) that are included as part of net income for the current year that have been reported as a part of other

comprehensive income (loss) in the current or prior year:

2010 2009 2008

Years Ended December 31,

(In millions)

Holdinggains(losses)oninvestmentsarisingduringtheyear..................... $10,092 $18,548 $(26,650)

Incometaxeffectofholdinggains(losses) ................................ (3,516) (6,243) 8,989

Reclassification adjustments:

Recognizedholding(gains)lossesincludedincurrentyearincome................ (143) 1,954 2,040

Amortization of premiums and accretion of discounts associated with investments . . . . . . (590) (490) (926)

Incometaxeffect ................................................ 255 (493) (377)

Allocation of holding (gains) losses on investments relating to other policyholder amounts . . . (2,813) (2,979) 4,809

Income tax effect of allocation of holding (gains) losses to other policyholder amounts . . . . . 980 1,002 (1,621)

Unrealizedinvestmentlossofsubsidiaryatdateofsale ........................ — — 131

Deferredincometaxonunrealizedinvestmentlossofsubsidiaryatdateofsale ......... — — (60)

Netunrealizedinvestmentgains(losses),netofincometax...................... 4,265 11,299 (13,665)

Foreign currency translation adjustments, net of income tax . . .................... (350) 63 (700)

Defined benefit plans adjustment, net of income tax . .......................... 96 (102) (1,199)

Othercomprehensiveincome(loss)..................................... 4,011 11,260 (15,564)

Other comprehensive income (loss) attributable to noncontrolling interests . . . ......... (5) 11 (10)

Other comprehensive income (loss) attributable to noncontrolling interests of subsidiary at

dateofdisposal................................................ — — 150

Foreign currency translation adjustments attributable to noncontrolling interests of subsidiary

atdateofdisposal .............................................. — — 107

Defined benefit plans adjustment attributable to noncontrolling interests of subsidiary at date

ofdisposal................................................... — — (4)

Other comprehensive income (loss) attributable to MetLife, Inc., excluding cumulative effect

ofchangeinaccountingprinciple..................................... 4,006 11,271 (15,321)

Cumulative effect of change in accounting principle, net of income tax of $27 million,

$40millionand$0(seeNote1)...................................... 52 (76) —

Othercomprehensiveincome(loss)attributabletoMetLife,Inc. ................... $ 4,058 $11,195 $(15,321)

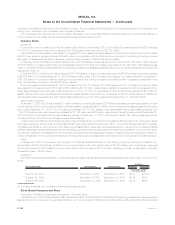

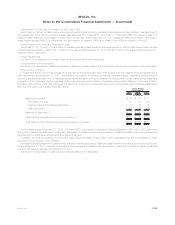

19. Other Expenses

Information on other expenses was as follows:

2010 2009 2008

Years Ended December 31,

(In millions)

Compensation ............................................... $ 3,584 $ 3,402 $ 3,299

Pension,postretirement&postemploymentbenefitcosts.................... 380 452 120

Commissions................................................ 3,646 3,433 3,384

Volume-relatedcosts........................................... 379 407 354

Interestcreditedtobankdeposits................................... 137 163 166

CapitalizationofDAC........................................... (3,343) (3,019) (3,092)

AmortizationofDACandVOBA .................................... 2,801 1,307 3,489

Interestexpenseondebtanddebtissuecosts .......................... 1,550 1,044 1,051

Premiumtaxes,licenses&fees .................................... 514 527 471

Professionalservices........................................... 1,104 902 949

Rent,netofsubleaseincome...................................... 307 385 373

Other ..................................................... 1,744 1,553 1,383

Totalotherexpenses ........................................... $12,803 $10,556 $11,947

F-138 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)