MetLife 2010 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

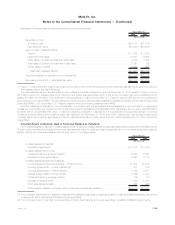

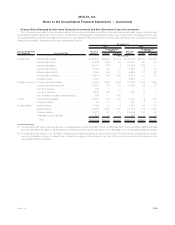

Primary Risks Managed by Derivative Financial Instruments and Non-Derivative Financial Instruments

The Company is exposed to various risks relating to its ongoing business operations, including interest rate risk, foreign currency risk,

credit risk and equity market risk. The Company uses a variety of strategies to manage these risks, including the use of derivative instruments.

The following table presents the gross notional amount, estimated fair value and primary underlying risk exposure of the Company’s derivative

financial instruments, excluding embedded derivatives, held at:

Primary Underlying

Risk Exposure Instrument Type Notional

Amount Assets Liabilities Notional

Amount Assets Liabilities

Estimated Fair

Value(1)

2010

Estimated Fair

Value(1)

2009

December 31,

(In millions)

Interest rate Interest rate swaps . . . . . . . . . . . . . . . . . . . $ 54,803 $2,654 $1,516 $ 38,152 $1,570 $1,255

Interest rate floors . . . . . . . . . . . . . . . . . . . 23,866 630 66 23,691 461 37

Interest rate caps . . . . . . . . . . . . . . . . . . . . 35,412 176 1 28,409 283 —

Interestratefutures .................. 9,385 43 17 7,563 8 10

Interest rate options . . . . . . . . . . . . . . . . . . 8,761 144 23 4,050 117 57

Interest rate forwards . . . . . . . . . . . . . . . . . 10,374 106 135 9,921 66 27

SyntheticGICs ..................... 4,397 — — 4,352 — —

Foreign currency Foreign currency swaps . . . . . . . . . . . . . . . 17,626 1,616 1,282 16,879 1,514 1,392

Foreign currency forwards . . . . . . . . . . . . . . 10,443 119 91 6,485 83 57

Currencyfutures .................... 493 2 — — — —

Currencyoptions.................... 5,426 50 — 822 18 —

Non-derivative hedging instruments(2) . . . . . . 169 — 185 — — —

Credit Credit default swaps . . . . . . . . . . . . . . . . . . 10,957 173 104 6,723 74 130

Creditforwards ..................... 90 2 3 220 2 6

Equitymarket Equityfutures ...................... 8,794 21 9 7,405 44 21

Equity options . . . . . . . . . . . . . . . . . . . . . . 33,688 1,843 1,197 27,175 1,712 1,018

Variance swaps . . . . . . . . . . . . . . . . . . . . . 18,022 198 118 13,654 181 58

Totalrateofreturnswaps .............. 1,547 — — 376 — 47

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . $254,253 $7,777 $4,747 $195,877 $6,133 $4,115

(1) The estimated fair value of all derivatives in an asset position is reported within other invested assets in the consolidated balance sheets

and the estimated fair value of all derivatives in a liability position is reported within other liabilities in the consolidated balance sheets.

(2) The estimated fair value of non-derivative hedging instruments represents the amortized cost of the instruments, as adjusted for foreign

currency transaction gains or losses. Non-derivative hedging instruments are reported within policyholder account balances in the

consolidated balance sheets.

F-59MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)