MetLife 2010 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

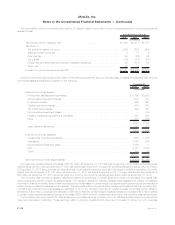

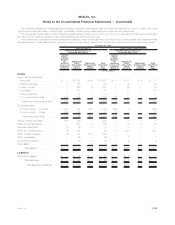

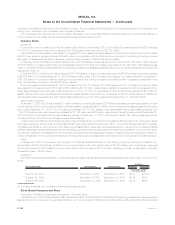

The aggregate pension accumulated benefit obligation and aggregate fair value of plan assets for pension benefit plans with accumulated

benefit obligations in excess of plan assets was as follows:

2010 2009

December 31,

(In millions)

Projectedbenefitobligations................................................. $1,436 $798

Accumulatedbenefitobligations .............................................. $1,307 $714

Fairvalueofplanassets.................................................... $ 106 $ 1

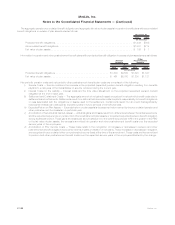

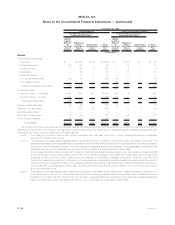

Information for pension and other postretirement benefit plans with a projected benefit obligation in excess of plan assets were as follows:

2010 2009 2010 2009

December 31,

Pension

Benefits

Other

Postretirement

Benefits

(In millions)

Projectedbenefitobligations.................................. $1,803 $6,580 $1,845 $1,847

Fairvalueofplanassets..................................... $ 461 $5,700 $1,200 $1,121

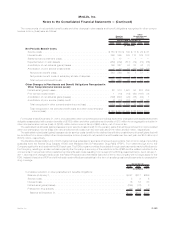

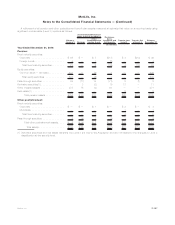

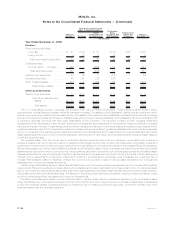

Net periodic pension costs and net periodic other postretirement benefit plan costs are comprised of the following:

i) Service Costs — Service costs are the increase in the projected (expected) pension benefit obligation resulting from benefits

payable to employees of the Subsidiaries on service rendered during the current year.

ii) Interest Costs on the Liability — Interest costs are the time value adjustment on the projected (expected) pension benefit

obligation at the end of each year.

iii) Settlement and Curtailment Costs — The aggregate amount of net gains (losses) recognized in net periodic benefit costs due to

settlements and curtailments. Settlements result from actions that relieve/eliminate the plan’s responsibility for benefit obligations

or risks associated with the obligations or assets used for the settlement. Curtailments result from an event that significantly

reduces/eliminates plan participants’ expected years of future services or benefit accruals.

iv) Expected Return on Plan Assets — Expected return on plan assets is the assumed return earned by the accumulated pension and

other postretirement fund assets in a particular year.

v) Amortization of Net Actuarial Gains (Losses) — Actuarial gains and losses result from differences between the actual experience

and the expected experience on pension and other postretirement plan assets or projected (expected) pension benefit obligation

during a particular period. These gains and losses are accumulated and, to the extent they exceed 10% of the greater of the PBO

or the fair value of plan assets, the excess is amortized into pension and other postretirement benefit costs over the expected

service years of the employees.

vi) Amortization of Prior Service Costs — These costs relate to the recognition of increases or decreases in pension and other

postretirement benefit obligation due to amendments in plans or initiation of new plans. These increases or decreases in obligation

are recognized in accumulated other comprehensive income (loss) at the time of the amendment. These costs are then amortized

to pension and other postretirement benefit costs over the expected service years of the employees affected by the change.

F-122 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)