MetLife 2010 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

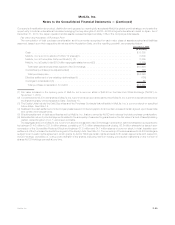

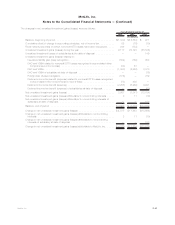

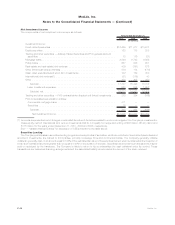

(1) All of the Company’s Alt-A RMBS holdings in the 2009 and 2010 vintage years are Re-REMIC Alt-A RMBS that were purchased in 2009

and 2010 and are comprised of original issue vintage year 2005 through 2007 Alt-A RMBS. All of the Company’s Re-REMIC Alt-A RMBS

holdings are NAIC 1 rated.

Amount %of

Total Amount %of

Total

2010 2009

December 31,

(In millions)

Netunrealizedgain(loss)...................................... $(670) $(1,248)

RatedAa/AAorbetter........................................ 15.9% 26.3%

RatedNAIC1 ............................................. 39.5% 31.3%

Distribution of holdings — at estimated fair value — by collateral type:

Fixedratemortgageloanscollateral ............................. 90.7% 89.3%

Hybridadjustableratemortgageloanscollateral ..................... 9.3 10.7

Total Alt-A RMBS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100.0% 100.0%

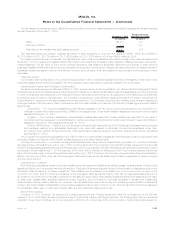

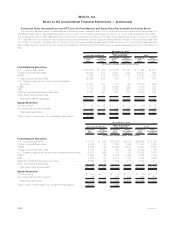

Concentrations of Credit Risk (Fixed Maturity Securities) — CMBS. The Company’s holdings in CMBS were $20.7 billion and $15.6 bil-

lion at estimated fair value at December 31, 2010 and 2009, respectively. The Company had no exposure to CMBS index securities at

December 31, 2010 or 2009. The Company held commercial real estate collateralized debt obligations securities of $138 million and

$111 million at estimated fair value at December 31, 2010 and 2009, respectively.

The following tables present the Company’s holdings of CMBS by rating agency designation and by vintage year at:

Amortized

Cost

Estimated

Fair

Value Amortized

Cost

Estimated

Fair

Value Amortized

Cost

Estimated

Fair

Value Amortized

Cost

Estimated

Fair

Value Amortized

Cost

Estimated

Fair

Value Amortized

Cost

Estimated

Fair

Value

Aaa Aa A Baa

Below

Investment

Grade Total

December 31, 2010

(In millions)

2003 & Prior . . . . . . . . . . . $ 7,411 $ 7,640 $ 282 $ 282 $228 $227 $ 74 $ 71 $ 28 $ 24 $ 8,023 $ 8,244

2004................ 3,489 3,620 277 273 216 209 181 175 91 68 4,254 4,345

2005................ 3,113 3,292 322 324 286 280 263 255 73 66 4,057 4,217

2006................ 1,463 1,545 159 160 168 168 385 398 166 156 2,341 2,427

2007................ 840 791 344 298 96 95 119 108 122 133 1,521 1,425

2008................ 2 2 — — — — — — — — 2 2

2009................ 3 3 — — — — — — — — 3 3

2010................ 8 8 — — 4 4 — — — — 12 12

Total............... $16,329 $16,901 $1,384 $1,337 $998 $983 $1,022 $1,007 $480 $447 $20,213 $20,675

Ratings Distribution . . . . . . . 81.7% 6.4% 4.8% 4.9% 2.2% 100.0%

The December 31, 2010 table reflects rating agency designations assigned by nationally recognized rating agencies including Moody’s,

S&P, Fitch and Realpoint, LLC.

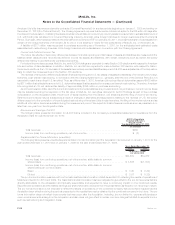

Amortized

Cost

Estimated

Fair

Value Amortized

Cost

Estimated

Fair

Value Amortized

Cost

Estimated

Fair

Value Amortized

Cost

Estimated

Fair

Value Amortized

Cost

Estimated

Fair

Value Amortized

Cost

Estimated

Fair

Value

Aaa Aa A Baa

Below

Investment

Grade Total

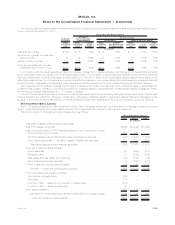

December 31, 2009

(In millions)

2003 & Prior . . . . . . . . . . . $ 6,836 $ 6,918 $394 $365 $ 162 $140 $ 52 $ 41 $ 36 $ 18 $ 7,480 $ 7,482

2004................ 2,240 2,255 200 166 114 71 133 87 88 58 2,775 2,637

2005................ 2,956 2,853 144 108 85 65 39 24 57 51 3,281 3,101

2006................ 1,087 1,009 162 139 380 323 187 129 123 48 1,939 1,648

2007................ 432 314 13 12 361 257 234 153 35 13 1,075 749

2008................ 5 5 — — — — — — — — 5 5

2009................ — — — — — — — — — — — —

Total............... $13,556 $13,354 $913 $790 $1,102 $856 $645 $434 $339 $188 $16,555 $15,622

Ratings Distribution . . . . . . . 85.4% 5.1% 5.5% 2.8% 1.2% 100.0%

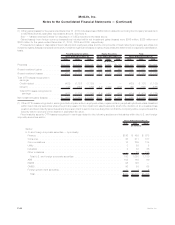

F-38 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)