MetLife 2010 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

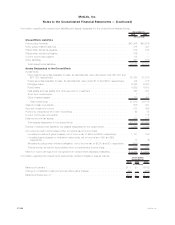

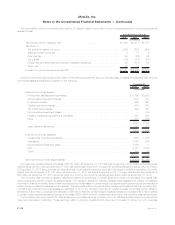

The reconciliation of the income tax provision at the U.S. statutory rate to the provision for income tax as reported for continuing operations

wasasfollows:

2010 2009 2008

Years Ended December 31,

(In millions)

TaxprovisionatU.S.statutoryrate .................................... $1,385 $(1,517) $1,771

Tax effect of:

Tax-exemptinvestmentincome ..................................... (242) (288) (254)

Stateandlocalincometax ........................................ 9 17 2

Prioryeartax................................................. 59 (26) 53

Taxcredits .................................................. (82) (87) (58)

Foreigntaxratedifferentialandchangeinvaluationallowance ................. 26 (118) 65

Other,net................................................... 26 4 1

Provisionforincometaxexpense(benefit)................................ $1,181 $(2,015) $1,580

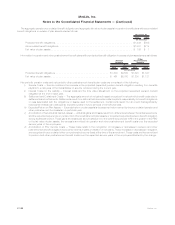

Deferred income tax represents the tax effect of the differences between the book and tax basis of assets and liabilities. Net deferred

income tax assets and liabilities consisted of the following:

2010 2009

December 31,

(In millions)

Deferred income tax assets:

Policyholderliabilitiesandreceivables ....................................... $ 5,169 $3,929

Netoperatinglosscarryforwards .......................................... 1,400 871

Employeebenefits.................................................... 664 661

Capitallosscarryforwards............................................... 408 551

Taxcreditcarryforwards ................................................ 459 401

Netunrealizedinvestmentlosses .......................................... — 816

Litigation-relatedandgovernmentmandated................................... 227 240

Other ............................................................ 331 276

8,658 7,745

Less:Valuationallowance............................................... 261 217

8,397 7,528

Deferred income tax liabilities:

Investments,includingderivatives.......................................... 1,253 1,434

Intangibles......................................................... 3,068 334

Netunrealizedinvestmentgains........................................... 1,490 —

DAC............................................................. 4,342 4,439

Other ............................................................ 125 93

10,278 6,300

Netdeferredincometaxasset(liability)........................................ $(1,881) $1,228

Domestic net operating loss carryforwards of $2,181 million at December 31, 2010 will expire beginning in 2020. State net operating loss

carryforwards of $123 million at December 31, 2010 will expire beginning in 2011. Foreign net operating loss carryforwards of $2,132 million

at December 31, 2010 were generated in various foreign countries with expiration periods of five years to indefinite expiration. Domestic

capital loss carryforwards of $1,130 million at December 31, 2010 will expire beginning in 2011. Foreign capital loss carryforwards of

$35 million at December 31, 2010 will expire beginning in 2014. Tax credit carryforwards were $459 million at December 31, 2010.

The Company has recorded a valuation allowance related to tax benefits of certain state and foreign net operating and capital loss

carryforwards and certain foreign unrealized losses. The valuation allowance reflects management’s assessment, based on available

information, that it is more likely than not that the deferred income tax asset for certain foreign net operating and capital loss carryforwards and

certain foreign unrealized losses will not be realized. The tax benefit will be recognized when management believes that it is more likely than

not that these deferred income tax assets are realizable. In 2010, the Company recorded an overall increase to the deferred tax valuation

allowance of $44 million, comprised of a decrease of $2 million related to certain foreign unrealized losses, an increase of $18 million related

to certain foreign capital loss carryforwards, an increase of $28 million related to certain state and foreign net operating loss carryforwards.

The Company has not provided U.S. deferred taxes on cumulative earnings of certain non-U.S. affiliates and associated companies that

have been reinvested indefinitely. These earnings relate to ongoing operations and have been reinvested in active non-U.S. business

F-112 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)