MetLife 2010 Annual Report Download - page 223

Download and view the complete annual report

Please find page 223 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

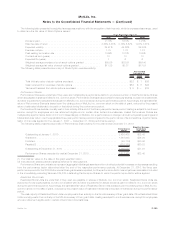

Stock Options

Stock Options are the contingent right of award holders to purchase shares of MetLife, Inc. common stock at a stated price for a limited

time. All Stock Options have an exercise price equal to the closing price of MetLife, Inc. common stock reported on the NYSE on the date of

grant, and have a maximum term of ten years. The vast majority of Stock Options granted have become or will become exercisable at a rate of

one-third of each award on each of the first three anniversaries of the grant date. Other Stock Options have become or will become

exercisable on the third anniversary of the grant date. Vesting is subject to continued service, except for employees who are retirement

eligible and in certain other limited circumstances.

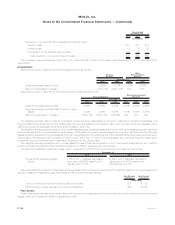

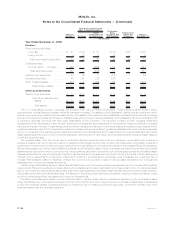

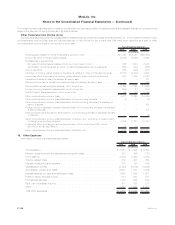

A summary of the activity related to Stock Options for the year ended December 31, 2010 is as follows:

Shares Under

Option Weighted Average

Exercise Price

Weighted

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value(1)

(Years) (In millions)

Outstanding at January 1, 2010 . . . . . . . . . . . . . . . . . . . 30,152,405 $38.51 5.50 $ —

Granted(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,683,144 $35.06

Exercised . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,742,003) $29.74

Expired . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (154,947) $47.78

Forfeited . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (236,268) $34.64

Outstanding at December 31, 2010 . . . . . . . . . . . . . . . . 32,702,331 $38.47 5.30 $195

Aggregate number of stock options expected to vest at

December 31, 2010 . . . . . . . . . . . . . . . . . . . . . . . . . 31,930,964 $38.62 5.21 $186

Exercisable at December 31, 2010 . . . . . . . . . . . . . . . . . 23,405,998 $40.43 4.00 $ 94

(1) The aggregate intrinsic value was computed using the closing share price on December 31, 2010 of $44.44 and December 31, 2009 of

$35.35, as applicable.

(2) The total fair value on the date of the grant was $53 million.

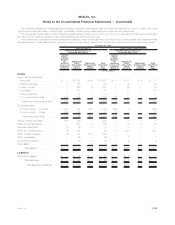

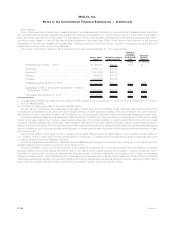

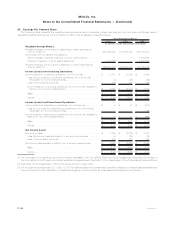

The fair value of Stock Options is estimated on the date of grant using a binomial lattice model. Significant assumptions used in the

Company’s binomial lattice model, which are further described below, include: expected volatility of the price of MetLife, Inc. common stock;

risk-free rate of return; expected dividend yield on MetLife, Inc. common stock; exercise multiple; and the post-vesting termination rate.

Expected volatility is based upon an analysis of historical prices of MetLife, Inc. common stock and call options on that common stock

traded on the open market. The Company uses a weighted-average of the implied volatility for publicly-traded call options with the longest

remaining maturity nearest to the money as of each valuation date and the historical volatility, calculated using monthly closing prices of

MetLife, Inc.’s common stock. The Company chose a monthly measurement interval for historical volatility as it believes this better depicts the

nature of employee option exercise decisions being based on longer-term trends in the price of the underlying shares rather than on daily

price movements.

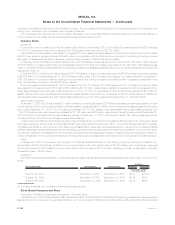

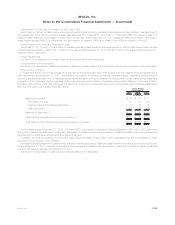

The binomial lattice model used by the Company incorporates different risk-free rates based on the imputed forward rates for

U.S. Treasury Strips for each year over the contractual term of the option. The table below presents the full range of rates that were used

for options granted during the respective periods.

Dividend yield is determined based on historical dividend distributions compared to the price of the underlying common stock as of the

valuation date and held constant over the life of the Stock Option.

The binomial lattice model used by the Company incorporates the contractual term of the Stock Options and then factors in expected

exercise behavior and a post-vesting termination rate, or the rate at which vested options are exercised or expire prematurely due to

termination of employment, to derive an expected life. Exercise behavior in the binomial lattice model used by the Company is expressed

using an exercise multiple, which reflects the ratio of exercise price to the strike price of Stock Options granted at which holders of the Stock

Options are expected to exercise. The exercise multiple is derived from actual historical exercise activity. The post-vesting termination rate is

determined from actual historical exercise experience and expiration activity under the Incentive Plans.

F-134 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)