MetLife 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Company delivered 20,244,549 shares of its common stock held in treasury at a value of $1,064 million to settle the stock purchase

contracts.

Other. In March 2009, the Company sold Cova Corporation, the parent company of Texas Life Insurance Company, for $130 million in

cash consideration, excluding $1 million of transaction costs. The proceeds of the transaction were paid to the Holding Company.

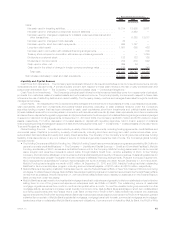

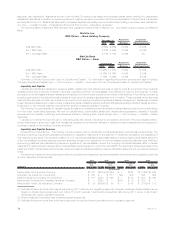

Credit and Committed Facilities. The Company maintains unsecured credit facilities and committed facilities, which aggregated

$4.0 billion and $12.4 billion, respectively, at December 31, 2010. When drawn upon, these facilities bear interest at varying rates in

accordance with the respective agreements.

The unsecured credit facilities are used for general corporate purposes, to support the borrowers’ commercial paper programs and for the

issuance of letters of credit. At December 31, 2010, the Company had outstanding $1.5 billion in letters of credit and no drawdowns against

these facilities. Remaining unused commitments were $2.5 billion at December 31, 2010.

The committed facilities are used for collateral for certain of the Company’s affiliated reinsurance liabilities. At December 31, 2010, the

Company had outstanding $5.4 billion in letters of credit and $2.8 billion in aggregate drawdowns against these facilities. Remaining unused

commitments were $4.2 billion at December 31, 2010.

See Note 11 of the Notes to the Consolidated Financial Statements for further discussion of these facilities.

We have no reason to believe that our lending counterparties will be unable to fulfill their respective contractual obligations under these

facilities. As commitments associated with letters of credit and financing arrangements may expire unused, these amounts do not necessarily

reflect the Company’s actual future cash funding requirements.

As a result of the successful offerings of certain senior notes and common stock in August 2010, the commitment letter for a $5.0 billion

senior credit facility, which the Holding Company signed to partially finance the Acquisition, was terminated. During March 2010, the Holding

Company paid $28 million in fees related to this senior credit facility, all of which were expensed during the year ended December 31, 2010.

Covenants. Certain of the Company’s debt instruments, credit facilities and committed facilities contain various administrative,

reporting, legal and financial covenants. The Company believes it was in compliance with all covenants at December 31, 2010 and 2009.

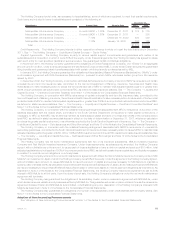

Preferred Stock. During the year ended December 31, 2010, the Holding Company did not issue any non-convertible preferred stock. In

December 2008, the Holding Company entered into a replacement capital covenant (the “Replacement Capital Covenant”) whereby the

Company agreed for the benefit of holders of one or more series of the Company’s unsecured long-term indebtedness designated from time

to time by the Company in accordance with the terms of the Replacement Capital Covenant (“Covered Debt”), that the Company will not repay,

redeem or purchase and will cause its subsidiaries not to repay, redeem or purchase, on or before the termination of the Replacement Capital

Covenant on December 31, 2018 (or earlier termination by agreement of the holders of Covered Debt or when there is no longer any

outstanding series of unsecured long-term indebtedness which qualifies for designation as “Covered Debt”), the Floating Rate Non-

Cumulative Preferred Stock, Series A, of the Holding Company or the 6.500% Non-Cumulative Preferred Stock, Series B, of the Holding

Company, unless such repayment, redemption or purchase is made from the proceeds of the issuance of certain replacement capital

securities and pursuant to the other terms and conditions set forth in the Replacement Capital Covenant.

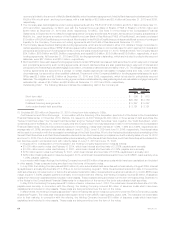

Convertible Preferred Stock. In November 2010, the Holding Company issued to ALICO Holdings in connection with the financing of the

Acquisition 6,857,000 shares of Series B contingent convertible junior participating non-cumulative perpetual preferred stock (the “Con-

vertible Preferred Stock”) convertible into approximately 68,570,000 shares (valued at $40.90 per share at the time of the Acquisition) of the

Holding Company’s common stock (subject to anti-dilution adjustments) upon a favorable vote of the Holding Company’s common

stockholders. If a favorable vote of its common stockholders is not obtained by the first anniversary of the Acquisition Date, then the

Holding Company must pay ALICO Holdings $300 million and use reasonable efforts to list the preferred stock on the New York Stock

Exchange. Management considers the likelihood that the Holding Company will fail to obtain a vote of its common stockholders to be remote.

Common Stock. In November 2010, the Holding Company issued to ALICO Holdings in connection with the financing of the Acquisition

78,239,712 new shares of its common stock at $40.90 per share. The aggregate amount of MetLife, Inc.’s common stock to be issued to

ALICO Holdings in connection with the transaction is expected to be 214.6 million to 231.5 million shares, consisting of the 78.2 million

shares issued at closing, 68.6 million shares to be issued upon conversion of the Convertible Preferred Stock (with the stockholder vote on

such conversion to be held within one year after the closing) (together with $3.0 billion aggregate stated amount of Equity Units of MetLife,

Inc., the “Securities”) and between 67.8 million and 84.7 million shares of common stock, in total, issuable upon settlement of the purchase

contracts forming part of the Equity Units (in three tranches approximately two, three and four years after the closing). The ownership of the

Securities is subject to an investor rights agreement, which grants to ALICO Holdings certain rights and sets forth certain agreements with

respect to ALICO Holdings’ ownership, voting and transfer of the Securities, including minimum holding periods, restrictions on the number of

sharesALICOHoldingscansellatonetime,itsagreementtovotethecommonstockinthesameproportionasthecommonstockvotedbyall

other stockholders, and its agreement not to seek control or influence the Company’s management or Board of Directors. ALICO Holdings has

indicated that it intends to monetize the Securities over time, subject to market conditions, following the lapse of agreed-upon minimum

holding periods. See “— The Company — Liquidity and Capital Sources — Equity Units.”

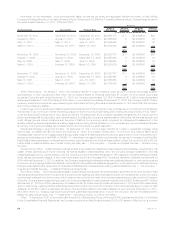

In August 2010, the Holding Company issued 86,250,000 new shares of its common stock at a price of $42.00 per share for gross

proceeds of $3,623 million. In connection with the offering of common stock, the Holding Company incurred $94 million of issuance costs

which have been recorded as a reduction of additional paid-in-capital.

In connection with the remarketing of the junior subordinated debt securities, in February 2009, the Holding Company delivered

24,343,154 shares of its newly issued common stock, and in August 2008, the Holding Company delivered 20,244,549 shares of its

common stock from treasury stock, to settle the stock purchase contracts. See “— The Company — Liquidity and Capital Sources —

Remarketing of Junior Subordinated Debt Securities and Settlement of Stock Purchase Contracts.”

In October 2008, the Holding Company issued 86,250,000 shares of its common stock at a price of $26.50 per share for gross proceeds

of $2.3 billion. Of these shares issued, 75,000,000 shares were issued from treasury stock, and 11,250,000 were newly issued shares.

During the years ended December 31, 2010, 2009 and 2008, 332,121 shares, 861,586 shares and 2,271,188 shares of common stock

were issued from treasury stock for $18 million, $46 million and $118 million, respectively, to satisfy various stock option exercises. During the

year ended December 31, 2010, 2,182,174 new shares of common stock were issued for $74 million to satisfy various stock option

exercises. During both the years ended December 31, 2009 and 2008, no new shares of common stock were issued to satisfy stock option

exercises.

66 MetLife, Inc.