MetLife 2010 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

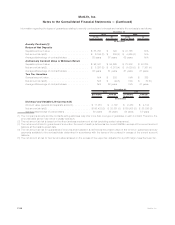

As described in more detail in Note 1, the Company performed its annual goodwill impairment tests during the third quarter of 2010 based

upon data at June 30, 2010. The tests indicated that goodwill was not impaired.

Management continues to evaluate current market conditions that may affect the estimated fair value of the Company’s reporting units to

assess whether any goodwill impairment exists. Continued deteriorating or adverse market conditions for certain reporting units may have a

significant impact on the estimated fair value of these reporting units and could result in future impairments of goodwill.

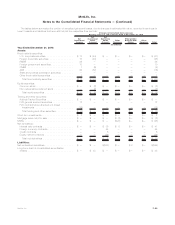

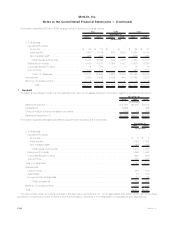

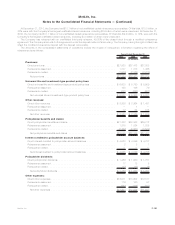

8. Insurance

Insurance Liabilities

Insurance liabilities were as follows:

2010 2009 2010 2009 2010 2009

December 31,

Future Policy

Benefits Policyholder Account

Balances Other Policy-Related

Balances

(In millions)

U.S. Business:

Insurance Products:

Group life . . . . . . . . . . . . . . . . . . . . . . $ 2,717 $ 2,981 $ 9,175 $ 8,985 $ 2,454 $2,411

Individual life . . . . . . . . . . . . . . . . . . . . 56,533 55,291 19,731 18,632 2,752 2,911

Non-medical health . . . . . . . . . . . . . . . . 13,686 12,738 501 501 625 616

Total Insurance Products . . . . . . . . . . . 72,936 71,010 29,407 28,118 5,831 5,938

Retirement Products . . . . . . . . . . . . . . . . . 8,829 8,226 46,517 46,855 146 122

Corporate Benefit Funding . . . . . . . . . . . . . 39,187 37,377 57,773 55,522 184 197

Auto&Home ..................... 3,036 2,972 — — 171 184

Total U.S. Business . . . . . . . . . . . . . 123,988 119,585 133,697 130,495 6,332 6,441

International . . . . . . . . . . . . . . . . . . . . . . . . 43,587 10,830 77,281 8,128 9,051 1,637

Banking, Corporate & Other . . . . . . . . . . . . . 5,798 5,464 42 50 423 368

Total . . . . . . . . . . . . . . . . . . . . . . . $173,373 $135,879 $211,020 $138,673 $15,806 $8,446

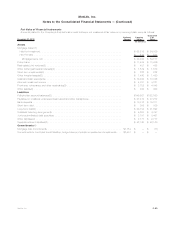

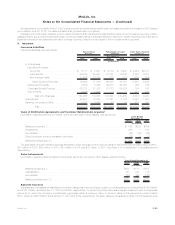

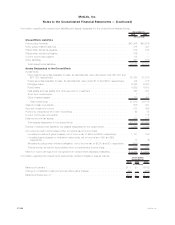

Value of Distribution Agreements and Customer Relationships Acquired

InformationregardingVODAandVOCRA,whicharereportedinotherassets,wasasfollows:

2010 2009 2008

Years Ended

December 31,

(In millions)

BalanceatJanuary1,................................................ $ 792 $822 $706

Acquisitions ...................................................... 356 — 144

Amortization...................................................... (42) (34) (25)

Effectofforeigncurrencytranslationandother................................ (12) 4 (3)

BalanceatDecember31, ............................................. $1,094 $792 $822

The estimated future amortization expense allocated to other expenses for the next five years for VODA and VOCRA is $63 million in 2011,

$74 million in 2012, $80 million in 2013, $84 million in 2014 and $82 million in 2015. See Note 2 for a description of acquisitions and

dispositions.

Sales Inducements

Information regarding deferred sales inducements, which are reported in other assets, was as follows:

2010 2009 2008

Years Ended December 31,

(In millions)

BalanceatJanuary1, ............................................... $841 $711 $677

Capitalization..................................................... 157 193 176

Amortization ..................................................... (80) (63) (142)

BalanceatDecember31,............................................. $918 $841 $711

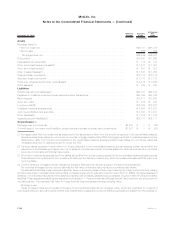

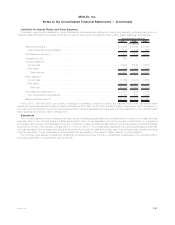

Separate Accounts

Separate account assets and liabilities include two categories of account types: pass-through separate accounts totaling $149.2 billion

and $121.4 billion at December 31, 2010 and 2009, respectively, for which the policyholder assumes all investment risk, and separate

accounts for which the Company contractually guarantees either a minimum return or account value to the policyholder which totaled

$34.1 billion and $27.6 billion at December 31, 2010 and 2009, respectively. The latter category consisted primarily of funding agreements

F-95MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)