MetLife 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

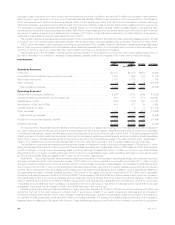

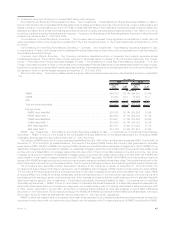

Fair Value Hierarchy. Fixed maturity securities and equity securities available-for-sale measured at estimated fair value on a recurring

basis and their corresponding fair value pricing sources and fair value hierarchy are as follows:

Fixed Maturity

Securities Equity

Securities

December 31, 2010

(In millions)

Level 1:

Quotedpricesinactivemarketsforidenticalassets............................ $ 15,025 4.6% $ 832 23.1%

Level 2:

Independent pricing source . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 257,625 78.7 616 17.1

Internalmatrixpricingordiscountedcashflowtechniques........................ 31,839 9.8 985 27.3

Significant other observable inputs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 289,464 88.5 1,601 44.4

Level 3:

Independentpricingsource............................................ 10,481 3.2 1,011 28.0

Internalmatrixpricingordiscountedcashflowtechniques........................ 9,872 3.0 149 4.1

Independentbrokerquotations ......................................... 2,442 0.7 13 0.4

Significantunobservableinputs........................................ 22,795 6.9 1,173 32.5

Total estimated fair value. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $327,284 100.0% $3,606 100.0%

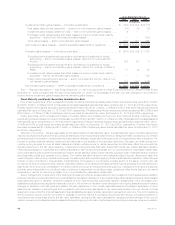

Quoted Prices

in Active

Markets for

Identical Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Estimated

Fair Value

Fair Value Measurements Using

December 31, 2010

(In millions)

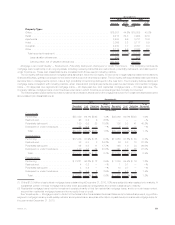

Fixed Maturity Securities:

U.S.corporatesecurities ...................................... $ — $ 85,419 $ 7,149 $ 92,568

Foreigncorporatesecurities .................................... — 62,401 5,777 68,178

Residentialmortgage-backedsecurities............................. 274 43,037 1,422 44,733

Foreigngovernmentsecurities................................... 149 40,092 3,159 43,400

U.S. Treasury, agency and government guaranteed securities . . . . . . . . . . . . . . . 14,602 18,623 79 33,304

Commercialmortgage-backedsecurities(“CMBS”)...................... — 19,664 1,011 20,675

Asset-backedsecurities....................................... — 10,142 4,148 14,290

Stateandpoliticalsubdivisionsecurities ............................ — 10,083 46 10,129

Otherfixedmaturitysecurities ................................... — 3 4 7

Totalfixedmaturitysecurities .................................. $15,025 $289,464 $22,795 $327,284

Equity Securities:

Commonstock............................................. $ 832 $ 1,094 $ 268 $ 2,194

Non-redeemablepreferredstock ................................. — 507 905 1,412

Totalequitysecurities ....................................... $ 832 $ 1,601 $ 1,173 $ 3,606

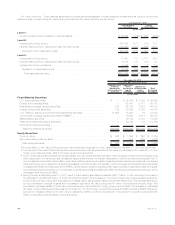

The composition of fair value pricing sources for and significant changes in Level 3 securities at December 31, 2010 are as follows:

• The majority of the Level 3 fixed maturity and equity securities (84%, as presented above) were concentrated in four sectors: U.S. and

foreign corporate securities, ABS and foreign government securities.

• Level 3 fixed maturity securities are priced principally through market standard valuation methodologies, independent pricing services

and independent non-binding broker quotations using inputs that are not market observable or cannot be derived principally from or

corroborated by observable market data. Level 3 fixed maturity securities consists of less liquid fixed maturity securities with very limited

trading activity or where less price transparency exists around the inputs to the valuation methodologies including alternative residential

mortgage loan RMBS and less liquid prime RMBS, certain below investment grade private placements and less liquid investment grade

corporate securities (included in U.S. and foreign corporate securities) and less liquid ABS including securities supported by sub-prime

mortgage loans (included in ABS).

• During the year ended December 31, 2010, Level 3 fixed maturity securities increased by $371 million, or 2%, excluding the impact of

the Acquisition, and $5,605 million, or 33%, including the impact of the Acquisition. The Level 3 fixed maturity securities acquired from

ALICO of $5,435 million have been included in purchases, sales, issuances and settlements in the table below. The increase was driven

by net purchases in excess of sales and increases in estimated fair value recognized in other comprehensive income (loss). Net

purchases in excess of sales of fixed maturity securities were concentrated in foreign government and ABS. The increase in estimated

fair value in fixed maturity securities was concentrated in U.S. and foreign corporate securities and ABS (including RMBS backed by

sub-prime mortgage loans) due to improving or stabilizing market conditions including an improvement in liquidity coupled with the

effect of decreased interest rates on such securities.

44 MetLife, Inc.