MetLife 2010 Annual Report Download - page 181

Download and view the complete annual report

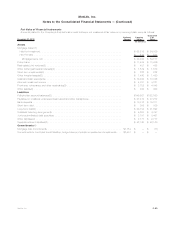

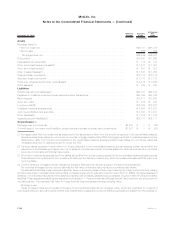

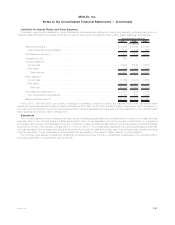

Please find page 181 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The amounts on deposit for derivative settlements essentially represent the equivalent of demand deposit balances and amounts due for

securities sold are generally received over short periods such that the estimated fair value approximates carrying value. In light of recent

market conditions, the Company has monitored the solvency position of the financial institutions and has determined additional adjustments

are not required.

Other Assets

Other assets in the preceding tables is a receivable for cash paid to an unaffiliated financial institution under the MetLife Reinsurance

Company of Charleston (“MRC”) collateral financing arrangement as described in Note 12. With the exception of the receivable for cash paid

to the unaffiliated financial institution, other assets are not considered financial instruments subject to disclosure. Accordingly, the amount

presented in the preceding tables represents the receivable for the cash paid to the unaffiliated financial institution under the MRC collateral

financing arrangement for which the estimated fair value was determined by discounting the expected future cash flows using a discount rate

that reflects the credit rating of the unaffiliated financial institution.

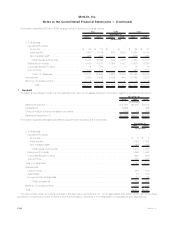

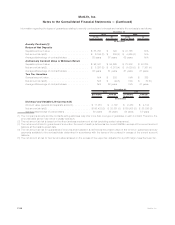

Policyholder Account Balances

Policyholder account balances in the tables above include investment contracts. Embedded derivatives on investment contracts and

certain variable annuity guarantees accounted for as embedded derivatives are included in this caption in the consolidated financial

statements but excluded from this caption in the tables above as they are separately presented in “— Recurring Fair Value Measurements.”

The remaining difference between the amounts reflected as policyholder account balances in the preceding table and those recognized in the

consolidated balance sheets represents those amounts due under contracts that satisfy the definition of insurance contracts and are not

considered financial instruments.

The investment contracts primarily include certain funding agreements, fixed deferred annuities, modified guaranteed annuities, fixed

term payout annuities and total control accounts. The fair values for these investment contracts are estimated by discounting best estimate

future cash flows using current market risk-free interest rates and adding a spread to reflect the nonperformance risk in the liability.

Payables for Collateral Under Securities Loaned and Other Transactions

The estimated fair value for payables for collateral under securities loaned and other transactions approximates carrying value. The related

agreements to loan securities are short-term in nature such that the Company believes there is limited risk of a material change in market

interest rates. Additionally, because borrowers are cross-collateralized by the borrowed securities, the Company believes no additional

consideration for changes in nonperformance risk are necessary.

Bank Deposits

Due to the frequency of interest rate resets on customer bank deposits held in money market accounts, the Company believes that there is

minimal risk of a material change in interest rates such that the estimated fair value approximates carrying value. For time deposits, estimated

fair values are estimated by discounting the expected cash flows to maturity using a discount rate based on an average market rate for

certificates of deposit being offered by a representative group of large financial institutions at the date of the valuation.

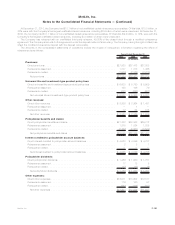

Short-term and Long-term Debt, Collateral Financing Arrangements and Junior Subordinated Debt Securities

The estimated fair value for short-term debt approximates carrying value due to the short-term nature of these obligations. The estimated

fair values of long-term debt, collateral financing arrangements and junior subordinated debt securities are generally determined by

discounting expected future cash flows using market rates currently available for debt with similar remaining maturities and reflecting the

credit risk of the Company, including inputs when available, from actively traded debt of the Company or other companies with similar types of

borrowing arrangements. Risk-adjusted discount rates applied to the expected future cash flows can vary significantly based upon the

specific terms of each individual arrangement, including, but not limited to: subordinated rights; contractual interest rates in relation to current

market rates; the structuring of the arrangement; and the nature and observability of the applicable valuation inputs. Use of different risk-

adjusted discount rates could result in different estimated fair values.

The carrying value of long-term debt presented in the table above differs from the amounts presented in the consolidated balance sheets

as it does not include capital leases which are not required to be disclosed at estimated fair value.

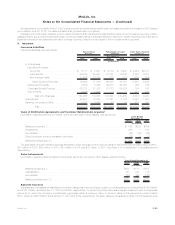

Other Liabilities

Other liabilities included in the tables above reflect those other liabilities that satisfy the definition of financial instruments subject to

disclosure. These items consist primarily of interest and dividends payable; amounts due for securities purchased but not yet settled; and

amounts payable under certain assumed reinsurance treaties accounted for as deposit type treaties. The Company evaluates the specific

terms, facts and circumstances of each instrument to determine the appropriate estimated fair values, which were not materially different from

the carrying values.

Separate Account Liabilities

Separate account liabilities included in the preceding tables represent those balances due to policyholders under contracts that are

classified as investment contracts. The remaining amounts presented in the consolidated balance sheets represent those contracts

classified as insurance contracts, which do not satisfy the definition of financial instruments.

Separate account liabilities classified as investment contracts primarily represent variable annuities with no significant mortality risk to the

Company such that the death benefit is equal to the account balance; funding agreements related to group life contracts; and certain

contracts that provide for benefit funding.

Separate account liabilities are recognized in the consolidated balance sheets at an equivalent value of the related separate account

assets. Separate account assets, which equal net deposits, net investment income and realized and unrealized investment gains and losses,

are fully offset by corresponding amounts credited to the contractholders’ liability which is reflected in separate account liabilities. Since

separate account liabilities are fully funded by cash flows from the separate account assets which are recognized at estimated fair value as

F-92 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)