MetLife 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Equity Units. In November 2010, the Holding Company issued to ALICO Holdings in connection with the financing of the Acquisition

$3.0 billion aggregate stated amount of Equity Units. The Equity Units, which are mandatorily convertible securities, will initially consist of

(i) purchase contracts obligating the holder to purchase a variable number of shares of MetLife, Inc.’s common stock on each of three

specified future settlement dates (expected to be approximately two, three and four years after closing of the Acquisition), for a fixed amount

per purchase contract, (an aggregate of $1.0 billion on each settlement date) and (ii) an interest in each of three series of Debt Securities of

MetLife, Inc. The value of the purchase contracts at issuance of $247 million was calculated as the present value of the future contract

payments and was recorded in other liabilities. At future dates, the Series C, D and E Debt Securities will be subject to remarketing and sold to

investors. Holders of the Equity Units who elect to include their Debt Securities in a remarketing can use the proceeds thereof to meet their

obligations under the purchase contracts.

See Note 14 of the Notes to the Consolidated Financial Statements for further discussion of the Equity Units.

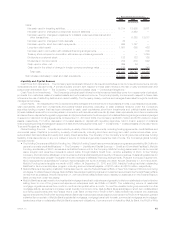

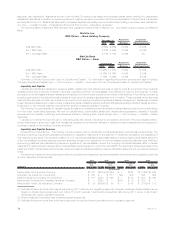

Liquidity and Capital Uses

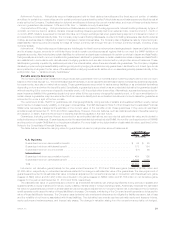

Acquisitions. The computation of the purchase price of the Acquisition is presented below:

November 1, 2010

(In millions)

Cash (includes $396 million of contractual purchase price adjustments) . . . . . . . . . . . . . . . . . . . . . $ 7,196

MetLife, Inc.’s common stock (78,239,712 shares at $40.90 per share) . . . . . . . . . . . . . . . . . . . . . 3,200

MetLife,Inc.’sConvertiblePreferredStock........................................ 2,805

MetLife,Inc.’sEquityUnits($3.0billionaggregatestatedamount)......................... 3,189

Totalpurchaseprice..................................................... $16,390

Debt Repayments. During the years ended December 31, 2010, 2009 and 2008, MetLife Bank made repayments of $349 million,

$497 million and $371 million, respectively, to the FHLB of NY related to long-term borrowings. During the years ended December 31, 2010,

2009 and 2008, MetLife Bank made repayments to the FHLB of NY related to short-term borrowings of $12.9 billion, $26.4 billion and

$4.6 billion, respectively. During the years ended December 31, 2009 and 2008, MetLife Bank made repayments related to short-term

borrowings to the Federal Reserve Bank of New York of $21.2 billion and 650 million, respectively. No repayments were made to the Federal

Reserve Bank of New York during the year ended December 31, 2010. During the year ended December 31, 2009, MICC made repayments of

$300 million to the FHLB of Boston related to short-term borrowings. No repayments were made to the FHLB of Boston during the years ended

December 31, 2010 and 2008.

Debt Repurchases. We may from time to time seek to retire or purchase our outstanding debt through cash purchases and/or exchanges

for other securities, in open market purchases, privately negotiated transactions or otherwise. Any such repurchases or exchanges will be

dependent upon several factors, including our liquidity requirements, contractual restrictions, general market conditions, and applicable

regulatory, legal and accounting factors. Whether or not to repurchase any debt and the size and timing of any such repurchases will be

determined in the Company’s discretion.

Insurance Liabilities. The Company’s principal cash outflows primarily relate to the liabilities associated with its various life insurance,

property and casualty, annuity and group pension products, operating expenses and income tax, as well as principal and interest on its

outstanding debt obligations. Liabilities arising from its insurance activities primarily relate to benefit payments under the aforementioned

products, as well as payments for policy surrenders, withdrawals and loans. For annuity or deposit type products, surrender or lapse product

behavior differs somewhat by segment. In the Retirement Products segment, which includes individual annuities, lapses and surrenders tend

to occur in the normal course of business. During the years ended December 31, 2010 and 2009, general account surrenders and

withdrawals from annuity products were $3.8 billion and $4.3 billion, respectively. In the Corporate Benefit Funding segment, which includes

pension closeouts, bank owned life insurance and other fixed annuity contracts, as well as funding agreements (including funding

agreements with the FHLB of NY and the FHLB of Boston) and other capital market products, most of the products offered have fixed

maturities or fairly predictable surrenders or withdrawals. With regard to Corporate Benefit Funding liabilities that provide customers with

limited liquidity rights, at December 31, 2010 there were $1,615 million of funding agreements and other capital market products that could be

put back to the Company after a period of notice. Of these liabilities, $1,565 million were subject to notice periods between 15 and 90 days.

The remainder of the balance was subject to a notice period of 9 months or greater. An additional $375 million of Corporate Benefit Funding

liabilities were subject to credit ratings downgrade triggers that permit early termination subject to a notice period of 90 days. See “— The

Company — Liquidity and Capital Uses — Contractual Obligations.”

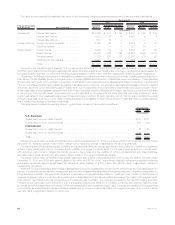

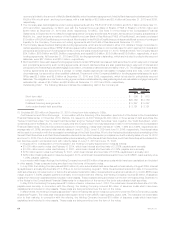

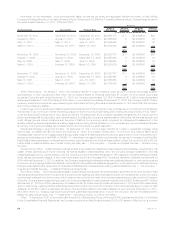

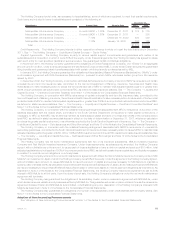

Dividends. Thetable below presents declaration, record and payment dates, as well as per share and aggregate dividend amounts, for

thecommonstock:

Declaration Date Record Date Payment Date Per Share Aggregate

Dividend

(In millions, except per

share data)

October 26, 2010 . . . . . . . . . . . . . . . . . . . . . . November 9, 2010 December 14, 2010 $0.74 $784(1)

October 29, 2009 . . . . . . . . . . . . . . . . . . . . . . November 9, 2009 December 14, 2009 $0.74 $610

October 28, 2008 . . . . . . . . . . . . . . . . . . . . . . November 10, 2008 December 15, 2008 $0.74 $592

(1) Includes dividends on Convertible Preferred Stock issued in November 2010. See “— The Company — Liquidity and Capital Sources —

Convertible Preferred Stock.”

Future common stock dividend decisions will be determined by the Holding Company’s Board of Directors after taking into consideration

factors such as the Company’s current earnings, expected medium- and long-term earnings, financial condition, regulatory capital position,

and applicable governmental regulations and policies. Furthermore, the payment of dividends and other distributions to the Holding Company

by its insurance subsidiaries is regulated by insurance laws and regulations.

67MetLife, Inc.