MetLife 2010 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

American Life’s life insurance and annuity contracts (“Covered Payments”) for any tax periods beginning on January 1, 2005 and ending on

December 31, 2013 (the “Deferral Period”). The Closing Agreement requires that American Life submit a plan to the IRS within 90 days after

the close of the Acquisition, indicating the steps American Life will take (on a country by country basis) to ensure that no substantial amount of

U.S. withholding tax will arise from Covered Payments made by American Life’s foreign branches to foreign customers after the Deferral

Period. Such plan, which was submitted to the Internal Revenue Service (“IRS”) on January 29, 2011, involves the transfer of businesses from

certain of the foreign branches of American Life to one or more existing or newly-formed subsidiaries of MetLife, Inc. or American Life.

A liability of $277 million was recognized in purchase accounting as of November 1, 2010, for the anticipated and estimated costs

associated with restructuring American Life’s foreign branches into subsidiaries in connection with the Closing Agreement.

Current and Deferred Income Tax

The future tax effects of temporary differences between financial reporting and tax bases of assets and liabilities are measured at the

balance sheet dates and are recorded as deferred income tax assets and liabilities, with certain exceptions such as certain temporary

differences relating to goodwill under purchase accounting.

For federal income tax purposes, MetLife, Inc. and ALICO Holdings are expected to make Section 338 elections with respect to American

Life and certain of its subsidiaries. In addition, MetLife, Inc. and AIG are expected to make a Section 338 election with respect to DelAm.

Under such elections, the U.S. tax basis of the assets deemed acquired and liabilities assumed of ALICO were adjusted as of the Acquisition

Date to reflect the consequences of the Section 338 elections.

The reversal of temporary differences (between financial reporting and U.S. tax bases of assets and liabilities) of American Life’s foreign

branches, post-branch restructuring, in connection with the Closing Agreement (i.e., generally, after the end of the Deferral Period) is not

expected to result in any direct U.S. tax effect. Thus, as of November 1, 2010, American Life reduced its net deferred tax asset of $425 million

by $671 million that reflects the amount of U.S. deferred tax asset that is expected to reverse post-branch restructuring. Therefore, American

Life recognized a U.S. net deferred tax liability of approximately $246 million in purchase accounting.

As of the Acquisition Date, ALICO’s current and deferred income tax liabilities are provisional and not yet finalized. Current income taxes

may be adjusted pending the resolution of the tax value of MetLife, Inc. securities delivered to ALICO Holdings as part of the purchase

consideration on the Acquisition Date, the amount of taxes resulting from the Section 338 elections and the filing of income tax returns.

Deferred income taxes may be adjusted as a result of changes in estimates and assumptions relating to the reversal of U.S. temporary

differences prior to the completion of the anticipated restructuring of American Life’s foreign branches, the filing of income tax returns and as

additional information becomes available during the measurement period. We expect to finalize these amounts as soon as possible but no

later than one year from the Acquisition Date.

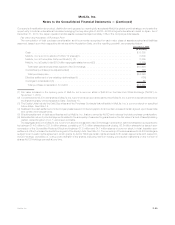

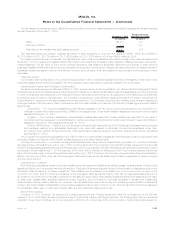

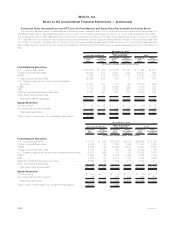

Revenues and Earnings of ALICO

The following table presents information for ALICO that is included in the Company’s consolidated statement of operations from the

Acquisition Date through November 30, 2010:

ALICO’s Operations

Included in MetLife’s

Results for the

Year Ended December 31, 2010

(In millions)

Totalrevenues .................................................. $950

Income(loss)fromcontinuingoperations,netofincometax..................... $ (2)

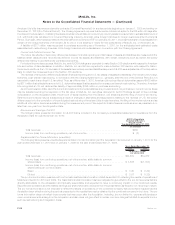

Supplemental Pro Forma Information (unaudited)

The following table presents unaudited supplemental pro forma information as if the Acquisition had occurred on January 1, 2010 for the

year ended December 31, 2010 and on January 1, 2009 for the year ended December 31, 2009.

2010 2009

Years Ended December 31,

(In millions, except

per share data)

Totalrevenues..................................................... $64,680 $54,282

Income (loss) from continuing operations, net of income tax, attributable to common

shareholders .................................................... $ 3,888 $(1,353)

Income (loss) from continuing operations, net of income tax, attributable to common

shareholders per common share:

Basic ......................................................... $ 3.60 $ (1.29)

Diluted ........................................................ $ 3.57 $ (1.29)

The pro forma information was derived from the historical financial information of MetLife and ALICO, reflecting the results of operations of

MetLife and ALICO for 2010 and 2009. The historical financial information has been adjusted to give effect to the pro forma events that are

directly attributable to the Acquisition and factually supportable and expected to have a continuing impact on the combined results.

Discontinued operations and the related earnings per share have been excluded from the presentation as they are non-recurring in nature.

The pro forma information is not intended to reflect the results of operations of the combined company that would have resulted had the

Acquisition been effective during the periods presented or the results that may be obtained by the combined company in the future. The pro

forma information does not reflect future events that may occur after the Acquisition, including, but not limited to, expense efficiencies or

revenue enhancements arising from the Acquisition and also does not give effect to certain one-time charges that MetLife expects to incur

such as restructuring and integration costs.

F-32 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)