MetLife 2010 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

December 31, 2010 for CMBS and the remaining ABS (which may not correspond to rating agency designations). All NAIC designation (e.g.,

NAIC 1 — 6) amounts and percentages presented herein are based on the revised NAIC methodologies. All rating agency designation (e.g.,

Aaa/AAA) amounts and percentages presented herein are based on rating agency designations without adjustment for the revised NAIC

methodologies described above. Rating agency designations are based on availability of applicable ratings from rating agencies on the NAIC

acceptable rating organization list, including Moody’s Investors Service (“Moody’s”), S&P and Fitch Ratings (“Fitch”).

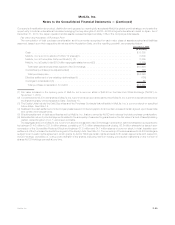

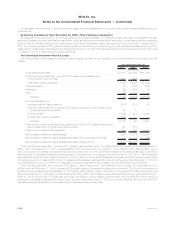

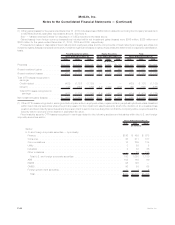

The following table presents selected information about certain fixed maturity securities held by the Company at:

2010 2009

December 31,

(In millions)

Below investment grade or non-rated fixed maturity securities:

Estimatedfairvalue ................................................. $24,886 $20,201

Netunrealizedgain(loss).............................................. $ (696) $(2,609)

Non-income producing fixed maturity securities:

Estimatedfairvalue ................................................. $ 130 $ 312

Netunrealizedgain(loss).............................................. $ (23) $ (31)

Concentrations of Credit Risk (Fixed Maturity Securities) — Summary. The following section contains a summary of the concentrations

of credit risk related to fixed maturity securities holdings.

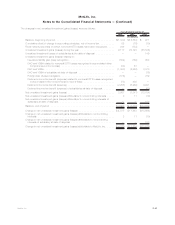

The Company was not exposed to any concentrations of credit risk of any single issuer greater than 10% of the Company’s equity, other

than the government securities summarized in the table below. The estimated fair value of the Company’s holdings in sovereign fixed maturity

securities of Portugal, Ireland, Italy, Greece and Spain, commonly referred to as “Europe’s perimeter region,” was $1,562 million and

$6 million prior to, and was $1,392 million and $6 million, after considering net purchased credit default swap protection at December 31,

2010 and 2009, respectively. Collectively, the net exposure in these Europe perimeter region sovereign fixed maturity securities was 2.8% of

the Company’s equity and 0.3% of total cash and invested assets at December 31, 2010.

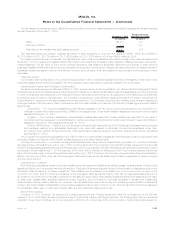

2010 2009

December 31,

Estimated Fair Value

(In millions)

Government and agency fixed maturity securities:

UnitedStates(1).................................................... $33,304 $25,447

Japan .......................................................... $15,591 $ —

Mexico.......................................................... $ 5,050 $ 4,813

(1) Includes certain corporate fixed maturity securities guaranteed by the FDIC Program, as described above.

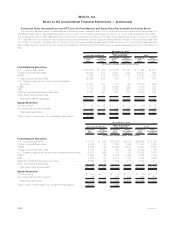

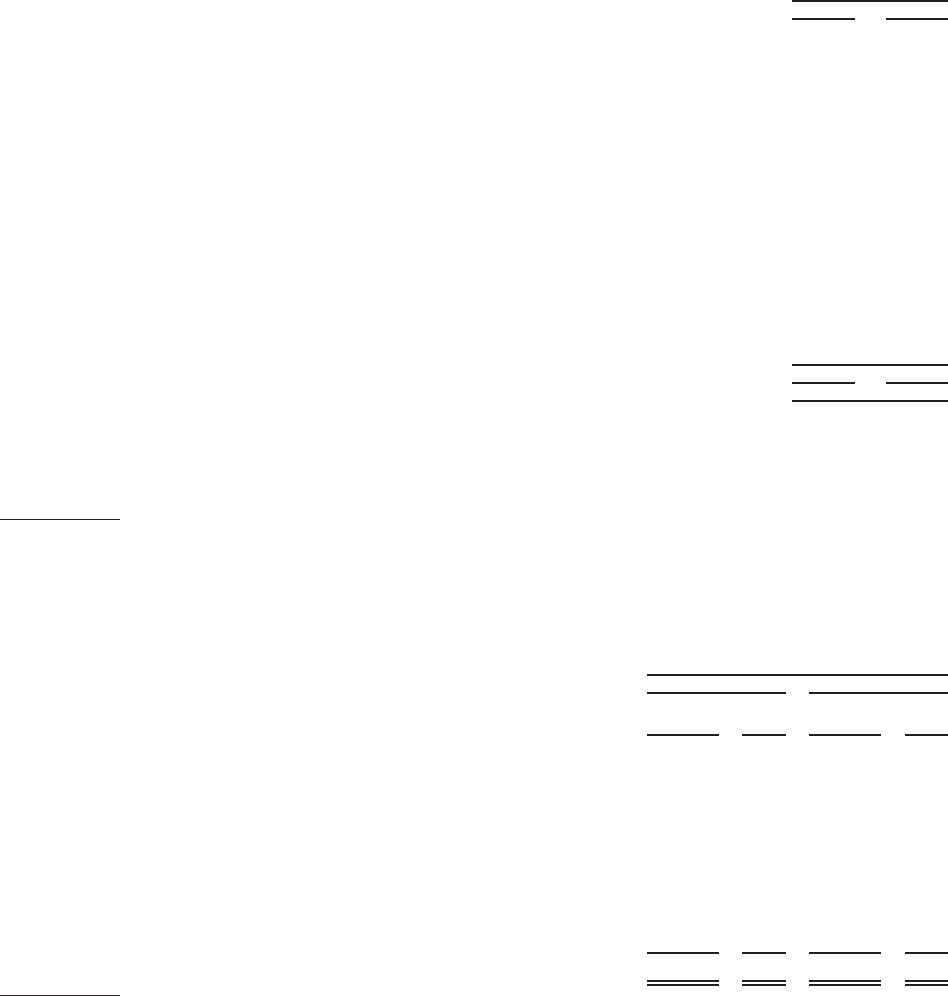

Concentrations of Credit Risk (Fixed Maturity Securities) — U.S. and Foreign Corporate Securities. The Company maintains a diversified

portfolio of corporate fixed maturity securities across industries and issuers. This portfolio does not have an exposure to any single issuer in

excess of 1% of total investments. The tables below present for all corporate fixed maturity securities holdings, corporate securities by sector,

U.S. corporate securities by major industry types, the largest exposure to a single issuer and the combined holdings in the ten issuers to

which it had the largest exposure at:

Estimated

Fair

Value %of

Total

Estimated

Fair

Value %of

Total

2010 2009

December 31,

(In millions)

Corporate fixed maturity securities — by sector:

Foreign corporate fixed maturity securities(1) . . . . . . . . . . . . . . . . . . . . $ 68,178 42.4% $ 38,030 34.5%

U.S. corporate fixed maturity securities — by industry:

Industrial............................................ 22,314 13.9 17,246 15.6

Consumer........................................... 21,737 13.5 16,924 15.4

Finance ............................................ 20,917 13.0 13,756 12.5

Utility.............................................. 17,027 10.6 14,785 13.4

Communications ...................................... 7,375 4.6 6,580 6.0

Other.............................................. 3,198 2.0 2,896 2.6

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $160,746 100.0% $110,217 100.0%

(1) Includes U.S. dollar-denominated debt obligations of foreign obligors and other foreign fixed maturity securities.

F-36 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)