MetLife 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

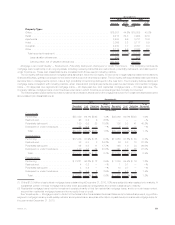

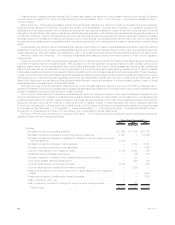

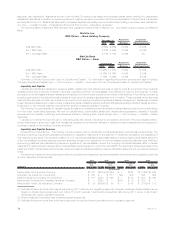

2010 2009 2008

Years Ended December 31,

(In millions)

Uses:

Netcashusedininvestingactivities................................ 18,314 13,935 2,671

Netcashusedforchangesinpolicyholderaccountbalances ............... — 2,282 —

Net cash used for changes in payables for collateral under securities loaned and

othertransactions.......................................... — 6,863 13,077

Netcashusedforchangesinbankdeposits .......................... 32 — —

Netcashusedforshort-termdebtrepayments......................... 606 1,747 —

Long-termdebtrepaid ........................................ 1,061 555 422

Netcashpaidinconnectionwithcollateralfinancingarrangements............ — — 800

Treasury stock acquired in connection with share repurchase agreements . . . . . . . — — 1,250

Dividendsonpreferredstock .................................... 122 122 125

Dividendsoncommonstock .................................... 784 610 592

Cashusedinother,net........................................ 299 34 —

Cash used in the effect of change in foreign currency exchange rates . . . . . . . . . . 129 — 349

Totaluses ............................................... 21,347 26,148 19,286

Net increase (decrease) in cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . $ 2,934 $(14,127) $13,871

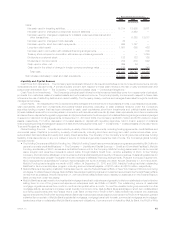

Liquidity and Capital Sources

Cash Flows from Operations. The Company’s principal cash inflows from its insurance activities come from insurance premiums, annuity

considerations and deposit funds. A primary liquidity concern with respect to these cash inflows is the risk of early contractholder and

policyholder withdrawal. See “— The Company — Liquidity and Capital Uses — Contractual Obligations.”

Cash Flows from Investments. The Company’s principal cash inflows from its investment activities come from repayments of principal,

proceeds from maturities, sales of invested assets and net investment income. The primary liquidity concerns with respect to these cash

inflows are the risk of default by debtors and market volatility. The Company closely monitors and manages these risks through its credit risk

management process.

Liquid Assets. An integral part of the Company’s liquidity management is the amount of liquid assets it holds. Liquid assets include cash,

cash equivalents, short-term investments and publicly-traded securities, excluding: (i) cash collateral received under the Company’s

securities lending program that has been reinvested in cash, cash equivalents, short-term investments and publicly-traded securities;

(ii) cash collateral received from counterparties in connection with derivative instruments; (iii) cash, cash equivalents, short-term investments

and securities on deposit with regulatory agencies; and (iv) securities held in trust in support of collateral financing arrangements and pledged

in support of debt and funding agreements. At December 31, 2010 and 2009, the Company had $245.7 billion and $158.4 billion in liquid

assets, respectively. For further discussion of invested assets on deposit with regulatory agencies, held in trust in support of collateral

financing arrangements and pledged in support of debt and funding agreements, see “— Investments — Invested Assets on Deposit, Held in

Trust and Pledged as Collateral.”

Global Funding Sources. Liquidity is provided by a variety of short-term instruments, including funding agreements, credit facilities and

commercial paper. Capital is provided by a variety of instruments, including short-term and long-term debt, preferred securities, junior

subordinated debt securities and equity and equity-linked securities. The diversity of the Company’s funding sources enhances funding

flexibility, limits dependence on any one market or source of funds and generally lowers the cost of funds. The Company’s global funding

sources include:

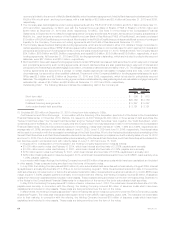

• The Holding Company and MetLife Funding, Inc. (“MetLife Funding”) each have commercial paper programs supported by $4.0 billion in

general corporate credit facilities (see “— The Company — Liquidity and Capital Sources — Credit and Committed Facilities”). MetLife

Funding, a subsidiary of MLIC, serves as a centralized finance unit for the Company. MetLife Funding raises cash from its commercial

paper program and uses the proceeds to extend loans, through MetLife Credit Corp., another subsidiary of MLIC, to the Holding

Company, MLIC and other affiliates in order to enhance the financial flexibility and liquidity of these companies. Outstanding balances for

the commercial paper program fluctuate in line with changes to affiliates’ financing arrangements. Pursuant to a support agreement,

MLIC has agreed to cause MetLife Funding to have a tangible net worth of at least one dollar. At both December 31, 2010 and 2009,

MetLife Funding had a tangible net worth of $12 million. At December 31, 2010 and 2009, MetLife Funding had total outstanding

liabilities for its commercial paper program, including accrued interest payable, of $102 million and $319 million, respectively.

• MetLife Bank is a depository institution that is approved to use the Federal Reserve Bank of New York Discount Window borrowing

privileges. To utilize these privileges, MetLife Bank has pledged qualifying loans and investment securities to the Federal Reserve Bank

of New York as collateral. At both December 31, 2010 and 2009, MetLife Bank had no liability for advances from the Federal Reserve

Bank of New York under this facility.

• MetLife Bank has a cash need to fund residential mortgage loans that it originates and generally holds for a relatively short period before

selling them to one of the government-sponsored enterprises such as FNMA or FHLMC. The outstanding volume of residential

mortgage originations varies from month to month and is cyclical within a month. To meet the variable funding requirements from this

mortgage activity, as well as to increase overall liquidity from time to time, MetLife Bank takes advantage of short-term collateralized

borrowing opportunities with the Federal Home Loan Bank of New York (“FHLB of NY”). MetLife Bank has entered into advances

agreements with the FHLB of NY whereby MetLife Bank has received cash advances and under which the FHLB of NY has been granted

a blanket lien on certain of MetLife Bank’s residential mortgages, mortgage loans held-for-sale, commercial mortgages and mortgage-

backed securities to collateralize MetLife Bank’s repayment obligations. Upon any event of default by MetLife Bank, the FHLB of NY’s

63MetLife, Inc.