MetLife 2010 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

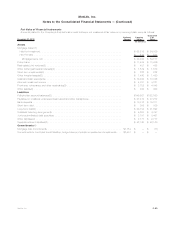

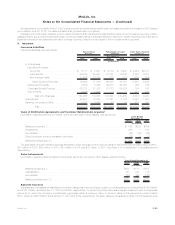

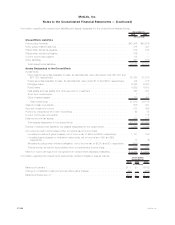

Liabilities for Unpaid Claims and Claim Expenses

Information regarding the liabilities for unpaid claims and claim expenses relating to property and casualty, group accident and non-

medical health policies and contracts, which are reported in future policy benefits and other policy-related balances, is as follows:

2010 2009 2008

Years Ended December 31,

(In millions)

BalanceatJanuary1, ........................................... $ 8,219 $8,260 $7,836

Less:Reinsurancerecoverables ................................... 547 1,042 955

NetbalanceatJanuary1,......................................... 7,672 7,218 6,881

Acquisitions,net............................................... 583 — —

Incurred related to:

Currentyear ................................................ 6,482 6,569 6,263

Prioryears ................................................. (75) (152) (353)

Totalincurred.............................................. 6,407 6,417 5,910

Paid related to:

Currentyear ................................................ (4,050) (3,972) (3,861)

Prioryears ................................................. (2,102) (1,991) (1,712)

Totalpaid................................................. (6,152) (5,963) (5,573)

NetbalanceatDecember31, ...................................... 8,510 7,672 7,218

Add:Reinsurancerecoverables.................................... 2,198 547 1,042

BalanceatDecember31,......................................... $10,708 $8,219 $8,260

During 2010, 2009 and 2008, as a result of changes in estimates of insured events in the respective prior year, claims and claim

adjustment expenses associated with prior years decreased by $75 million, $152 million and $353 million, respectively, due to a reduction in

prior year automobile bodily injury and homeowners’ severity, reduced loss adjustment expenses, improved loss ratio for non-medical health

claim liabilities and improved claim management.

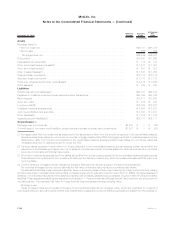

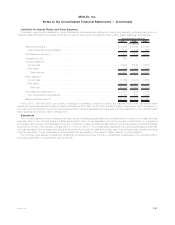

Guarantees

The Company issues annuity contracts which may include contractual guarantees to the contractholder for: (i) return of no less than total

deposits made to the contract less any partial withdrawals (“return of net deposits”); and (ii) the highest contract value on a specified

anniversary date minus any withdrawals following the contract anniversary, or total deposits made to the contract less any partial withdrawals

plus a minimum return (“anniversary contract value” or “minimum return”). The Company also issues annuity contracts that apply a lower rate

of funds deposited if the contractholder elects to surrender the contract for cash and a higher rate if the contractholder elects to annuitize

(“two tier annuities”). These guarantees include benefits that are payable in the event of death, maturity or at annuitization.

The Company also issues universal and variable life contracts where the Company contractually guarantees to the contractholder a

secondary guarantee or a guaranteed paid-up benefit.

F-97MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)