MetLife 2010 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

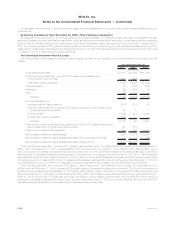

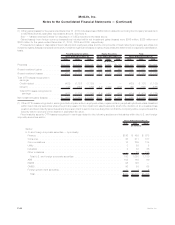

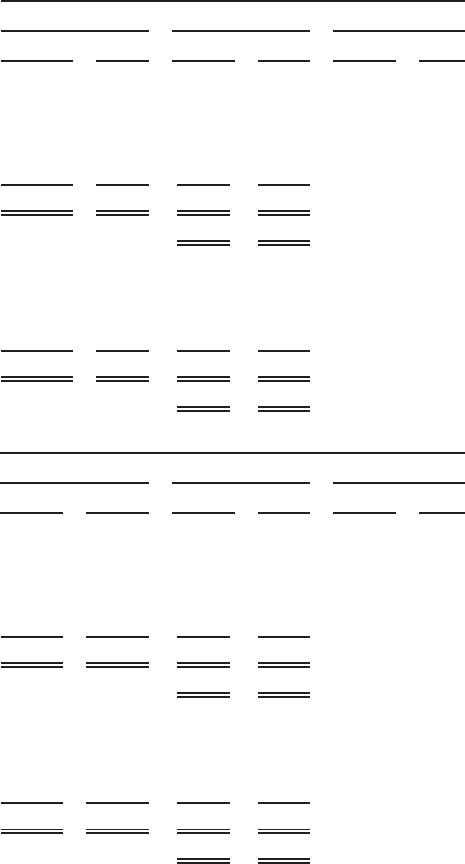

Aging of Gross Unrealized Loss and OTTI Loss for Fixed Maturity and Equity Securities Available-for-Sale

The following tables present the cost or amortized cost, gross unrealized loss, including the portion of OTTI loss on fixed maturity

securities recognized in accumulated other comprehensive income (loss), gross unrealized loss as a percentage of cost or amortized cost

and number of securities for fixed maturity and equity securities where the estimated fair value had declined and remained below cost or

amortizedcostbylessthan20%,or20%ormoreat:

Less than

20% 20% or

more Less than

20% 20% or

more Less than

20% 20% or

more

Cost or Amortized Cost Gross Unrealized

Loss Number of

Securities

December 31, 2010

(In millions, except number of securities)

Fixed Maturity Securities:

Lessthansixmonths................................. $105,968 $1,408 $2,379 $ 369 5,472 125

Six months or greater but less than nine months . . . . . . . . . . . . . . . 1,125 376 29 102 104 29

Nine months or greater but less than twelve months . . . . . . . . . . . . . 375 89 28 27 51 9

Twelve months or greater . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21,721 5,567 1,876 1,821 1,267 316

Total .......................................... $129,189 $7,440 $4,312 $2,319

Percentageofamortizedcost ........................... 3% 31%

Equity Securities:

Lessthansixmonths................................. $ 247 $ 94 $ 10 $ 22 131 33

Sixmonthsorgreaterbutlessthanninemonths ............... 29 65 5 16 7 2

Nine months or greater but less than twelve months . . . . . . . . . . . . . 6 47 — 16 4 2

Twelvemonthsorgreater .............................. 518 340 56 116 40 15

Total .......................................... $ 800 $ 546 $ 71 $ 170

Percentageofcost .................................. 9% 31%

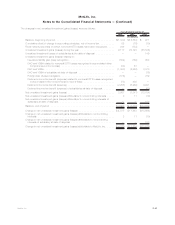

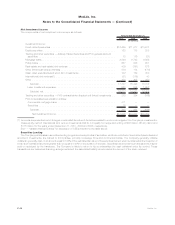

Less than

20% 20% or

more Less than

20% 20% or

more Less than

20% 20% or

more

Cost or Amortized Cost Gross Unrealized

Loss Number of

Securities

December 31, 2009

(In millions, except number of securities)

Fixed Maturity Securities:

Lessthansixmonths................................. $35,163 $ 2,658 $ 933 $ 713 1,725 186

Six months or greater but less than nine months . . . . . . . . . . . . . . . 4,908 674 508 194 124 49

Nine months or greater but less than twelve months . . . . . . . . . . . . . 1,723 1,659 167 517 106 79

Twelve months or greater . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41,721 12,067 3,207 4,247 2,369 724

Total .......................................... $83,515 $17,058 $4,815 $5,671

Percentageofamortizedcost ........................... 6% 33%

Equity Securities:

Lessthansixmonths................................. $ 66 $ 63 $ 7 $ 14 199 8

Sixmonthsorgreaterbutlessthanninemonths ............... 6 1 1 1 15 2

Nine months or greater but less than twelve months . . . . . . . . . . . . . 13 94 2 39 8 6

Twelvemonthsorgreater .............................. 610 488 73 138 50 24

Total .......................................... $ 695 $ 646 $ 83 $ 192

Percentageofcost .................................. 12% 30%

Equity securities with a gross unrealized loss of 20% or more for twelve months or greater decreased from $138 million at December 31,

2009 to $116 million at December 31, 2010. As shown in the section “— Evaluating Temporarily Impaired Available-for-Sale Securities”

below, the $116 million of equity securities with a gross unrealized loss of 20% or more for twelve months or greater at December 31, 2010

were non-redeemable preferred stock, of which $115 million, or 99%, were financial services industry investment grade non-redeemable

preferred stock, of which 77% were rated A or better.

F-43MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)