MetLife 2010 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Although it no longer received compensation, the Company continued to be responsible for managing the funds of those participants that

transferred to the government system. This change resulted in the establishment of a liability for future servicing obligations and the

elimination of the Company’s obligations under death and disability policy coverages. During 2008, the future servicing obligation was

reduced by $23 million, net of income tax, when information regarding the level of participation in the government pension plan became fully

available.

In September 2008, the Argentine Supreme Court ruled against the validity of the 2002 Pesification Law enacted by the Argentine

government. This ruling applied to certain social security pension annuity contractholders that had filed a lawsuit against the 2002 Pesification

Law. The annuity contracts impacted by this ruling, which were deemed peso denominated under the 2002 Pesification Law, are now

considered to be U.S. dollar denominated obligations of the Company. The applicable contingent liabilities were then adjusted and refined to

be consistent with this ruling. The impact of the refinements resulting from the change in these contingent liabilities and the associated future

policyholder benefits was an increase to net income of $34 million, net of income tax, during the year ended December 31, 2008.

In October 2008, the Argentine government announced its intention to nationalize private pensions and, in December 2008, the Argentine

government nationalized the private pension system seizing the underlying investments of participants which were being managed by the

Company. With this action, the Company’s pension business in Argentina ceased to exist and the Company eliminated certain assets and

liabilities held in connection with the pension business. Deferred acquisition costs, deferred tax assets, and liabilities — primarily the liability

for future servicing obligation referred to above — were eliminated and the Company incurred severance costs associated with the

termination of employees. The impact of the elimination of assets and liabilities and the incurral of severance costs was an increase to

net income of $6 million, net of income tax, during the year ended December 31, 2008.

In March 2009, in light of market developments resulting from the Supreme Court ruling contrary to the Pesification Law and the

implementation by the Company of a program to allow the contractholders that had not filed a lawsuit to convert to U.S. dollars the social

security annuity contracts denominated in pesos by the Pesification Law, the Company further reduced the outstanding contingent liabilities

by $108 million, net of income tax, which was partially offset by the establishment of contingent liabilities from the implementation of the

program to convert these contracts to U.S. dollars of $13 million, net of income tax, resulting in a decrease to net loss of $95 million, net of

income tax, for the year ended December 31, 2009.

Further governmental or legal actions are possible in Argentina. Such actions may impact the level of existing liabilities or may create

additional obligations or benefits to the Company’s operations in Argentina. Management has made its best estimate of its obligations based

upon information currently available; however, further governmental or legal actions could result in changes in obligations which could

materially impact the amounts presented within the consolidated financial statements.

Commitments

Leases

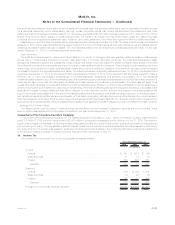

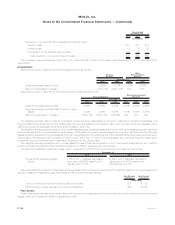

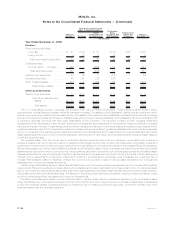

In accordance with industry practice, certain of the Company’s income from lease agreements with retail tenants are contingent upon the

level of the tenants’ revenues. Additionally, the Company, as lessee, has entered into various lease and sublease agreements for office

space, information technology and other equipment. Future minimum rental and sublease income, and minimum gross rental payments

relating to these lease agreements are as follows:

Rental

Income Sublease

Income

Gross

Rental

Payments

(In millions)

2011 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $444 $18 $366

2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $375 $17 $280

2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $331 $16 $237

2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $286 $10 $167

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $236 $ 6 $136

Thereafter.................................................... $724 $44 $965

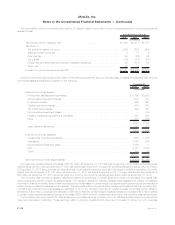

During 2008, the Company moved certain of its operations in New York from Long Island City, Queens to Manhattan. As a result of this

movement of operations and current market conditions, which precluded the Company’s immediate and complete sublet of all unused space

in both Long Island City and Manhattan, the Company incurred a lease impairment charge of $38 million which is included within other

expenses in Banking, Corporate & Other. The impairment charge was determined based upon the present value of the gross rental payments

less sublease income discounted at a risk-adjusted rate over the remaining lease terms which range from 15-20 years. The Company has

made assumptions with respect to the timing and amount of future sublease income in the determination of this impairment charge. During

2009, pending sublease deals were impacted by the further decline of market conditions, which resulted in an additional lease impairment

charge of $52 million. See Note 19 for discussion of $28 million of such charges related to restructuring. Additional impairment charges could

be incurred should market conditions deteriorate further or last for a period significantly longer than anticipated.

Commitments to Fund Partnership Investments

The Company makes commitments to fund partnership investments in the normal course of business. The amounts of these unfunded

commitments were $3.8 billion and $4.1 billion at December 31, 2010 and 2009, respectively. The Company anticipates that these amounts

will be invested in partnerships over the next five years.

F-119MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)