MetLife 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Japanese economy, to which we face increased exposure to as a result of the Acquisition, continues to experience low nominal growth, a

deflationary environment, and weak consumer spending. See “— Industry Trends.” See also “Investments — Fixed Maturity and Equity

Securities Available-for-Sale — Concentrations of Credit Risk (Fixed Maturity Securities) — Summary” in Note 3 of the Notes to Consolidated

Financial Statements for information about exposure to sovereign fixed maturity securities of Portugal, Ireland, Italy, Greece and Spain.

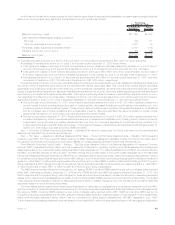

During the year ended December 31, 2010, the net unrealized loss position on fixed maturity and equity securities improved from a net

unrealized loss of $2.2 billion at December 31, 2009 to a net unrealized gain of $7.3 billion at December 31, 2010, as a result of a decrease in

interest rates, and to a lesser extent, a decrease in credit spreads.

Investment Outlook. Recovering private equity markets and stabilizing credit and real estate markets during 2010 had a positive impact

on returns and net investment income on private equity funds, hedge funds and real estate funds, which are included within other limited

partnership interests and real estate and real estate joint venture portfolios. Although the disruption in the global financial markets has

moderated, if there is a resumption of significant disruption, it could adversely impact returns and net investment income on these alternative

investment classes. Net cash flows arising from our business and our investment portfolio will be reinvested in a prudent manner and

according to our ALM discipline in appropriate assets over time. We will maintain a sufficient level of liquidity to meet business needs. Net

investment income may be adversely affected if excess liquidity is required over an extended period of time to meet changing business needs.

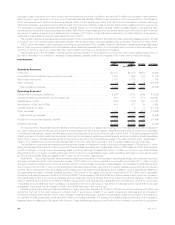

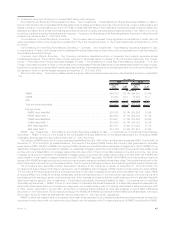

Composition of Investment Portfolio and Investment Portfolio Results

The following yield table presents the investment income, investment portfolio gains (losses), annualized yields on average ending assets

and ending carrying value for each of the asset classes within the Company’s investment portfolio, as well as investment income and

investment portfolio gains (losses) for the investment portfolio as a whole. The yield table also presents gains (losses) on derivative

instruments which are used to manage risk for certain invested assets and certain insurance liabilities:

2010 2009 2008

At and for the Years Ended December 31,

(In millions)

Fixed Maturity Securities:

Yield(1).................................................. 5.53% 5.77% 6.40%

Investmentincome(2),(3),(4) ................................... $ 12,650 $ 11,899 $ 12,403

Investmentgains(losses)(3).................................... $ (255) $ (1,663) $ (1,953)

Endingcarryingvalue(2),(3) .................................... $327,878 $230,026 $189,197

Mortgage Loans:

Yield(1) ................................................. 5.51% 5.38% 6.08%

Investmentincome(3),(4)...................................... $ 2,823 $ 2,735 $ 2,774

Investmentgains(losses)(3) .................................... $ 22 $ (442) $ (136)

Endingcarryingvalue(3)....................................... $ 55,536 $ 50,909 $ 51,364

Real Estate and Real Estate Joint Ventures:

Yield(1).................................................. 1.10% (7.47)% 2.98%

Investmentincome .......................................... $ 77 $ (541) $ 217

Investmentgains(losses)...................................... $ (40) $ (156) $ (9)

Endingcarryingvalue ........................................ $ 8,030 $ 6,896 $ 7,586

Policy Loans:

Yield(1).................................................. 6.37% 6.54% 6.22%

Investmentincome .......................................... $ 657 $ 648 $ 601

Endingcarryingvalue ........................................ $ 11,914 $ 10,061 $ 9,802

Equity Securities:

Yield(1).................................................. 4.39% 5.12% 5.25%

Investmentincome .......................................... $ 128 $ 175 $ 249

Investmentgains(losses)...................................... $ 104 $ (399) $ (253)

Endingcarryingvalue ........................................ $ 3,606 $ 3,084 $ 3,197

Other Limited Partnership Interests:

Yield(1).................................................. 14.99% 3.22% (2.77)%

Investmentincome .......................................... $ 879 $ 173 $ (170)

Investmentgains(losses)...................................... $ (18) $ (356) $ (140)

Endingcarryingvalue ........................................ $ 6,416 $ 5,508 $ 6,039

Cash and Short-Term Investments:

Yield(1).................................................. 0.46% 0.44% 1.62%

Investmentincome .......................................... $ 81 $ 94 $ 307

Investmentgains(losses)...................................... $ 2 $ 6 $ 3

Endingcarryingvalue(3)....................................... $ 22,394 $ 18,486 $ 38,085

Other Invested Assets:(5)

Investmentincome .......................................... $ 491 $ 339 $ 279

Investmentgains(losses)...................................... $ (8) $ (32) $ 313

Endingcarryingvalue ........................................ $ 15,430 $ 12,709 $ 17,248

39MetLife, Inc.