MetLife 2010 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

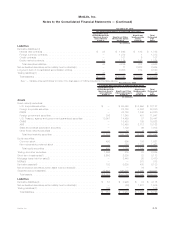

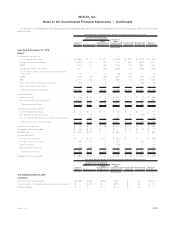

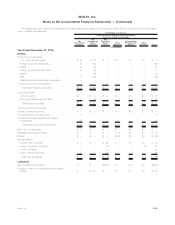

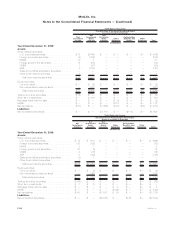

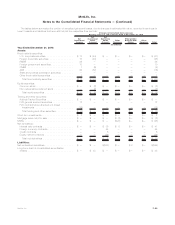

A rollforward of all assets and liabilities measured at estimated fair value on a recurring basis using significant unobservable (Level 3) inputs

is as follows:

Balance,

January 1, Earnings(1), (2)

Other

Comprehensive

Income (Loss)

Purchases,

Sales,

Issuances and

Settlements(3) Transfer Into

Level 3 (4) Transfer Out

of Level 3 (4) Balance,

December 31,

Tot al Reali zed/Unrealized

Gains (Losses) included in:

Fair Value Measurements Using Significant Unobservable Inputs (Level 3)

(In millions)

Year Ended December 31, 2010:

Assets:

Fixed maturity securities:

U.S.corporatesecurities .................... $ 6,694 $ 9 $ 277 $ (415) $ 898 $ (314) $7,149

Foreigncorporatesecurities................... 5,292 (19) 323 304 501 (624) 5,777

RMBS................................ 1,840 27 63 (303) 87 (292) 1,422

Foreigngovernmentsecurities ................. 401 1 (93) 2,965 40 (155) 3,159

U.S. Treasury, agency and government guaranteed

securities............................. 37 — 2 (6) 46 — 79

CMBS................................ 139 (5) 89 684 132 (28) 1,011

ABS ................................. 2,712 (53) 411 1,286 32 (240) 4,148

Stateandpoliticalsubdivisionsecurities ........... 69 — (2) 9 — (30) 46

Otherfixedmaturitysecurities.................. 6 1 2 (5) — — 4

Totalfixedmaturitysecurities................. $17,190 $(39) $1,072 $4,519 $1,736 $(1,683) $22,795

Equity securities:

Commonstock .......................... $ 136 $ 5 $ 7 $ 128 $ 1 $ (9) $ 268

Non-redeemablepreferredstock................ 1,104 46 12 (250) — (7) 905

Totalequitysecurities ..................... $ 1,240 $51 $ 19 $ (122) $ 1 $ (16) $ 1,173

Trading and other securities:

ActivelyTradedSecurities.................... $ 32 $ — $ — $ (22) $ — $ — $ 10

FVOgeneralaccountsecurities................. 51 8 — (1) 37 (18) 77

FVO contractholder-directed unit-linked investments . . . . — (15) — 750 — — 735

Totaltradingandothersecurities .............. $ 83 $ (7) $ — $ 727 $ 37 $ (18) $ 822

Short-terminvestments....................... $ 23 $ 2 $ (9) $ 842 $ — $ — $ 858

Mortgageloansheld-for-sale ................... $ 25 $ (2) $ — $ — $ 10 $ (9) $ 24

MSRs(5),(6) ............................. $ 878 $(79) $ — $ 151 $ — $ — $ 950

Net derivatives:(7)

Interestratecontracts ...................... $ 7 $ 37 $ (107) $ (23) $ — $ — $ (86)

Foreigncurrencycontracts ................... 108 42 2 (57) — (22) 73

Creditcontracts.......................... 42 4 13 (15) — — 44

Equitymarketcontracts ..................... 199 (88) 11 20 — — 142

Totalnetderivatives ...................... $ 356 $ (5) $ (81) $ (75) $ — $ (22) $ 173

Separateaccountassets(8) .................... $ 1,895 $139 $ — $ 242 $ 46 $ (234) $2,088

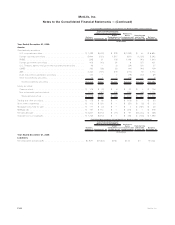

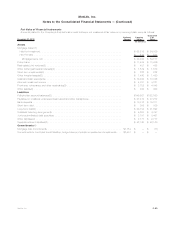

Balance,

January 1, Earnings(1), (2)

Other

Comprehensive

Income (Loss)

Purchases,

Sales,

Issuances and

Settlements(3) Transfer Into

Level 3(4) Transfer Out

of Level 3(4) Balance,

December 31,

Total Realized/Unrealized

(Gains) Losses included in:

Fair Value Measurements Using Significant Unobservable Inputs (Level 3)

(In millions)

Year Ended December 31, 2010:

Liabilities:

Netembeddedderivatives(9).................... $1,455 $335 $226 $422 $— $— $2,438

Long-term debt of consolidated securitization entities(10) . . $ — $ (48) $ — $232 $— $— $ 184

Trading liabilities . . . . . ...................... $ — $ — $ — $ — $— $— $ —

F-79MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)